Dollarama (TSE:DOL) (OTC:DLMAF) reported its Fiscal Q1-2024 earnings earlier today, with the discount retailer beating both revenue and EPS expectations. The company reported a noteworthy 20.7% year-over-year increase in sales to C$1.294 billion, which exceeded the anticipated C$1.25 billion. Similarly, diluted earnings per share soared by 28.6% to C$0.63, surpassing the consensus estimate of C$0.59.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Dollarama’s comparable store sales saw significant growth of 17.1%, mainly due to robust demand for consumables, seasonal items, and general merchandise. This growth is impressive, given the strong 7.3% increase in the same period of the previous year.

Further, EBITDA grew by 22.1% to C$366.3 million, accounting for 28.3% of sales, compared to 28.0% of sales in the previous year. The company opened 21 new stores during the quarter, expanding its store count to 1,507 and aiming for 2,000 stores across Canada by 2031.

Fiscal 2024 Outlook

Dollarama’s 2024 guidance remains unchanged from its March announcement, including a forecast of 60 to 70 net new store openings, comparable store sales growth of 5.0% to 6.0%, and a gross margin between 43.5% to 44.5%.

Is Dollarama Stock a Buy, According to Analysts?

According to analysts, Dollarama stock comes in as a Moderate Buy based on seven Buys and three Holds assigned in the past three months. The average DOL stock price target of C$104.98 implies 26.8% upside potential.

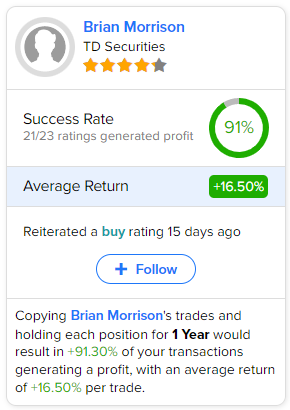

If you’re wondering which analyst you should follow if you want to buy and sell DOL stock, the most accurate analyst covering the stock (on a one-year timeframe) is Brian Morrison of TD Securities, with an average return of 16.5% per rating and a 91% success rate. See below.