The rhythms of the market don’t always beat to harmonious tunes, something investors in SoundHound AI (NASDAQ:SOUN) experienced throughout the past year. The voice AI platform lost around 50% of its value during 2025, which was characterized by multiple dips and valleys.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company’s tough luck came from a variety of sources, including a divestment from AI-leader Nvidia, profit-taking after a white-hot run to end 2024, worries about SoundHound’s lack of profits, and its M&A activities.

The company, however, can boast strong top-line growth, which reached $114 million for the first nine months of 2025 (representing year-over-year growth of 127%).

Yet, for all that growth, the stock kept sliding. And if top investor Will Ebiefung is right, SoundHound’s road ahead may remain bumpy, with little sign that smoother sailing is just around the corner.

“SoundHound’s roller-coaster ride highlights the danger of investing in a company based on hype and positive news stories,” explains the 5-star investor, who is among the top 3% of stock pros covered by TipRanks.

Ebiefung isn’t convinced by SOUN’s Q3 revenues of $42 million, though this represents 68% year-over-year growth, pointing out that much of these sales were powered by acquisitions. In contrast, the investor notes that the company’s operating losses of $115.9 million in Q3 grew by more than 240%.

“This is significantly bigger than revenue, and it’s safe to say the company has no clear pathway to profitability, especially if it continues to drive growth through acquisitions,” adds Ebiefung.

That’s not to say that the investor thinks all hope is lost. He calls voice- and speech-enabled AI “arguably the low-hanging fruit” of the generative AI opportunity, and that adoption through large swaths of industry could spread quite rapidly.

Ebiefung is also encouraged by the early-mover’s partnerships with major brands, including Krispy Kreme, Stellantis, and Mercedes-Benz. Still, the investor has a hard time peering beyond the company’s losses and unprofitable numbers, which he argues “speak louder than words.”

“Investors may want to wait on the sidelines until SoundHound’s losses begin to moderate and it demonstrates a convincing pathway to profitability. Shares should be avoided for now,” concludes Ebiefung. (To watch Will Ebiefung’s track record, click here)

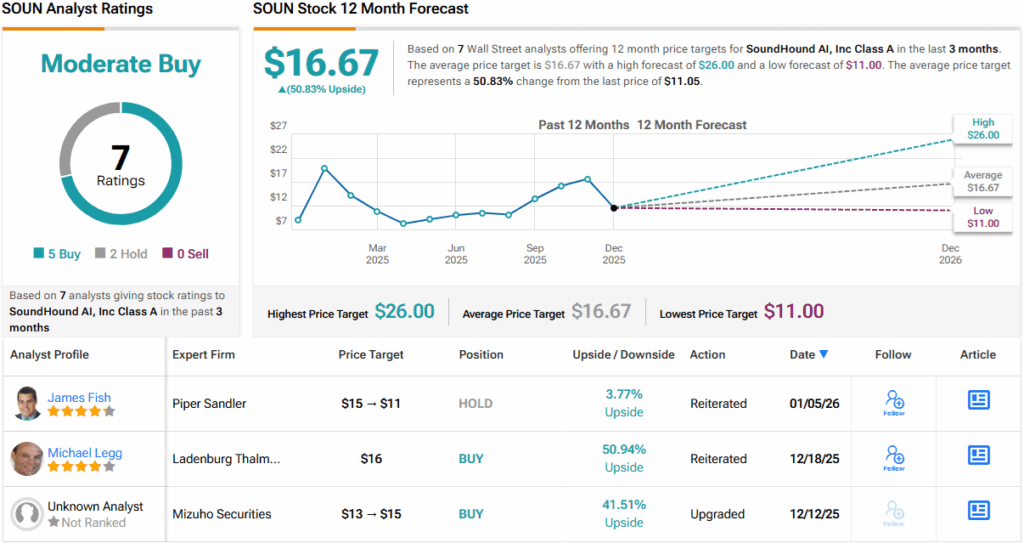

Wall Street is singing along to SOUN’s music, however. With 5 Buys and 2 Holds, SOUN enjoys a Moderate Buy consensus rating. Its 12-month average price target of $16.67 points to potential gains of ~51% in 2026. (See SOUN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.