Shares of government IT security contractor Palantir Technologies (NYSE:PLTR) enjoyed a terrific month of February shooting up more than 50% after reporting quarterly sales growth of 20%, and quarterly earnings growth of more than 200%. As a result of this rapid rise in share price, however, the company’s stock now sells for a nosebleed 270 times trailing earnings – and even 77 times the earnings it’s supposed to earn next year.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Is that too much to pay for Palantir, though? Although the stock has its positives, according to William Blair analyst Louie DiPalma, it is actually too much to pay – and that’s why DiPalma actually thinks you should sell Palantir stock despite its evident popularity.

Why does he think this?

Good news first. Keying off of reporting by Bloomberg Thursday night, DiPalma notes that Palantir is heavily involved in a U.S. Pentagon “machine vision” project called “Maven,” which aims to employ artificial intelligence algorithms to help military drones find their targets. What’s more, this so-called Maven Smart System has progressed beyond theory, and is supposed to be actually deployed at present in the Red Sea conflict zone.

Although Palantir isn’t the only IT company involved in Maven, and its defense business isn’t growing as quickly as its rivals’, DiPalma believes that revenues from Maven will help to give Palantir’s revenues a boost in Q1 2024. DiPalma’s objection is that that boost won’t be big enough to justify Palantir’s valuation after its recent run-up.

Indeed, DiPalma even seems to argue that Palantir stock was overvalued before the stock started running away in February. In giving guidance for 2024 revenues, you see, Palantir told investors to expect numbers in the $2.65 billion to $2.67 billion range. That sounds pretty good, implying that revenues will grow about 19% in comparison to 2023 levels. The problem is that, before this guidance came out, analysts had been thinking Palantir stock would more likely generate revenues of $2.8 billion or more… and valuing the stock in the $6- to $8-a-share range.

Let me repeat that: When investors thought Palantir would generate more revenue than management just said it would, they nonetheless valued the stock at a share price as much as 76% below where the stock now trades. Conversely, investors are now paying four times more money for a company that just said it’s going to make less revenue than it was supposed to.

Does that make sense to you? Because it doesn’t to DiPalma.

While it’s true that Palantir finally turned profitable in 2023 (and that’s a good thing), the stock’s $25-plus share price, divided by the $0.09 per share it earned last year, works out to a P/E ratio of 278. And even with earnings expected to grow 44% this year (to $0.13 per share), and 31% the year after that (to $0.17 per share)… well, that works out to forward P/E ratios of 192 and 147, respectively, for the next two years’ earnings.

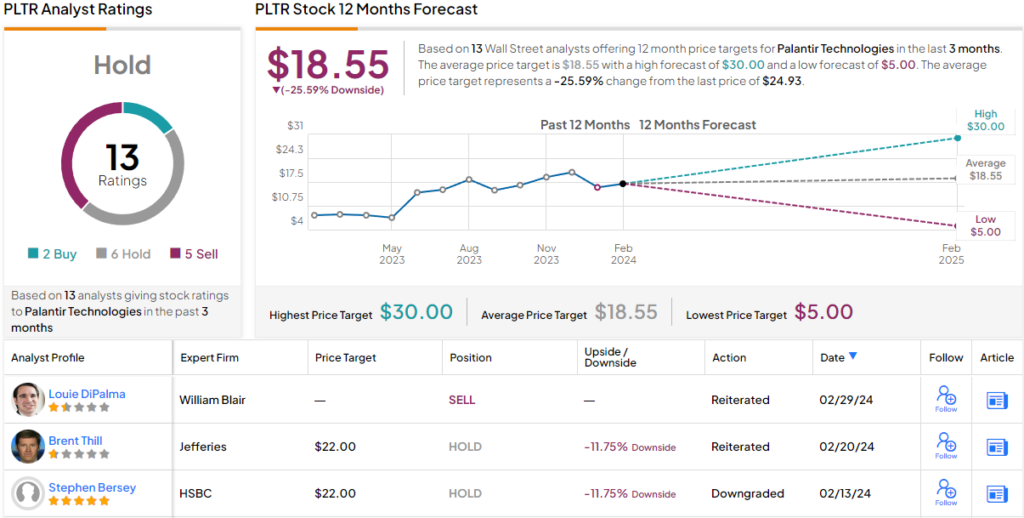

Overall, the Street is lukewarm at present regarding Palantir shares’ prospects. Based on 13 analysts tracked by TipRanks in the last 3 months, 6 rate PLTR as a Hold (i.e. neutral), 5 suggest Sell, and only 2 recommend Buy. The 12-month average price target stands at $18.55, marking ~26% downside from where the stock is currently trading. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.