Much has been made of big tech’s stellar run over the past year, with the Nasdaq (NDX) up 23.4% and hitting record highs. Yet the rally is much broader than tech. Discount retailer Dollar Tree (DLTR) has quietly surged almost 48% over the past 12 months and 32% since January—and I believe there’s still plenty of upside left.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

I’m Bullish on Dollar Tree due to its attractive valuation, strong shareholder returns, rapid store expansion, and unique value-driven shopping model. Moreover, if the economy softens, Dollar Tree stands out as a rare stock that could hold steady—or even benefit—as consumers trade down in search of low prices. Read on to see why this under-the-radar winner deserves attention.

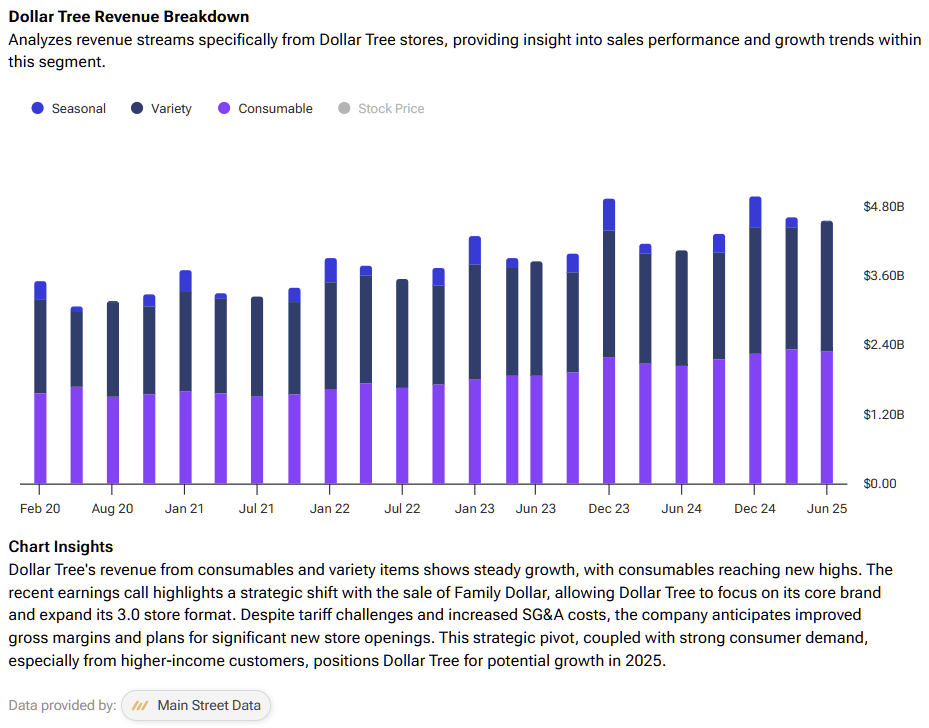

DLTR’s Expansion Story is Just Getting Started

Dollar Tree operates more than 9,000 discount retail stores across the U.S. and Canada, offering a wide assortment of groceries, snacks, household essentials, personal care items, toys, seasonal goods, greeting cards, and more.

What stands out most about Dollar Tree is its impressive pace of physical expansion—and the substantial runway that remains. The company recently celebrated the opening of its 9,000th store, having added roughly 1,100 new locations since 2023.

At its latest Investor Day, management reiterated confidence in sustaining a long-term pace of about 400 new stores per year. They also highlighted significant untapped growth opportunities in the Southwestern and Western U.S., as well as in dense urban corridors.

Differentiated Shopping Experience

Dollar Tree stands out for its ultra-low pricing, appealing not only to lower-income shoppers but also to value-conscious consumers across the income spectrum. The company’s average selling price per item is just $1.40, and roughly 85% of its inventory is priced at $2.00 or less. These savings resonate strongly in an era of persistent inflation—and could become even more compelling in a true economic downturn.

In that scenario, higher-income consumers are likely to “trade down” to more affordable retailers like Dollar Tree. Management notes that if its “occasional” shoppers—typically middle- and upper-income consumers who visit once every two months—made just one additional trip per year, it would add about $1 billion in incremental sales.

While low prices are the cornerstone of Dollar Tree’s value proposition, its appeal extends far beyond affordability. The company emphasizes “clean, bright, and inviting” stores that consistently exceed customer expectations. Its smaller-format locations are convenient, easy to navigate, and quick to shop—customers can complete a trip in around 10 minutes, which Dollar Tree calls “one of the fastest trips in retail.”

The convenience factor is hard to overstate. Many consumers, myself included, rely on big-box retailers for large grocery runs but don’t relish the thought of returning for a forgotten item like milk or detergent. In those moments, Dollar Tree’s convenience and speed make it the perfect solution—and often, a quick trip turns into an impulse buy or two, further boosting sales.

Finally, Dollar Tree offers something most discount retailers can’t: discovery. The company promotes the “treasure hunt” experience—shoppers come for essentials but often leave pleasantly surprised by unexpected finds. This element of surprise transforms an ordinary errand into something enjoyable, turning necessity-driven visits into repeat experiences that strengthen customer loyalty.

Discount Store Valuation

Despite its strong performance over the past 12 months, shares of Dollar Tree are still attractive, trading for just 17.2x January 2026 earnings estimates. This compares favorably to the S&P 500 (SPX), which currently fetches a multiple of 22.4x forward earnings.

Looking further out, shares of Dollar Tree look even cheaper. The stock trades for under 15x January 2027 earnings estimates, when analysts expect Dollar Tree to increase earnings to $6.36 per share. Obviously, a lot can happen between now and that time, but this is clearly a compelling valuation for a stock that is performing well and growing earnings.

Billion-Dollar Returns to Shareholders

Dollar Tree doesn’t pay a dividend, but it does return capital to shareholders through share repurchases. Since 2023, the company has repurchased roughly $2.1 billion worth of its own stock—a meaningful sum for a business with a market cap below $20 billion.

These buybacks are generally accretive to shareholders, as they reduce the share count, boost earnings per share, and effectively concentrate ownership among remaining investors. They also signal management’s confidence that the stock is undervalued.

Is DLTR a Good Stock to Buy?

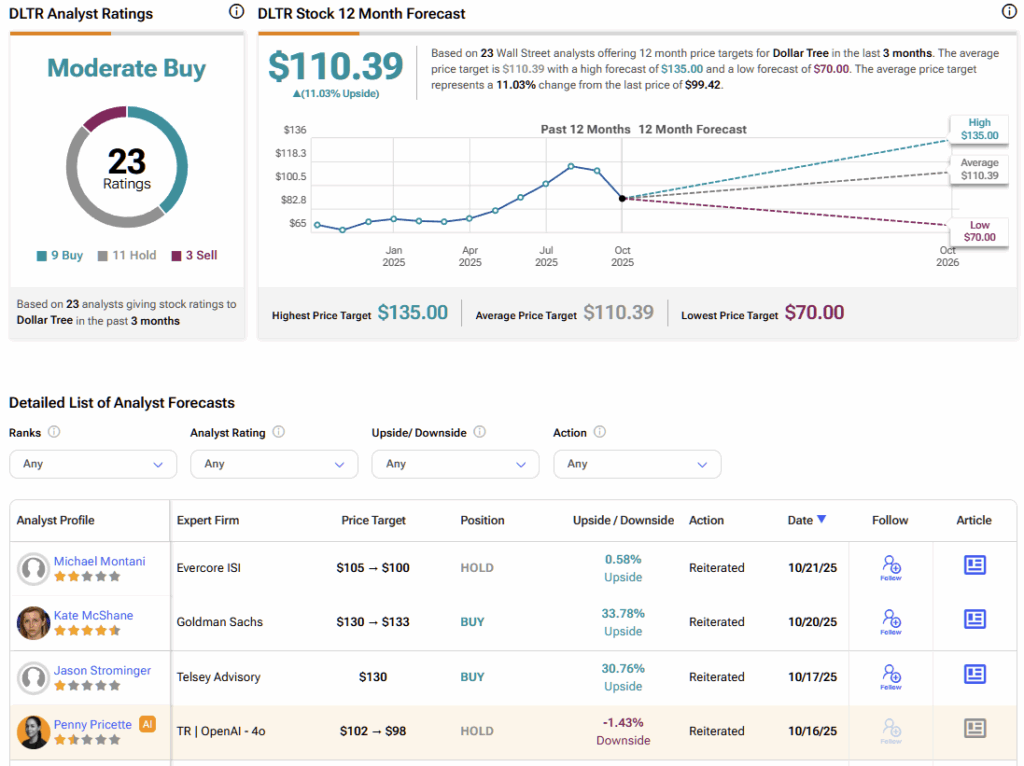

Turning to Wall Street, DLTR earns a Moderate Buy consensus rating based on nine Buys, 11 Holds, and three Sell ratings assigned in the past three months. The average DLTR stock price target of $110.39 implies 11% upside potential over the next 12 months.

A Quiet Winner with Plenty of Upside Left

I’m bullish on this quietly red-hot stock. Up nearly 50% over the past year, Dollar Tree shares have strong momentum but remain attractively priced, leaving meaningful upside potential. The company is also creating value through substantial share buybacks, returning significant capital to shareholders.

I’m particularly impressed by Dollar Tree’s steady pace of physical expansion and its distinct consumer experience, which gives the retailer a clear raison d’être. It delivers quality, low-cost products in clean, bright, and inviting stores—offering shoppers a quick, convenient trip often enhanced by the “treasure hunt” thrill of discovering unexpected deals. Finally, its value-driven model positions it well to weather, and even benefit from, an economic slowdown as consumers increasingly seek affordability.