The dockworkers’ strike from Maine to Texas has thrown a wrench into the U.S. supply chain just weeks before the busy holiday shopping season, potentially impacting retail stocks. Starting at midnight, members of the International Longshoremen’s Association (ILA) walked off the job at ports handling more than half of America’s imports and exports. The strike, which began as contract negotiations stalled, is already raising concerns about product shortages and price hikes for major retailers.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Big Retailers Brace for Short-Term Disruptions

For now, major retailers claim they’re prepared to ride out the storm, but the situation could change if the strike drags on. According to The Wall Street Journal, Brian Dodge, president of the Retail Industry Leaders Association, stated that “shoppers can rest assured holiday merchandise will be on shelves,” although prolonged delays would make it harder to “shield customers from its effects.” Stores like Best Buy, Home Depot, and Gap have already diverted shipments to West Coast ports and brought in products early, but there’s only so much time before costs rise.

The strike is already putting pressure on the supply chain. As a global supply manager at IKEA, Susanne Waidzunas shared that the company is moving its containers quickly, but “depending on how long the strike continues, it might have an impact on a larger scale of course.” So while retailers may appear calm now, there’s a real risk of increased prices in the long term.

Shipping Costs Climb, Affecting Imports and Prices

Even with proactive measures in place, the shipping industry is feeling the pinch. Freight rates are climbing as demand for space on ships surges. According to Yoshika Hirata, operations director at apparel brand Stance, “What it has impacted is the cost because obviously rates are going up because of the situation.”

Importers like Tim Ryan, owner of Square 1 Farms, are already passing along costs to customers. “We’re adding about 50 cents a pound to the prices we charge stores to cover higher airfreight costs,” Ryan noted. Whether supermarkets will absorb those costs or pass them on to consumers is anyone’s guess, but it’s a warning sign of what could come if the strike isn’t resolved soon.

If this strike stretches on, retail stocks could face a rough ride ahead as prices rise and consumer spending takes a hit.

Which Retail Stocks Are a Buy?

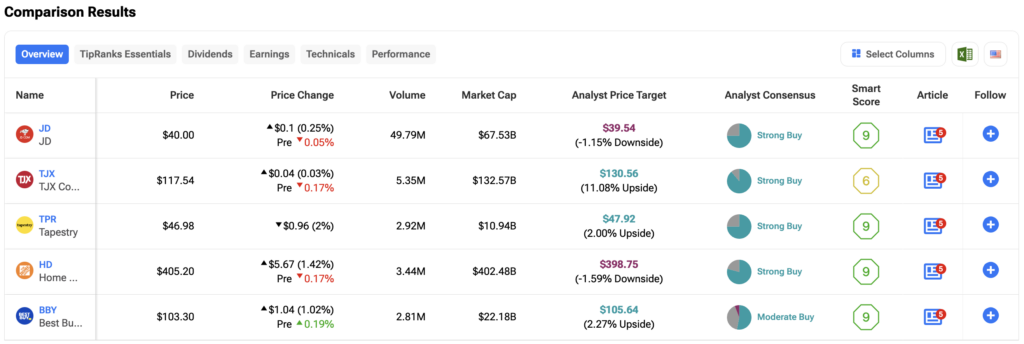

Investors looking for the best retail stocks to add to their portfolio can utilize TipRanks’ Stocks Comparison tool to easily evaluate their options. As seen in the image, the tool allows you to compare key metrics such as price, market cap, and analyst consensus for companies like JD.com (JD), TJX Companies (TJX), Tapestry (TPR), Home Depot (HD), and Best Buy (BBY). For example, TJX Companies has a price target of $130.56, representing an 11.08% potential upside, while Tapestry is projected to grow by 2% to $47.92. With features like Smart Scores and strong analyst ratings, this tool helps investors pinpoint the stock that best aligns with their investment strategy.