Memecoins like Dogecoin (DOGE-USD), Shiba Inu (SHIB), and Dogwifhat (WIF) took a brutal hit on December 10, with losses far surpassing the downturn in Bitcoin and Ethereum (ETH-USD). The collective market value of these tokens tumbled, dipping to a three-week low of $119.6 billion. The total decline across the sector was steep—21% in just 24 hours.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

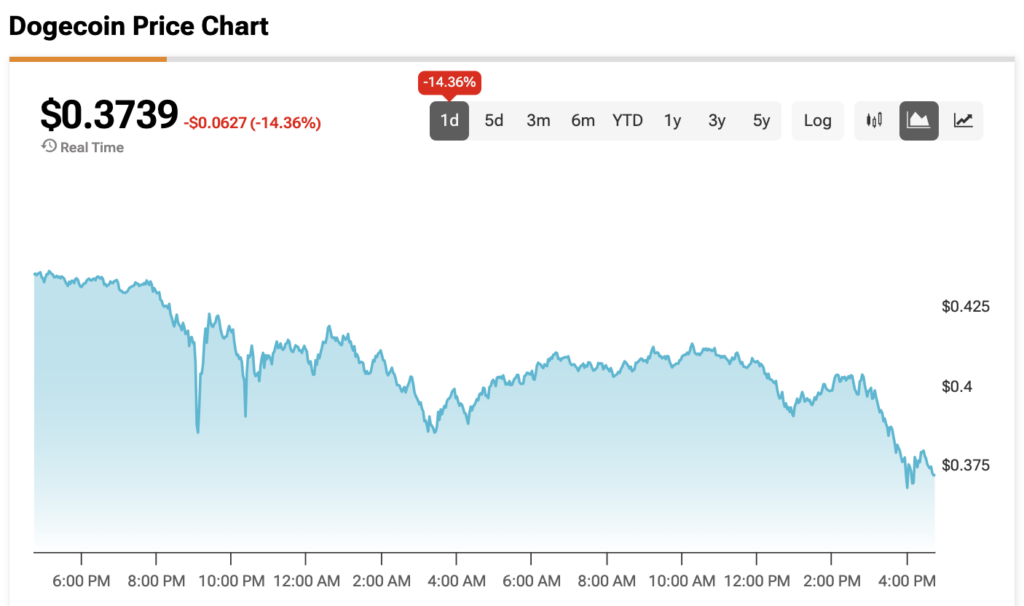

Dogecoin Leads the Decline

Dogecoin, the largest memecoin, bore the brunt of the crash, losing 5.6% in a day. SHIB fared even worse, dropping 10.4%. Meanwhile, Ethereum-based Pepe (PEPE) managed a small gain of 1.7%. But these losses are part of a broader trend. As CoinGlass noted, over $1.7 billion in crypto liquidations occurred in just 24 hours. The majority of this came from leveraged positions in memecoins, with $72.6 million in DOGE longs and $22.35 million in SHIB longs wiped out.

What’s Behind the Sell-Off?

Open interest (OI), which measures outstanding derivative contracts, also dropped sharply. CoinGlass observed a 30% decline in OI for Pnut (PNUT) and a 20% drop in DOGE’s OI. This suggests traders were pulling out positions in anticipation of further price drops.

It’s a huge wake-up call for the memecoin market, with the crash marking the biggest liquidation event since 2021. With leverage traders closing out contracts, these volatile tokens are in for a rough ride.

At the time of writing, Dogecoin is priced at $0.3739, down 14.4% over the past 24 hours.