Five-star DA Davidson analyst Gil Luria recently told Yahoo Finance that he believes chipmaker Nvidia (NVDA) is becoming too dependent on a few large tech companies, with around half of its revenue now tied to them. Interestingly, just three years ago, Microsoft (MSFT) made up less than 1% of Nvidia’s revenue. However, it now accounts for nearly 19%, with about 47% of its capital spending going just toward Nvidia chips. Luria warns that this level of spending may slow down as Big Tech firms increasingly rely on their own custom AI chips, which would reduce the need for Nvidia’s general-purpose GPUs. As a result, he has a Hold rating with a $120 per share price target.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

It is no secret that Nvidia’s growth has been fueled by strong demand for AI chips from top customers like Microsoft, Meta (META), Amazon (AMZN), and Alphabet (GOOG). Indeed, Bloomberg data shows that Microsoft is Nvidia’s largest customer, while Meta makes up over 9% of Nvidia’s revenue and spends 25% of its capital budget on its chips. At the same time, Microsoft also rents AI data center capacity from CoreWeave (CRWV), which buys billions in Nvidia chips. Together, these four tech giants are expected to spend more than $330 billion on AI this year.

However, there are signs that this growth could slow down. As previously mentioned, big tech companies are developing their own AI chips that will be designed for their specific needs, while competitors like Broadcom (AVGO) are building custom AI chips for others. Although Nvidia still leads in AI model training, rising competition and growing worries over AI monetization could impact future spending. It is also worth noting that Nvidia is set to report earnings on May 28, with analysts expecting 74% growth in data center revenue. This is still strong, but much lower than the 427% surge reported a year ago.

Is NVDA a Good Stock to Buy?

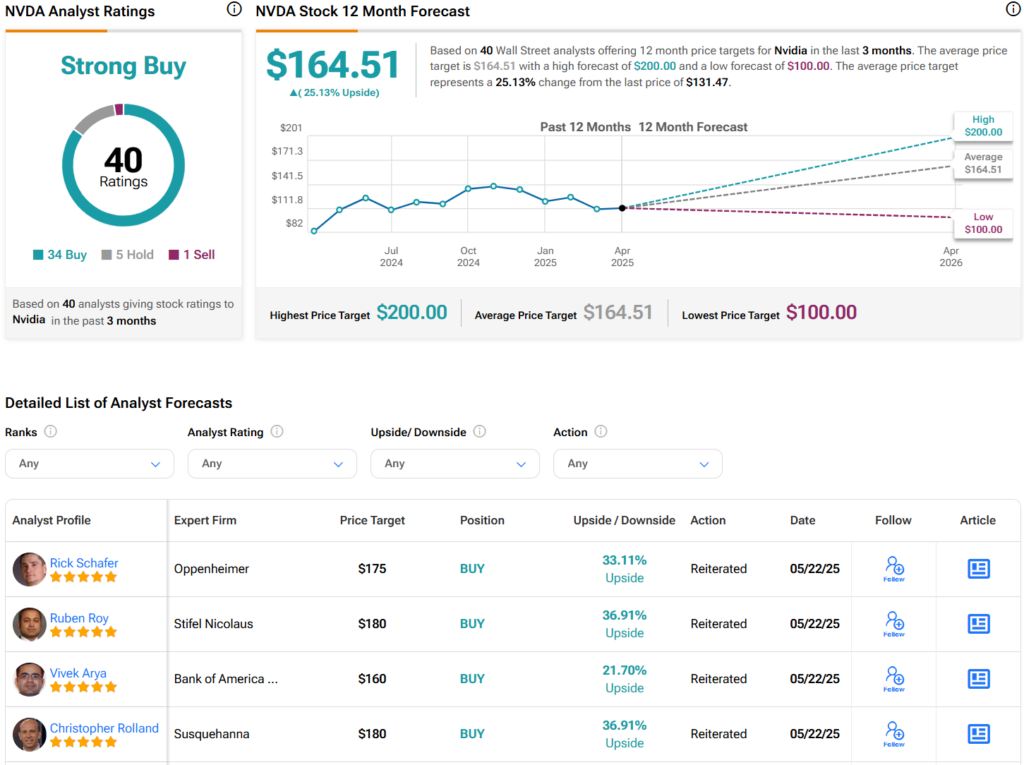

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 34 Buys, five Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $164.51 per share implies 25.1% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue