Airbnb (ABNB) is rolling out a major app redesign and adding a new services business beyond just accommodations. Importantly, several Top analysts see this expansion as a strategic push toward long-term growth.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

What Are ABNB’s New Offerings?

ABNB’s latest update introduces Airbnb Services, a new category that lets users book local professionals for services, such as private chefs, spa treatments, and fitness sessions, all bookable directly through the Airbnb platform.

Also, the update adds a new “Explore” tab to suggest places and services, and a better messaging system that lets guests and hosts share photos and videos.

Top Analysts’ Optimistic About Growth Potential

Top Wall Street analysts believe this shift could be a game-changer for Airbnb, expanding its total addressable market and boosting customer value.

Among the analysts who rated ABNB stock a Buy, John Colantuoni from Jefferies said that Airbnb’s share of the experiences market could double by 2030, fueling annual growth. He also believes that these new services will bring in more customers and boost profits. Further, ABNB’s new homepage and features lead to more engagement.

Similarly, five-star analyst Ralph Schackart from William Blair noted how Airbnb’s expansion into 10 new service categories bolsters its market position beyond travel, appealing to local users as well as travelers. The app redesign is likely to drive engagement and enhance user satisfaction.

Another Top analyst, Ronald Josey from Citigroup (C), says ABNB’s tech upgrades will help launch new services and grow yearly revenue, despite travel industry challenges. He thinks celebrity promotions and local guides will help Airbnb grow quickly while keeping high-quality offerings.

Is Airbnb a Buy or Sell?

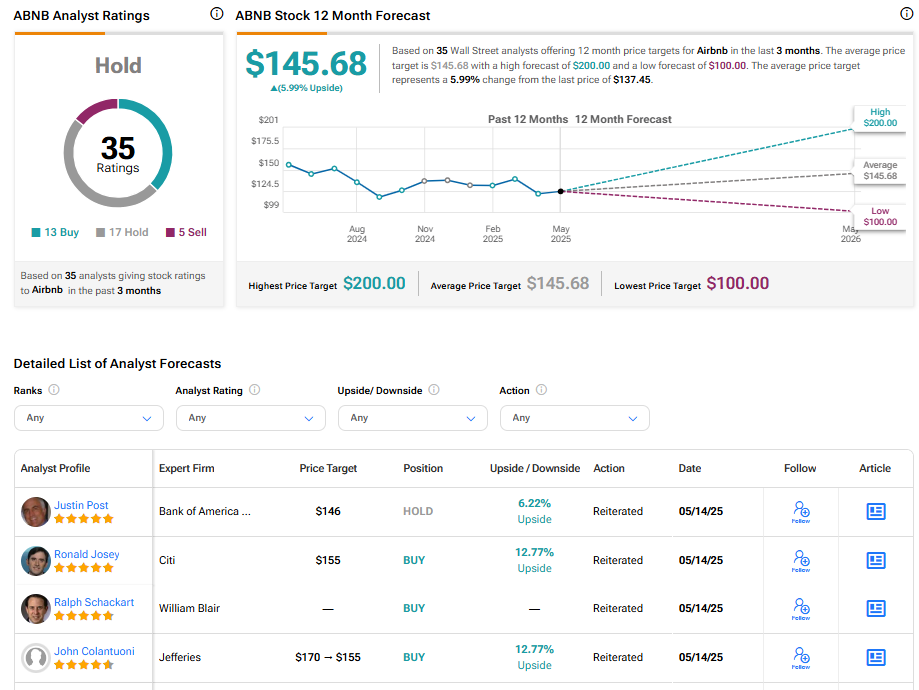

Turning to Wall Street, ABNB stock has a Hold consensus rating based on 13 Buys, 17 Holds, and five Sells assigned in the last three months. At $145.68, the average Airbnb stock price target implies a 5.99% upside potential.

See more ABNB analyst ratings.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue