There have been some storm clouds for Alphabet (NASDAQ:GOOGL) during the past few months, and its share price has been feeling the effects.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

GOOGL has lost roughly 10% of its value in 2025, thanks to general fears of a trade-induced recession, concerns over misplaced capex spending, and some regulatory hiccups in the European Union – where the company stands accused of violating the Digital Markets Act.

In addition, the rapid adoption AI-powered chatbots are causing worries that Google’s primacy for Internet searches is coming under threat.

More recently, however, the company delivered a strong Q1 earnings report, which surpassed both top- and bottom-line expectations. GOOGL has gained over 5% in the month since its April earnings call.

Investor Bohdan Kucheriavyi urges investors to look past all the noise, believing that GOOGL is going to be just fine.

“Going forward, it’s likely that Alphabet will continue to generate solid returns in the upcoming quarters primarily thanks to its dominant position in the digital advertising industry,” explains the 5-star investor. “This could be your last chance to buy.”

Kucheriavyi notes that Alphabet’s recent earnings shot past expectations, while also demonstrating “robust growth” in search, YouTube, and the company’s cloud businesses.

YouTube, for instance, saw its revenues increase by over 10% in Q1, and the investor cites estimates that now assess the video hosting platform could even be worth more than half a trillion dollars.

Kucheriavyi addresses concerns that Alphabet’s perch atop the search engine world is imperiled, noting that the company still controls almost 90% of this global market. Furthermore, search revenues grew 9.8% year-over-year during Q1 to reach $50.7 billion.

“Considering that the spending on search advertising is expected to increase in the following years, it makes sense to believe that Alphabet will be the biggest beneficiary of such growth,” adds Kucheriavyi.

In other words, Alphabet’s business is likely to remain on a roll. And yet, despite the attractive growth prospects, GOOGL trades at a P/E ratio of 18.55, which is well below those of its other Magnificent 7 peers.

“At this point, there’s nothing not to like about Alphabet,” concludes Kucheriavyi, who rates GOOGL a Buy. (To watch Bohdan Kucheriavyi’ track record, click here)

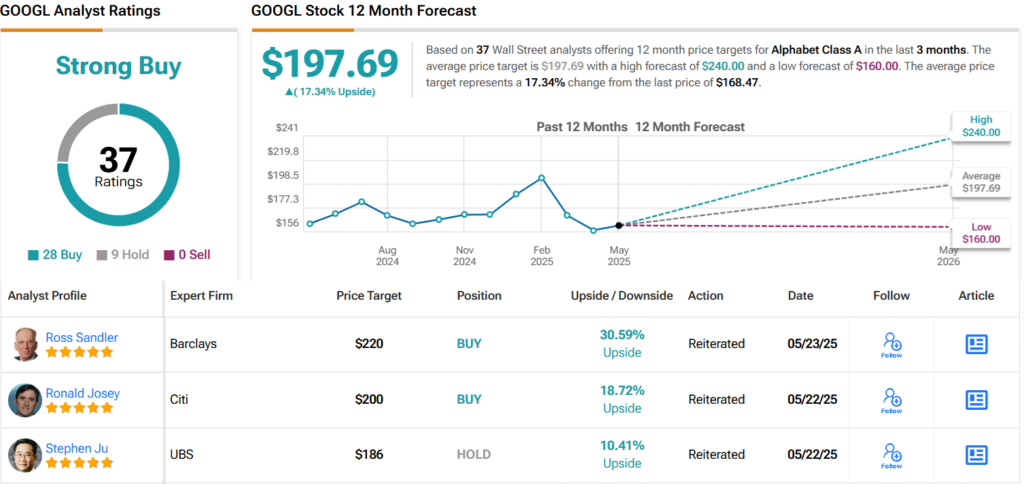

That’s the mood on Wall Street as well. With 28 Buy and 9 Hold ratings, GOOGL enjoys a Strong Buy consensus rating. Its 12-month average price target of $197.69 has an upside of some 17%. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.