SoFi Technologies (SOFI) stock rallied 70% in 2025, outperforming the broader market despite an uncertain macro backdrop. The fintech company has consistently delivered impressive results in recent quarters, supported by continued growth in its member base. While several analysts acknowledge the company’s ability to deliver solid financials, Wall Street’s consensus rating indicates a cautious stance. Also, Wall Street’s average price target reflects limited upside in SOFI stock from current levels.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SoFi Technologies’ focus on capital-light, fee-based revenue is bolstering its position. In fact, fee-based revenue grew 50% to $409 million in Q3 2025. Also, the company continues to expand rapidly. It ended Q3 2025 with 12.6 million members and 18.6 million products, reflecting a 35% and 36% year-over-year growth, respectively. Despite many positives, several analysts are wary about SOFI stock.

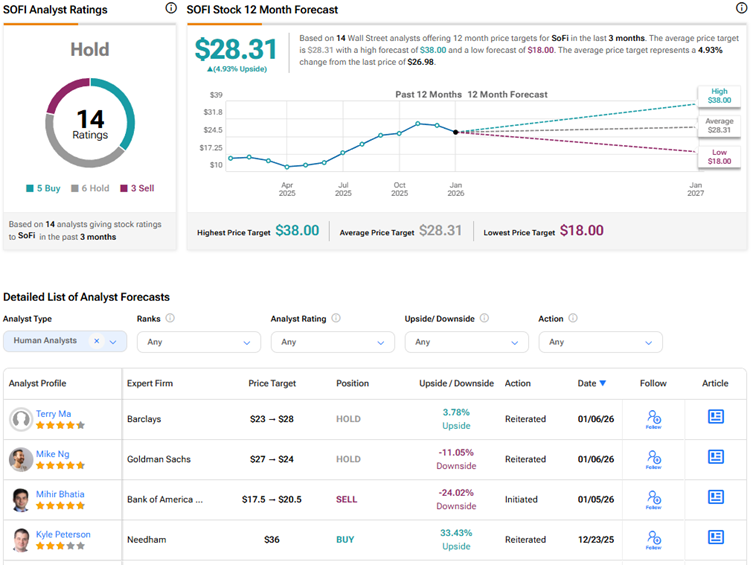

Analysts Are Cautious About SOFI Stock

On Tuesday, SOFI stock fell after Bank of America analyst Mihir Bhatia resumed coverage with a Sell rating and a price target of $20.50. The 5-star analyst views SoFi’s recent $1.5 billion capital raise as a “modest positive,” as it provides the required funds to invest in continued growth. That said, Bhatia believes that SOFI’s capital raises have sparked more questions about potential acquisitions. Any deal is “likely to be smaller and more complementary than game-changing,” contends Bhatia. The analyst is bearish on SOFI stock as he sees limited upside at the current valuation levels.

Meanwhile, Barclays analyst Terry Ma increased the price target for SOFI stock to $28 from $23 as part of his 2026 outlook and reaffirmed a Hold rating. The 4-star analyst sees further upside in select consumer finance stocks in 2026. Ma expects a “benign” credit backdrop to boost loan growth. He also expects the mortgage origination market to improve in 2026.

Furthermore, Goldman Sachs analyst Michael Ng lowered his price target for SOFI stock to $24 from $27 and reiterated a Hold rating. In his 2026 outlook, Ng stated that he prefers companies with long-term adoption trends, such as BNPL (buy now, pay later) providers Klarna Group (KLAR) and Affirm (AFRM) and neobanks Block (XYZ) and Chime Financial (CHYM), where lending is generally of very short duration and activity levels are not completely dependent on lending volumes. Ng remains more cautious about longer-duration credit consolidation lenders, like SoFi and Upstart (UPST), due to their “relatively high market shares and less differentiated product offerings.”

Is SOFI a Good Stock to Buy?

Overall, Wall Street has a Hold consensus rating on SoFi Technologies stock based on six Holds, five Buys, and three Sell recommendations. The average SOFI stock price target of $28.31 indicates 5% upside potential from current levels.