The narrative around Intel (NASDAQ:INTC) has taken on a more positive hue over the past few months, as new CEO Lip-Bu Tan has announced a bold vision to return the company to its former glory. Tan, whose industry credentials are top-notch, has outlined plans to transform Intel into a world-class foundry, expand its AI initiatives, and cut thousands of jobs in an effort to streamline operations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

But while optimism around Tan’s strategic overhaul is building, not everyone is convinced the path ahead is clear. INTC’s share price has yet to reflect the renewed enthusiasm – and one investor, known by the pseudonym Livy Investment Research, is raising a red flag about a looming geopolitical threat that could derail Tan’s ambitious plans.

“The increasingly adverse regulatory backdrop facing Intel’s China-dominant exposure remains a prominent yet underappreciated risk at current levels,” says the 5-star investor.

Livy points out that roughly a third of Intel’s revenues are related to China, leaving the company at risk for steep drops if this market gets cut off. While the investor notes that the current regulatory focus of the Trump administration is on advanced datacenter chips, there is no guarantee that this will not eventually segue into PC processors.

Adding to the investor’s worries, Taiwan recently added Huawei to its “Strategic High-Tech Commodities” Entity List. This is a big deal for Intel, as Huawei is a major customer of Intel’s PC chips that are manufactured at TSMC’s Taiwan facilities. Moreover, a parallel move in China to boost domestic production will also hit Intel where it hurts.

“The momentum behind coordinated export controls by the U.S. and its allies, versus Beijing’s domestic tech substitution efforts, result in a double bind on Intel’s growth prospects,” adds the investor.

At the same time, Livy reminds investors that Tan’s capital-intensive initiative to revive Foundry has “steep execution hurdles” awaiting – while Intel has not shared its roadmap for AI infrastructure applications.

Put simply, Livy believes the market hasn’t fully digested these mounting headwinds – and that investors could be in for a rude awakening.

“We believe Intel remains prone to a potential downward re-rating from current levels, as rising geopolitical and execution risks mount across multiple fronts,” sums up Livy Investment Research, who rates INTC shares a Sell. (To watch Livy Investment Research’s track record, click here)

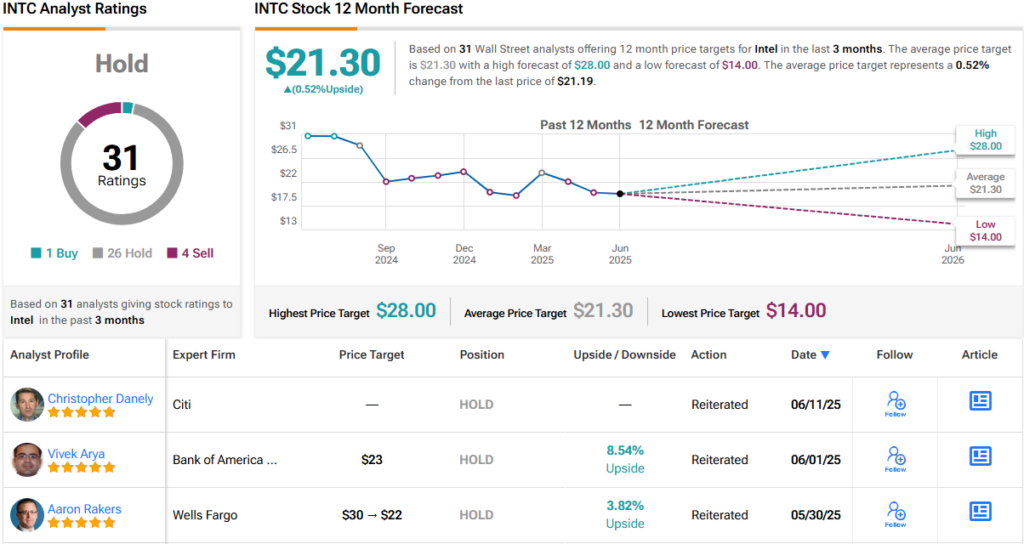

Wall Street at large is also hesitant to get behind Intel. Of the 31 recent analyst ratings, a lopsided 26 are Holds, compared to just 1 Buy and 4 Sells – all coalescing to a Hold (i.e., Neutral) consensus rating. The average 12-month price target of $21.30 suggests analysts see little movement ahead. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.