Shares of DocuSign (NASDAQ:DOCU) sank in after-hours trading after the electronic signature company reported earnings for its first quarter of Fiscal Year 2025. Earnings per share came in at $0.82, which beat analysts’ consensus estimate of $0.79 per share.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Sales increased by 7.3% year-over-year, with revenue hitting $709.64 million. This beat analysts’ expectations of $707.4 million. Interestingly, investors could have anticipated the solid results by simply looking at DocuSign’s website traffic. As the image below shows, the number of visitors rose during the most recent quarter. In fact, total estimated visits jumped 17.62% when compared to the same quarter of last year.

Looking forward, management now expects revenue and a non-GAAP operating margin for FY 2025 to be in the ranges of $2,920 million to $2,932 million and 26.5% to 28%, respectively. This was essentially in line with expectations, as analysts were looking for $2,926 million in revenue, and it is likely the reason why shares are down.

Is DocuSign a Buy, Sell, or Hold?

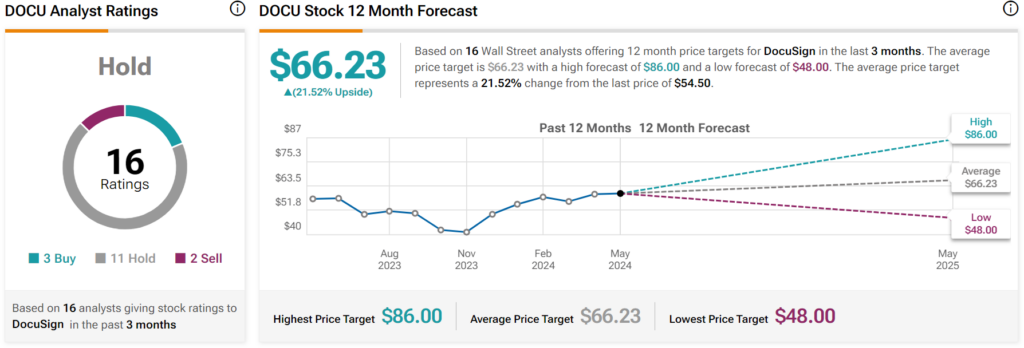

Turning to Wall Street, analysts have a Hold consensus rating on DOCU stock based on three Buys, 11 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 5% rally in its share price over the past year, the average DOCU price target of $66.23 per share implies 21.52% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.