A month’s worth of good news has Tesla (NASDAQ:TSLA) bulls feeling – what else? – ebullient.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Elon Musk got his $56 billion pay package (re) approved by shareholders. China will probably let Tesla operate FSD EVs in the Middle Kingdom, the company is building Optimus robots, and plans to unveil its long-awaited Robotaxi… eventually. All this has stock market investors feeling positive on Tesla stock again, and the stock is up 44% over the past month.

Despite all this, Wells Fargo analyst Colin Langan is unimpressed.

Tesla stock’s remarkable turnaround, warns the analyst, owes more to Elon Musk’s trademark “razzle dazzle,” and to short sellers closing their short positions to avoid getting blinded by the light, than to any long-term sustainable competitive advantage in the stock. To the contrary, says Langan, Tesla’s fundamentals remain weak, and while Q2 2024 numbers could be a bit better than expected, the long-term trend on this stock is going to turn lower again – and probably sooner than you think.

What’s wrong with Tesla? As the analyst reminds, Q2 deliveries, while better than expected, were still down 5% year-over-year. What’s more, the decline probably would have been steeper but for Tesla (basically) bribing consumers to buy its cars, with “finance promos of up to $5K.”

That’s not going to be great for profit margins. It also doesn’t speak highly of underlying demand for Tesla’s EVs. Short term, sure, Langan says the better than expected delivery number means Tesla’s Q2 profits will probably be about $0.50 per share – better than the $0.41 Langan previously forecast. But $0.50 will still be down 45% from last year’s Q2 profit.

And the bad news won’t end there.

Looking out through end-of-year, Langan forecasts Tesla profits will fall by nearly half year-over-year, to about $1.60 per share, and he predicts a further 16% deterioration in profit in 2025 as well. As the analyst explains, new tariffs instituted to promote America’s battery industry (and hamper China’s) are likely to add $1,000 to the cost of Model 3 electric cars sold in the U.S. this year. In Europe, similar trade protections could raise the cost of Chinese-imported Model 3s there by $9,000 each.

Between sales lost to cheaper automakers, and costs absorbed by Tesla as it attempts to win what sales it can, Langan calculates tariffs could cost Tesla $600 million in lost profit – and twice that in 2025.

As revenues continue to shrink and costs continue to rise, things are not looking great for Tesla on the bottom line. More than just the risk to “profits,” as generally accepted accounting principles calculate such things, Langan warns that Tesla’s free cash flow will be cut in half this year, to just over $2 billion. And don’t think the fact that GAAP profits will fall only 16% next year is good news. It’s not – because free cash flow in 2025 could crash as much as 65%, to as little as $720 million.

It almost goes without saying, but with a forecast as bleak as this one, Langan rates Tesla stock as Underweight (i.e. Sell) – and predicts a year from now, Tesla’s $256 stock will sell for just $120 a share. (To watch Langan’s track record, click here)

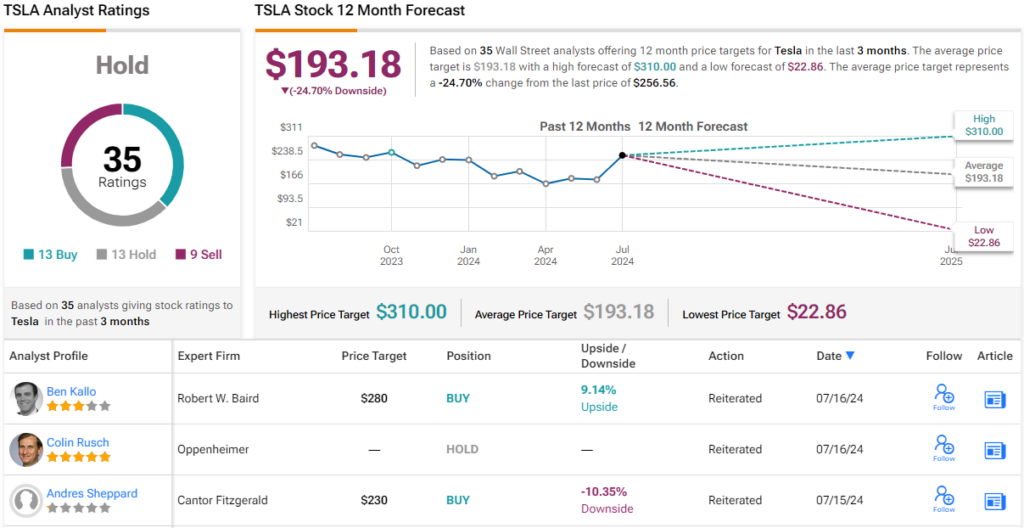

Overall, TSLA gets a Hold (i.e. Neutral) rating from the analyst consensus. The stock has 35 recent analyst reviews, breaking down to 13 Buys, 13 Holds, and 9 Sells. The shares are selling for $256.56, and the average price target of $193.18 indicates a potential upside of ~25% over the next 12 months. (See TSLA stock analysis)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.