Micron (NYSE:MU) stock blasted out of the starting gate as the new year dawned, racing to double-digit gains on the first trading day of 2026. This marked a continuation of a strong trend for the shares, which have risen 261% over the past year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The momentum traces back to Micron’s fiscal Q1 2026 earnings in mid-December, a report that reinforced the bull case. The company not only topped expectations on both revenue and earnings, but its entire High-Bandwidth Memory (HBM) capacity for calendar 2026 is already fully booked.

Furthermore, the company’s fiscal Q2 2026 guidance raised expectations for continued growth. Micron’s revenue projections of $18.7 billion (plus or minus $400 million) represent a significant sequential leap from Q1’s $13.64 billion.

However, one top investor, known by the pseudonym Value Portfolio, isn’t so convinced that MU is primed to beat the market.

“Despite strong current fundamentals, MU’s history of low shareholder returns and looming supply ramp raise caution,” explains the 5-star investor, who is among the top 4% of stock pros covered by TipRanks.

Value Portfolio acknowledges that the HBM market is expected to grow dramatically in the coming years, shifting upward from $35 billion to $100 billion between 2025 and 2028. However, the investor also worries that this is a “lofty” presumption, as it is resting on huge data center buildouts that could run into some snags.

Another big concern for the investor is the cyclical nature of the memory chip industry. While prices are high at present, there are no guarantees that this will continue. Micron, which is ramping up its capex spend, could be left holding the bag if things shift.

“Once that capex is spent, it’s spent. The best case scenario is prices remain high with new supply and the capex is paid off, but if they decline, Micron is once again in a tough position,” the investor adds.

Worried about Micron’s 2026 price-to-earnings multiple of ~9.5x (“that’s a high P/E for a cyclical industry”) and these cyclical risks, Value Portfolio is rating MU a Strong Sell. (To watch The Value Portfolio’s track record, click here)

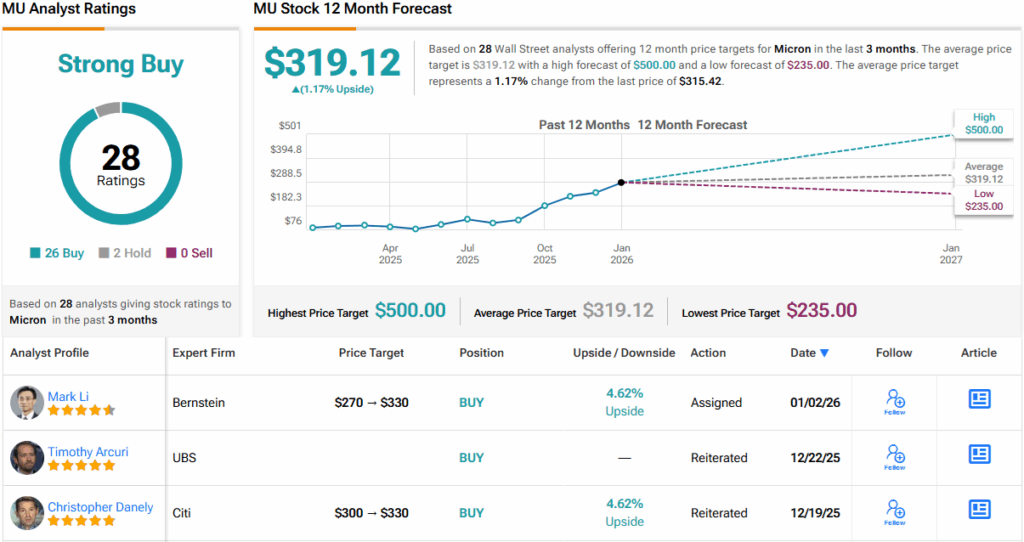

Wall Street, however, is taking the polar opposite view, betting that surging capex spending will continue to power MU higher. With 26 Buys and 2 Holds, the stock carries a Strong Buy consensus rating. Yet, after the massive run-up, its 12-month average price target of $319.12 implies limited upside. (See MU stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.