Donald Trump has long prided himself on disruption, but his latest antics involve a triple-hit combo of a $15 billion lawsuit against The New York Times (NYT), a renewed push to end quarterly corporate reporting, and pushing the SEC to move disputes away from public courts into private arbitration. All three developments have put market participants on high alert. The moves bear the unmistakable hallmarks of what’s becoming known as “Trumponomics”: headline-driven, destabilizing, and aimed as much at political theater as at economic policy.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to the Financial Times, the lawsuit, filed in Florida, accuses the NYT of defamation, branding it a “virtual mouthpiece” for Democrats. While the battle appears to be a skirmish between politics and media, it ultimately bleeds into the markets. Meanwhile, critics wailed that Trump was “shifting corporate power away from investors.”

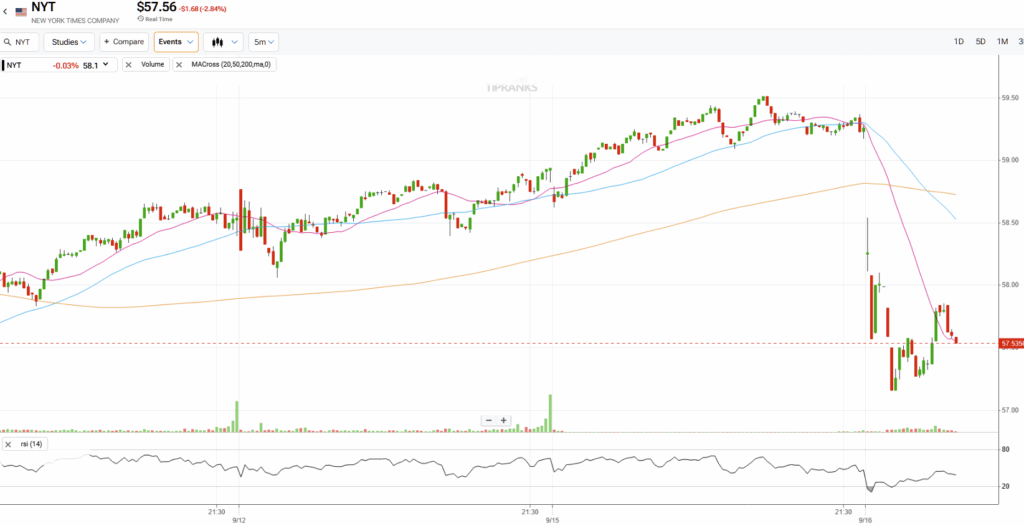

Amid the corporate boardroom ripples, NYT’s stock dropped almost 3% in early trade today, evidence that investors are factoring in both litigation risk and heightened political hostility leading to the dreaded boycott. A Trumpian wrecking ball aimed at poor corporate governance is unlikely to bear shareholder value in any high regard, or so the NYT stock bears must be thinking right now.

Ironically, the NYT’s underlying performance remains robust. The global media company reported a surge of 230,000 net new digital subscribers, pushing its total base to nearly 12 million. Digital subscription revenue rose more than 15%, while digital advertising jumped almost 19%, according to the firm’s earnings figures published in August.

Overall, the media firm is sustaining a ~10% year-on-year revenue growth rate, while adjusted operating profit is ~28%. In the first half of 2025, the Times generated $193 million in free cash flow and returned $134 million to shareholders through dividends and buybacks. Summed up, the stock outpaced the S&P 500 (SPX) over the past three years, but not by much.

A newly inked licensing deal with Amazon (AMZN) centered on generative AI promises yet another growth engine. Yet the real test may not be in the earnings reports but in the courtroom — and critics warn that in a legal arena tilted toward Trump loyalists, even solid fundamentals could struggle to carry weight.

However, before value accretion proponents celebrate, it could be noted that the NYT’s fundamentals aren’t all that strong, as several challenges persist. Traffic from search and news aggregators is being disrupted by AI-generated results from the likes of ChatGPT and Google (GOOGL), thereby cutting off casual readers. That leaves NYT ever more reliant on its core subscriber base — a strength today, but a vulnerability if consumer growth slows. With Trump’s lawsuit now in public news, the company faces not only operational headwinds but also political ‘foot-in-mouth’ risk that can sway sentiment in a single trading session.

The Beginning of the End for Quarterly Earnings Seasons

Meanwhile, the President’s push to end quarterly reporting adds another tremor for markets. By halving disclosure requirements, Trump argues companies will save costs and “focus on properly running their businesses.” Shareholder advocates see a darker side: reduced transparency, less accountability, and more room for corporations to conceal inconvenient developments.

For media companies like the NYT, quarterly results not only reassure investors but also spotlight trends in subscriptions, advertising, and traffic. Slowing that cadence, while questioning its relevance, could blur an accurate picture of corporate health into something that suits only particular interests. Surely, the U.S. Commander-in-Chief wouldn’t allow U.S. corporate reporting standards to devolve? The answer, it seems, is that it all depends on what people mean by devolution.

Markets tolerate volatility, but volatility engineered from the Oval Office is another matter. Trump’s mix of political grievance and stock meddling ensures investors must now price in what Trump would probably call ‘the cost of doing business’: Trumponomics risk. For the Times and the broader market, the real question is whether this wrecking-ball approach leaves cracks too deep to plaster over.

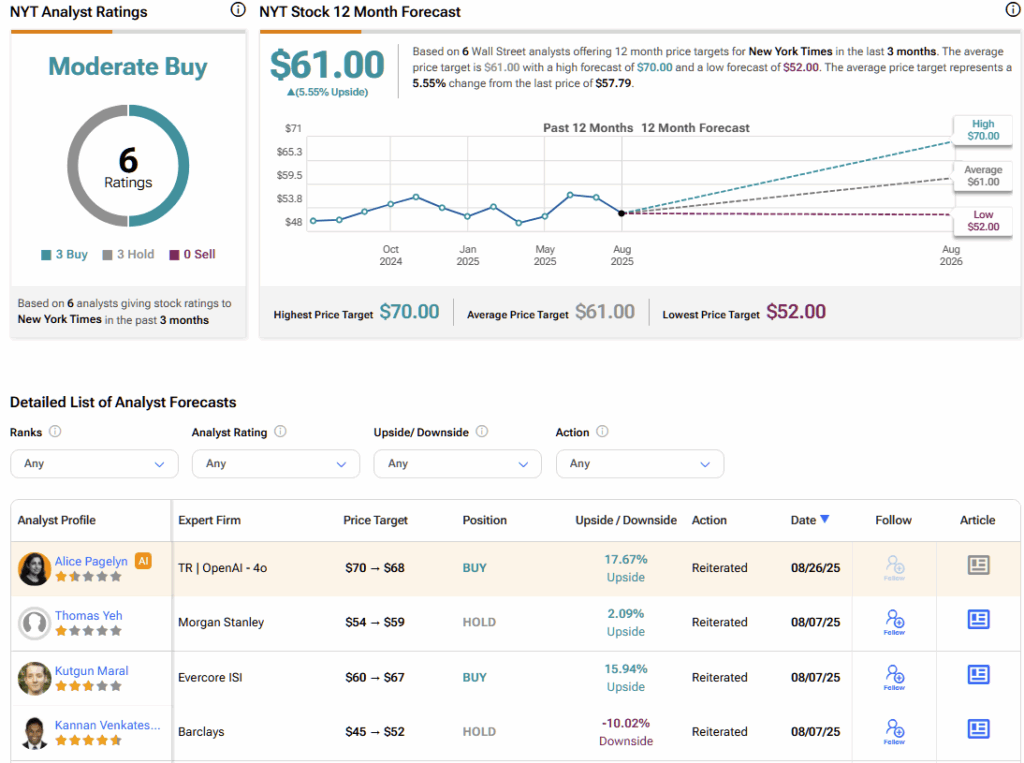

For now, Wall Street analysts remain on the fence about NYT, projecting the stock to extend its uptrend from 2022, though at a more measured pace. Yet how long that confidence endures may hinge less on fundamentals or speculative flows than on how forcefully the NYT is willing to stand against the one and only.