Dominion Energy (D) stock was on the move Monday after the energy company filed a lawsuit against the U.S. government. The lawsuit specifically came from Dominion Energy Virginia, which is developing wind energy production sites off the East Coast. The company was joined by others who were named in a stop-work order from the Bureau of Ocean Energy Management.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The stop-work order halts development of these offshore wind projects for 90 days while they are evaluated as potential threats to national security. The lawsuit calls this order “arbitrary and capricious.” It also highlights that the government order is costing it $5 million a day just for the ships needed for the construction.

While the stop-work order was only recently issued, legal proceedings are moving swiftly. as U.S. District Judge Jamar Walker has set a hearing date for 2 p.m. ET today. This will have the judge weigh in on Dominion Energy’s request for a temporary restraining order, which could allow it to resume operations at its Virginia project despite the government order. The judge’s decision will likely act as a strong catalyst for D stock.

Dominion Energy Stock Movement Today

Dominion Energy stock was up 0.12% in pre-market trading on Monday, following a 0.32% rally on Friday. The stock has increased 15.15% year-to-date and 9.89% over the past 12 months.

Investors will note that trading activity for D stock is low today at roughly 1,500 shares, compared to a three-month daily average of about 6.5 million units.

Is Dominion Energy Stock a Buy, Sell, or Hold?

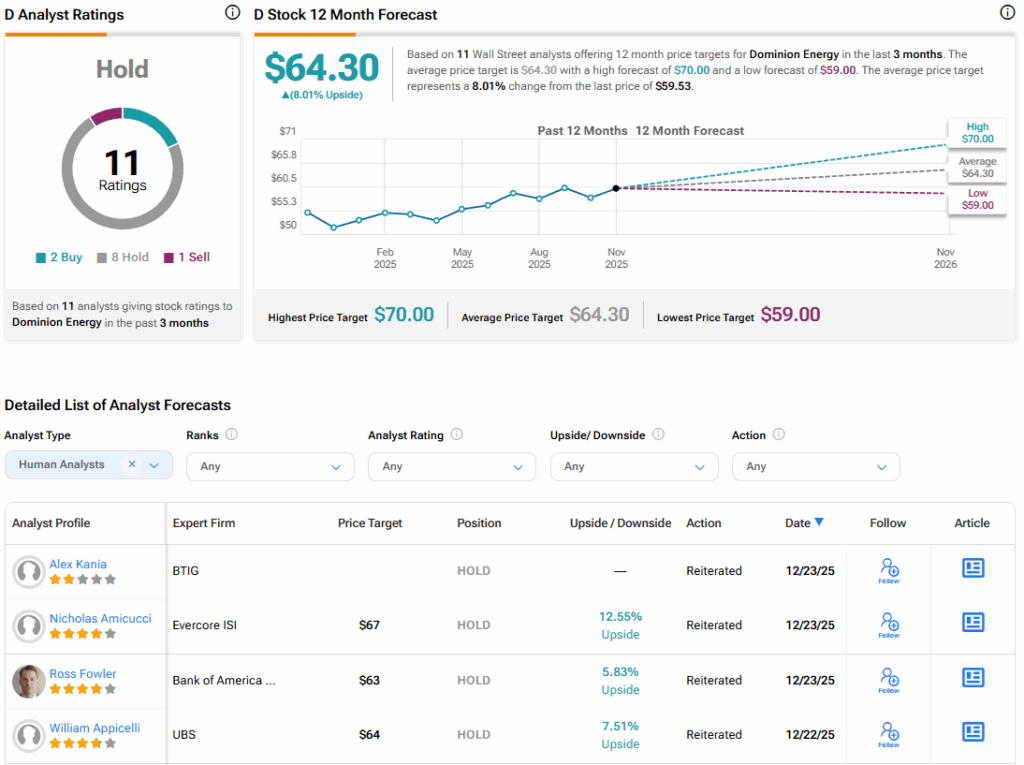

Turning to Wall Street, the analysts’ consensus rating for Dominion Energy is Hold, based on two Buy, eight Hold, and a single Sell rating over the past three months. With that comes an average D stock price target of $64.30, representing a potential 8.01% upside for the shares.