Hims & Hers Health (NYSE:HIMS) shares were on a massive run, but that momentum hit a wall recently. Since its peak on February 19, the stock has nosedived 53%.

The downturn coincided with the FDA announcing that Novo Nordisk’s Ozempic and Wegovy, used for diabetes and weight management, are no longer in shortage. This development impacted Hims & Hers, which had been selling compounded versions during the supply gap. With the shortage resolved, the telehealth company can no longer produce exact copies of these drugs.

Semaglutide-based GLP-1 drugs have faced supply constraints since 2022 due to rising obesity drug demand, allowing compounding pharmacies to step in. Hims & Hers began offering discounted compounded semaglutide last May, with the boost in revenue and earnings setting the scene for the huge share price gains.

So, can the company still hit its ambitious target of at least $725 million in weight loss revenue in 2025? That’s the key debate, as investors reassess whether the company can maintain its momentum without the tailwind of drug shortages.

Meanwhile, Eli Lilly and Novo Nordisk have launched direct-to-consumer (DTC) pharmacy platforms to expand patient access.

Lilly introduced LillyDirect in early 2024, allowing patients to order medications online with a valid prescription, while NovoCare, launched this month, offers copay savings and insurance support. Lilly has also adjusted Zepbound pricing to make it more accessible, following a subscription-based pricing model similar to other telehealth providers.

Morgan Stanley analyst Craig Hettenbach acknowledges that weight-loss drug sales are the dominant force shaping Hims & Hers’ stock performance in the near term, but that is not the only point to consider here.

“While the weight loss category is likely to have the greatest influence on near-term stock performance of HIMS with particular attention to its ‘hand-off’ motion (the “hand-off” motion refers to Hims & Hers’ strategic transition from offering compounded semaglutide injections to focusing on other weight-loss solutions), performance in the core business and execution on the company’s long-term strategy also matters,” says the analyst.

Compared to previous years, Hettenbach thinks the “setup for the stock is different in 2025.” While the company has consistently outperformed expectations, investors see its 2025 guide as more ambitious than in the past. The main concerns are the sustainability of personalized compounded GLP-1 drugs and the company’s projected ~150% year-over-year weight loss revenue growth. “Given these uncertainties,” he says, “investor expectations are more cautious than usual.”

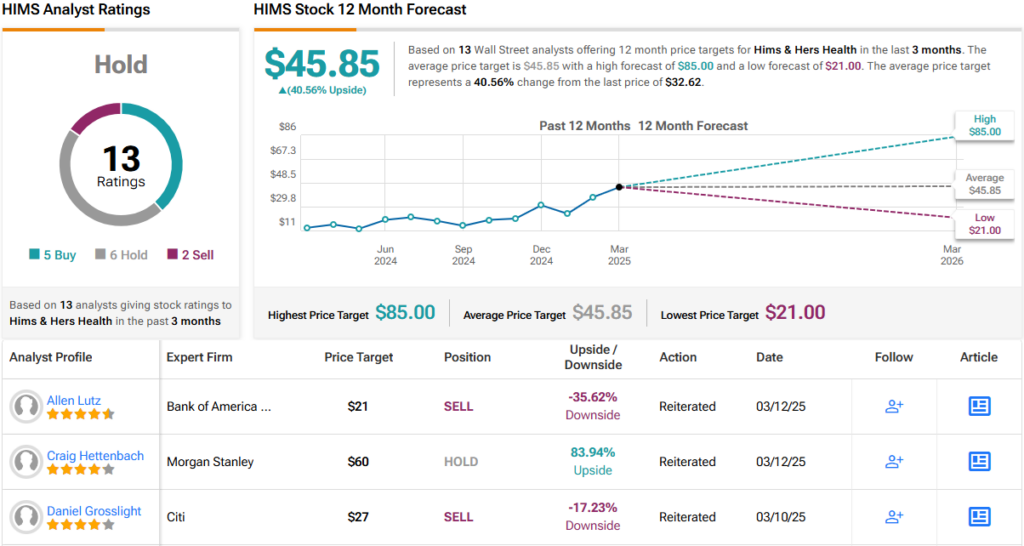

Accordingly, Hettenbach rates HIMS shares an Equal-weight (i.e., Neutral), although he might as well have said Buy, considering his $60 price target factors in a one-year gain of a hefty 84%. (To watch Hettenbach’s track record, click here)

It’s a similar, albeit more moderate story, amongst Hettenbach’s colleagues. On the one hand, based on 6 Holds, 5 Buys, and 2 Sells, the stock only claims a Hold consensus rating. However, the $45.85 average price target implies shares will climb by ~41% in the year ahead. It will be interesting to see whether analysts upgrade their ratings or reduce their targets shortly. (See HIMS stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Questions or Comments about the article? Write to editor@tipranks.com