Emotions ran wild last week after Super Micro Computer (NASDAQ:SMCI) shared its preliminary FY 2025 Q3 results. Disappointing figures jolted the company, sending its share prices down by almost 20% in the after-hours session following the announcement.

Indeed, the company’s expected adjusted EPS of $0.29 to $0.31 was well under the $0.54 that analysts had projected. By the same token, expected revenues of $4.5 to $4.6 billion also fell below the $5.0 to $6.0 billion that Wall Street had predicted.

The company partially chalked up the disappointing performance to delayed customer purchases, pushing revenues that had been expected in Q3 to shift into Q4.

Of course, none of these developments are taking place in a vacuum, and the market is paying close attention for signs that the AI spending explosion is slowing down.

SMCI is scheduled to report its audited financials later this week on Tuesday, May 6 after the market closes, when it is expected to confirm its past numbers and offer guidance for Q4 FY 2025.

One investor known by the pseudonym On the Pulse thinks the recent drop is short-term in nature – reminding investors that the industry trends remain firmly in SMCI’s favor.

“Investors are overly emotional,” explains the 5-star investor. “The server and storage market is projected to grow significantly, driven by AI deployment, providing long-term tailwinds for Super Micro’s sales and profitability.”

For one thing, On the Pulse argues that the AI data center build-up is going full steam ahead. In fact, the investor cites a recent report stating that the server market is expected to expand from $150 billion in 2025 to over $200 billion by 2028.

The investor asserts that last week’s dip is far from a “falling knife.” Especially if the delayed sales are achieved next quarter, things will certainly be looking up for SMCI.

“The total addressable markets for server and storage products is anticipated to up-scale rapidly in the next couple of years, creating a catalyst for net sales and profit growth for Super Micro,” concludes On the Pulse, who rates SMCI a Buy. (To watch On the Pulse’s track record, click here)

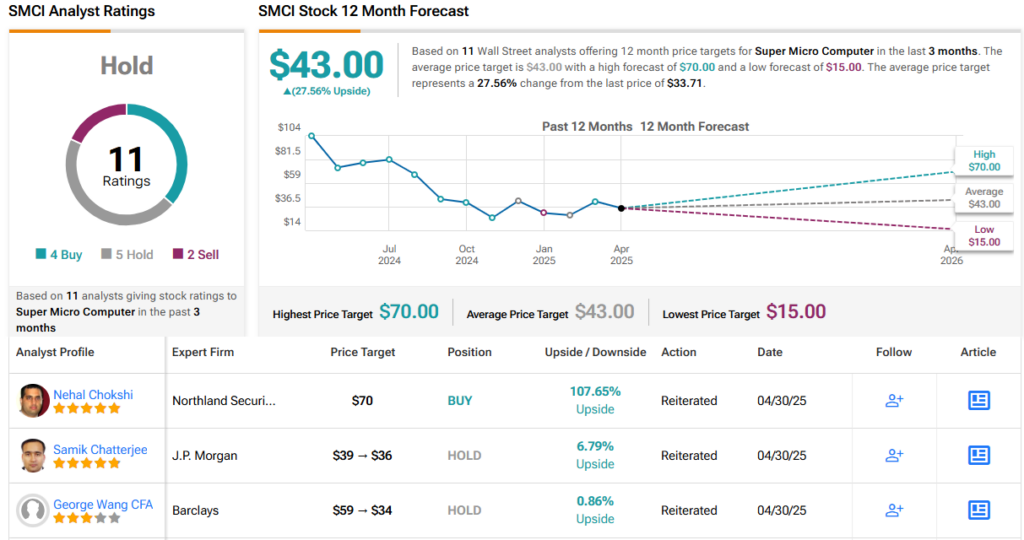

Wall Street, on the other hand, prefers to wait and see. With 4 Buy, 5 Hold, and 2 Sell ratings, SMCI holds a consensus Hold (i.e. Neutral) rating. Its 12-month average price target of $43.00 would yield gains approaching 30% in the year ahead. (See SMCI stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.