Whenever gold is mentioned in investor circles there is always a lazy writer ready to draw comparisons with the 19th century Californian gold rush.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

No Speculation

Well..even if this writer wanted to there is little point as Goldman Sachs (GS) analyst Lina Thomas has moved fast to dismiss any link between the huge record-toppling surge in the gold price this year – see below – and any fears of “them hills” speculation.

She believes that investors have been driven to the precious metal by solid “fundamentals not frenzy” and that the price still has some room to run.

“In reality, the move isn’t that unusual. Central banks are still buying record amounts of gold, and private investors are simply catching up as the Fed cuts rates,” said Thomas. “So after years of under-allocation, this is more normalization than mania.

Earlier this month, Goldman Sachs raised its December 2026 gold forecast to $4,900 per ounce from $4,300, citing strong inflows into Western gold ETFs and that central bank eagerness.

However, Thomas said there could still be a “significant upside” ahead, citing the 1970s gold rush as a historical parallel.

Nixon Knows

In that decade gold prices surged following President Richard Nixon’s decision to end the Bretton Woods fixed exchange-rate monetary system, which had pegged the dollar to gold.

The price rose dramatically due to market volatility, driven by soaring inflation, the oil crisis, and geopolitical fears tied to the Vietnam War and the Cold War.

“Back then, fiscal concerns and policy uncertainty led private investors to seek a store of value outside the system,” Thomas said. “If those fears were to crop up again, we could see the global trend toward diversification intensify,” she said.

Indeed geopolitics including the wars in the Middle East and Ukraine have played a large part in turning investors to look to the safe haven of gold this year.

But with a peace deal in place in the Israel/Palestine conflict and raised hopes for an end to the Ukraine conflict following new talks between President Trump and Russian leader Vladimir Putin some of the geopolitical fears may be easing.

That could tempt investors away from gold and back into equities, but given the events of this decade so far who knows what else is lurking around the corner?

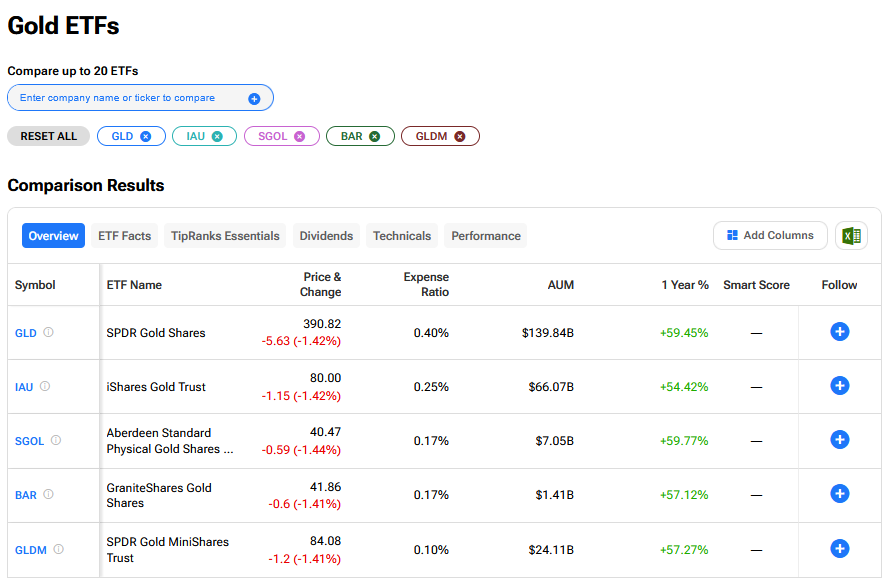

What are the Best Gold ETFs to Buy Now?

We have rounded up the best gold ETFs to buy now using our TipRanks comparison tool.