Palantir (NASDAQ:PLTR) appears to operate on one setting: BIG. It deals in big data, has delivered some very real-world big growth, and its stock has exploded big time – up 507% over the past year alone.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

But there’s one more thing that’s big, and it’s stirring debate: its valuation.

This is a point brought up by Bank of America analyst Mariana Perez Mora, who ranks in the top 1% of Wall Street stock experts.

“The biggest pushback we hear on PLTR is that it looks expensive,” said Perez Mora. “In traditional metrics based on 2026 consensus estimates, PLTR is trading at 7x PEG, 2x EV/Sales/Growth, & 4x EV/FCF/Growth. These valuation metrics are at least two-fold other software infrastructure peers.”

However, the analyst thinks traditional metrics do not properly reflect Palantir’s long-term and short-term growth potential or its “highly profitable” sales strategy. The company, she says, is “leap-frogging near-term expectations.” Its updated 2025 sales forecast of approximately $3.9 billion now matches what analysts had only projected for 2026 as recently as mid-last year. There has been “unrelenting demand” for Palantir’s AI offerings, and despite market skepticism about scalability, the company is proving its ability to deliver.

To reflect this stronger-than-expected trajectory, especially across U.S. commercial and government segments, Perez Mora has revised her estimates. She now sees sales growing at a 35% CAGR from 2024 to 2027 (up from 33%). She’s also raised her adjusted EPS forecasts from $0.52 to $0.57 in 2025, from $0.69 to $0.71 in 2026, and from $0.93 to $0.95 in 2027.

Looking beyond the next 3–5 years, Perez Mora believes the market is still underestimating Palantir’s capabilities – much like it did with other disruptive technologies in the past. For instance, in 1980, AT&T commissioned a consulting firm to forecast the mobile phone market by 2000 – the projection was for 900,000 users, a figure way off the eventual mobile subscriptions of 100 million+. These early forecasts also missed the emergence of apps, streaming, smart devices, and consequently the rise of the first trillion-dollar tech company. If Perez Mora is right, Palantir’s valuation might not be the elephant in the room – it might just be the elephant charging ahead.

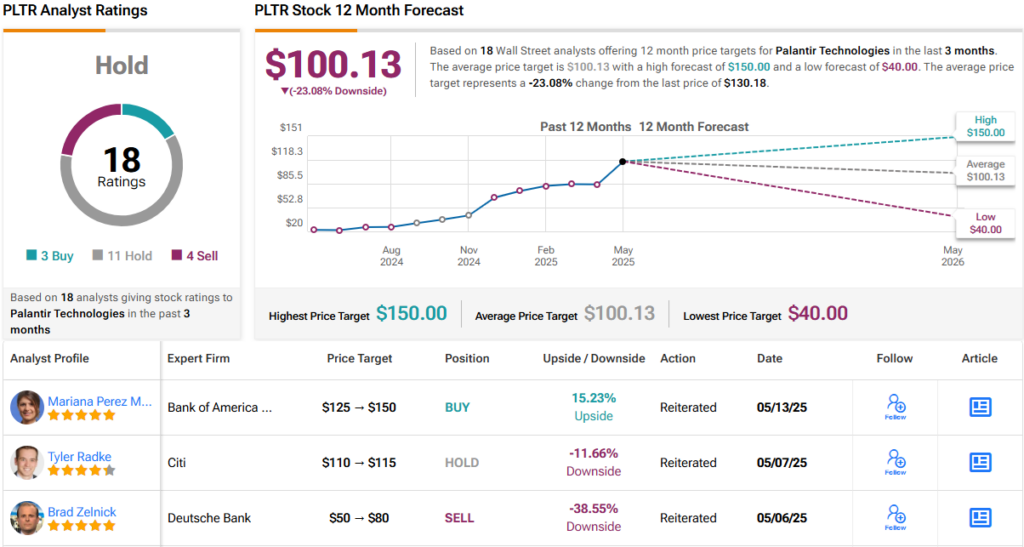

With both Defense and Commercial markets still in their early innings, the BofA analyst believes Palantir’s upside remains underappreciated. Her new price target reflects that conviction – she’s taking it from $125 to a Street-high $150, implying another 17% upside from here. And yes, she’s still firmly in the Buy camp. (To watch Perez Mora’s track record, click here)

The BofA take, however, is at odds with the broader Wall Street view. Based on a mix of 11 Holds, 4 Sells and 3 Buys, the analyst consensus rates PLTR stock a Hold (i.e., Neutral). Meanwhile, the $100.13 average price target suggests the shares are overvalued by 23%. (See PLTR stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.