Shares of luxury electric car start-up Lucid Group (NASDAQ:LCID), which began 2024 on a weak note before recovering in anticipation of earnings earlier this month, resumed sliding this week – falling nearly 19%. As you can probably guess, the earnings news was… not great.

Lucid reported a steep slide in revenue year over year in Q4, down 39% to $157.2 million. Now, on the plus side, despite this slide in sales, Lucid’s losses per share hardly budged at all, rising only from $0.28 per share a year ago, to $0.29 per share this time around. Unfortunately, the only reason losses per share were not much, much worse… was because Lucid issued a whole lot of new shares over the course of the past year. (As in, share count growing by 34%).

Total losses for the quarter approached $653.8 million, a 38% increase year over year. But because Lucid was able to spread its losses around across a much larger base of shares, the per share increase in losses was less noticeable.

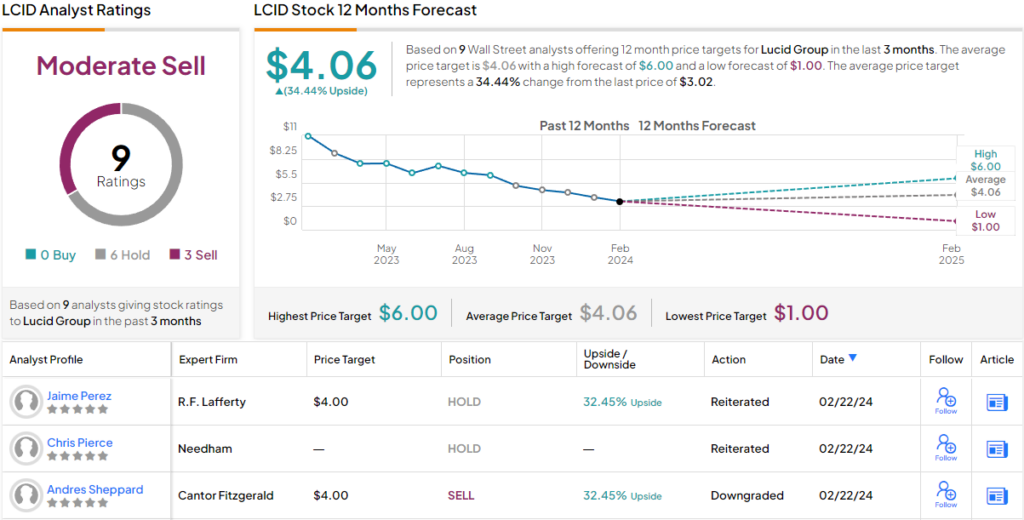

Now, you might see this as a clever way to make Lucid’s losses seem less dramatic – but at least one Wall Street analyst was not amused. Reviewing the results, Cantor analyst Andres Sheppard lost no time in downgrading Lucid stock from “neutral” to “underweight” (i.e. sell), and cutting his price target by a third, from $6 a share to just $4. (To watch Sheppard’s track record, click here)

Lucid missed its sales target for Q4 2023. Additionally, notes Sheppard, the company’s high negative gross profit margins “persist” (which is why Lucid lost so much money). What’s more, Sheppard expects negative margins to keep on persisting until at least the second half of 2025, and maybe longer than that.

And when we say negative, we mean really negative. As Sheppard points out, Lucid’s gross margin for Q4 2023 was a staggering 161%, while its gross margin for 2023 as a whole was an even worse negative 225%.

Yes, you read that right. For every $1 in sales Lucid made last year, it lost about $2.25 – gross. Add in operating and other costs below the top line, and in total, on the bottom line, Lucid lost closer to $4.75 for every $1 in sales in made.

Nor does this story seem to be getting better as time goes by. Turning to his 2024 predictions, Sheppard notes that Lucid is likely to produce far fewer cars than forecast. Management told investors to expect to see about 9,000 new Lucid cars produced this year. Sheppard had been expecting closer to 15,000 EVs – and the rest of Wall Street wanted 23,000.

In other words, on top of missing earnings Thursday, Lucid essentially promised to miss earnings again for all of 2024, and probably by a margin of more than 50%.

And even then the bad news is not done. In 2023, Lucid produced 8,428 EVs, but only managed to deliver (i.e. sell) 6,001 of them. Thus, it appears that (1) Lucid is going to grow its production by less than 7% year over year in 2024, and (2) if things keep going the way they have been going, it might not even sell all of those cars that it does produce.

It all adds up to a rather bleak report. And that’s precisely why Cantor thinks you should sell your Lucid stock.

Sheppard’s colleagues aren’t upbeat as well. Based on 6 Hold (i.e. neutral) ratings, and 3 Sells, the EV maker has a Moderate Sell consensus rating. However, the share price has declined to such an extent that there’s possible upside of 34%, should the $4.06 average price target be met in the following months. (See LCID stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.