Nvidia (NASDAQ:NVDA) has no shortage of fans on Wall Street – and for good reason. The chip titan has been at the heart of the AI-driven rally, transforming into one of the world’s most dominant companies.

Yet, even market darlings can stumble, and 2025 has proven challenging so far. Shares are down 27% year-to-date, raising questions about whether the bull run has hit a wall.

Amid growing investor caution, one analyst is warning that the glory days – at least for now – may be behind it.

“We now expect to see limited upside potential going forward given limited room for significant earnings upside surprise over the next 1-2 years and potential re-rating headwinds that we think are yet to be fully factored in by the market,” said HSBC analyst Frank Lee.

Nvidia has regularly delivered beat-and-raise earnings displays, but over the last three quarters, the earnings and guidance beats have been narrowing. Lee believes this is due to persistent uncertainty surrounding the ramp-up of its Blackwell supply chain – particularly related to its NVL rack architecture.

“More importantly,” Lee goes on to say, “we believe the pricing power of its GPU roadmap is slowing down, and this has been a key driver of its upside surprise in earnings momentum in previous quarters.”

Nvidia’s pricing power has increased substantially, rising from approximately $1,000 for its gaming GPUs to $13,500 with the launch of its first-generation AI GPU platform, Ampere. Subsequent platforms – Hopper and Blackwell – have seen further ASP (average selling price) increases of 96% and 51%, respectively. The debut of the Blackwell NVL72 rack architecture marked another major leap, boosting pricing significantly from the previous HGX platform range of $212,000–$320,000 (which included 8 Hopper or Blackwell GPUs) to $2,623,500 (a configuration that includes 72 Blackwell GPUs, 36 Grace CPUs, and 9 NVLink switch chips).

Lee points out there has been no notable ASP increase between the B200 and B300 GPUs or between the GB200 and GB300 NVL72 rack architectures. This is likely because the B300/GB300 upgrades focus less on performance and more on incremental improvements – such as a modest memory bump from HBM3E 8hi to HBM3E 12hi – and enhancements in system stability, aimed at resolving issues like overheating and lower yield rates seen in the B200/GB200.

Accordingly, Lee has lowered his FY26/FY27 EPS forecasts by 8% and 18%, respectively, to account for reduced expectations for NVL server rack shipments. The new EPS estimates of $4.72 for FY26 and $5.76 for FY27, are now nearer the respective consensus estimates of $4.59 and $5.80, suggesting “limited scope for upside surprise.”

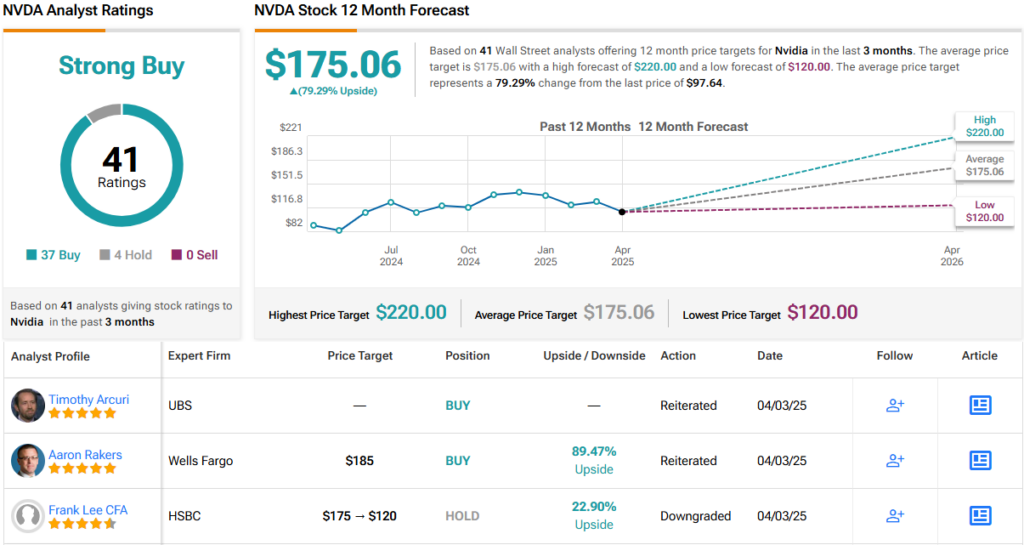

At the same time, Lee has dialed back his stance on NVDA stock, moving from a Buy to a Hold (i.e., Neutral) rating, while slashing his price target from $175 to $120. Even so, that still leaves room for a ~23% upside from current levels. (To watch Lee’s track record, click here)

3 other analysts join Lee on the sidelines, yet with an additional 37 Buys, the consensus view is that NVDA stock is a Strong Buy. Based on the $175.06 average price target, NVDA shares could be trading nearly 79% higher a year from now. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.