Alphabet (NASDAQ:GOOGL) is finally winning over investors to the long-term potential of its AI efforts, with the stock outperforming every other Magnificent 7 peer this year except Nvidia. And going by a recent AI chatbot comparison test undertaken by Jefferies, firm analyst Brent Thill thinks that confidence is justified.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Seven members of Jefferies’ Internet/Software team tested AI chatbots using the same ten prompts across three mobile apps from Google, OpenAI, and Perplexity. The prompts covered areas such as information retrieval, shopping, travel, image generation, and multi-modal tasks. Overall, ChatGPT came out on top with a score of 2.4, followed closely by Google Gemini at 2.3, and Perplexity at 2.2. However, performance varied by category: Perplexity led in five categories despite finishing last overall, Gemini won three, and ChatGPT two. Individual team members also had differing subjective preferences. Notably, Gemini excelled in image generation with a score of six, the highest achieved by any provider in any category.

Each provider demonstrated distinct strengths. Gemini performed best in image generation in terms of both quality and speed, as well as in retail search use cases and integration with other Google services, although this was not always consistent. ChatGPT stood out for its conversational tone, practical advice, guidance on car buying, including dealers and inventory, and well-organized comparisons. Perplexity was strong for local information, including maps, which provided a good balance between detail and conciseness, and offered the most user-friendly interface.

There were also notable weaknesses and surprises. Gemini sometimes failed to leverage other Google services, such as Maps or related hotel and restaurant information, and its answers were occasionally too brief. ChatGPT’s free version was slow with images and limited by restrictions like attachment uploads, and it was weaker on actionable tasks such as handoffs to maps or bookings. Perplexity lacked image generation, had limited integration with major providers like OpenTable, and showed occasional reliability issues with things like prices or locations.

Taken together, the findings show no single chatbot dominates across every measure, but Thill sees the outcome as a net positive for Alphabet. “At the same time,” the 5-star analyst notes, “we see untapped potential for Google Gemini. If Google could fully leverage data across its major products (7 solutions with >2B MAUs) and streamline its interface into one seamless UI that combines search, AI Overviews, and Gemini/AI Mode with intelligent, automatic routing, Google could transition its leadership in the search world to the AI world.”

So, while Gemini is not the obvious AI chatbot leader right now, Thill believes it is “strongly positioned to become one of the leading AI ‘answer engines.’”

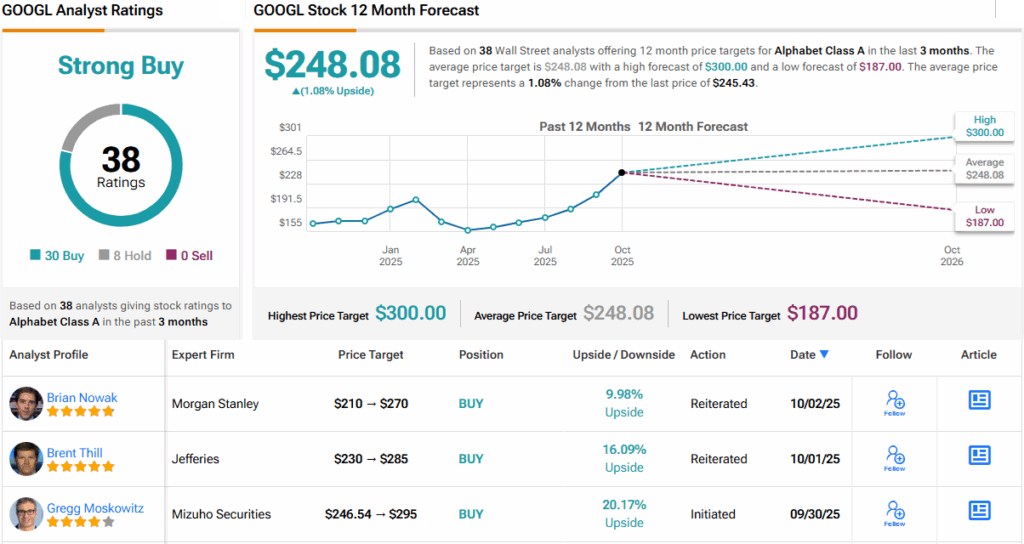

That conviction underpins his Buy rating on GOOGL shares, as well as his decision to raise the price target from $230 to $285 to reflect the “recent rapid pace of AI improvement.” That implies potential upside of 16% from current levels. (To watch Thill’s track record, click here)

Overall, Wall Street is clearly leaning bullish on Alphabet. In the past 3 months, 38 analysts have chimed in – 30 say Buy, 8 say Hold – giving the stock a Strong Buy consensus. The catch? With an average price target of $248.08, the Street sees little room to run in the immediate term. With this in mind, keep an eye out for either further price target hikes or rating downgrades shortly. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.