Shares of sporting goods retailer DICK’s Sporting Goods (NYSE:DKS) rallied by over 7% in the premarket session today after the company announced impressive first-quarter results and raised its financial outlook.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

DKS’ Impressive Q1 Performance

DKS’ top line improved by 6.2% year-over-year to $3.02 billion. The figure fared better than expectations by $80 million. In sync, EPS of $3.30 outpaced estimates by a healthy margin of $0.34.

A combination of solid demand and compelling athletic product offerings helped DKS improve its comparable store sales by 5.3%. Additionally, the company experienced growth in transactions and average ticket size.

DICK’s Sporting Goods’ Solid Outlook

Importantly, DKS is experiencing positive business momentum and market share gains. Buoyed by this trend, the retailer has hiked its financial outlook for the full year. It now expects net sales of $13.1-$13.2 billion for Fiscal year 2024. EPS for the year is seen landing in the range of $13.35-$13.75, compared to the prior estimate of $12.85-$13.25. Moreover, comparable store sales growth is now foreseen at 2%-3% versus the prior outlook of a 1%-2% increase.

Separately, the company has declared a quarterly dividend of $1.10 per share. The DKS dividend is payable on June 28 to investors of record on June 14.

What Is the Price Forecast for DKS Stock?

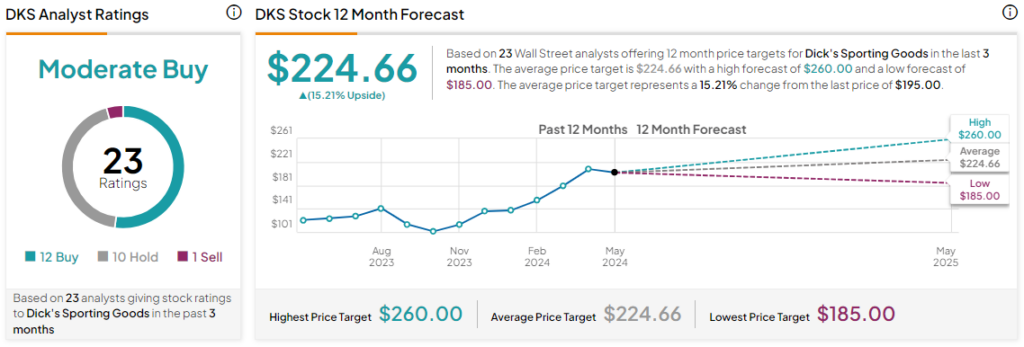

Today’s price gains come on top of a mega 54.3% rally in DICK’s Sporting Goods’ share price over the past six months. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average DKS price target of $224.66. However, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure