Kalshi, a prediction market platform, is starting to shake up the sports betting world. Indeed, over the weekend, the firm broke its own trading records by handling over $260 million in trades on Saturday and then beating that with more than $275 million on Sunday. This surpassed its previous high of $245 million, set on Election Day 2024, and shows just how fast the platform is growing in popularity.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, most of Kalshi’s weekend trading focused on football, which made up 98% of its activity. This happened even though other events like the Ryder Cup, Major League Baseball, and political headlines were happening at the same time. One game in particular, the Sunday Night NFL overtime showdown between the Green Bay Packers and the Dallas Cowboys, set a record on Kalshi as the most-traded single event ever, with $57.2 million in trades.

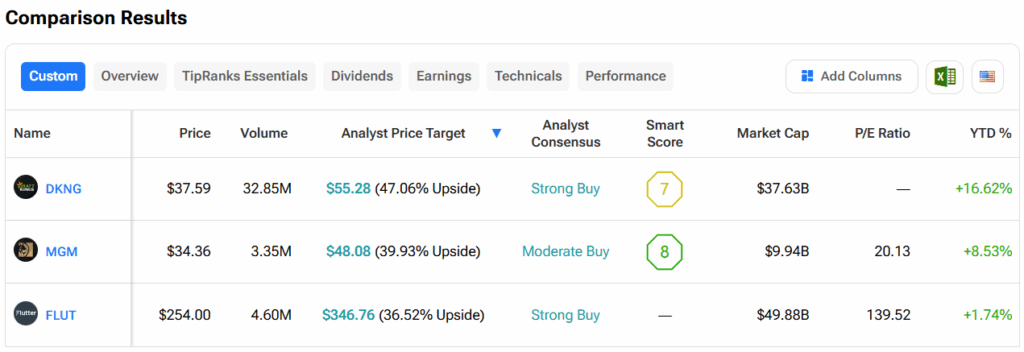

As a result, Kalshi is starting to take a noticeable share of the sports betting market and is possibly pulling in 5% to 10% of total activity. One reason why this is happening is because the platform is legal in states like California and Texas, where regular sports betting isn’t allowed. Unfortunately, this didn’t sit too well with investors of sports betting stocks—such as DraftKings (DKNG), Flutter Entertainment (FLUT), the owner of FanDuel, and MGM Resorts (MGM), which owns half of BetMGM—as their shares sank in today’s trading.

Which Sports Betting Stock Is the Better Buy?

Turning to Wall Street, out of the stocks mentioned above, analysts think that DKNG stock has the most room to run. In fact, DKNG’s average price target of $55.28 per share implies more than 47% upside potential. On the other hand, analysts expect the least from FLUT stock, as its average price target of $346.76 equates to a gain of 36.5%.