Dividend stocks have always had their boosters, and for plenty of good reasons. Steady income streams, based on reliable payments, are always good to have.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Barclays analyst Richard Hightower has been watching the lodging REIT sector, seeking solid dividend payers. It’s a logical place to look; REITs are known as ‘dividend champs’ in the stock markets, and frequently offer high-yield payments. Lodging REITs own and operate hotel properties ranging from economy brands to upscale resorts, and their cash flows are tied closely to tourism, business travel, and overall economic activity.

To be sure, Hightower acknowledges that lodging REITs have lagged in recent years. Still, the analyst argues that underperformance hasn’t wiped out the opportunity – and that selective investors can still uncover standout names offering both resilience and solid income.

“We do see opportunities for relative outperformance within Hotel REIT… With respect to the revenue growth outlook for 2026, we see reasons for optimism, as follows: First, beginning in 2Q26, overall ‘comps’ are easier across several REITcentric markets, most notably in Washington, DC and Los Angeles, with other markets (e.g. the Bay Area) just beginning to ramp again following COVID-era depression. Second, 2026 will enjoy an exceptionally strong calendar for big events and citywides, including the Super Bowl, World Cup, and America 250. And finally, due to a limited environment for construction financing and the high cost of new hotel construction, the outlook for supply growth is stable, and should not present a headwind to revenue growth for the next several years,” Hightower opined.

Put it all together, and the setup starts to look more compelling than recent performance might suggest. Hightower has zeroed in on two lodging REITs offering dividend yields as high as 9%. The obvious follow-up is whether the rest of the Street shares his view. To answer that, we turned to the TipRanks database. Let’s take a closer look.

Apple Hospitality REIT (APLE)

The first Barclays pick we’ll look at, Apple Hospitality, is one of the largest lodging REITs in the US hotel market. The company holds a large and diverse portfolio of hotel properties, including some 217 hotels boasting a total of some 29,600 rooms. The company’s properties are located in 84 markets across 37 states plus DC. Apple’s portfolio includes hotels operating under brands owned by such major names as Marriott, Hilton, and Hyatt.

The key underlying point in Apple’s portfolio is location: the company’s hotels are located in high-demand areas, with access to the tourist trade. The company even has hotel properties in such far-flung places as Portland, Maine, and Anchorage, Alaska. Buying hotels in tourist-adjacent areas lets Apple leverage guest amenities, tourist traps, and scenic vistas to deliver performance.

What this means in performance is visible in the last quarterly report, from 3Q25. In that quarter, Apple Hospitality generated $373.88 million. This was down 1.3% year-over-year, but it beat the forecast by $3 million. At the bottom line, the company realized an FFO of 42 cents per share, a figure that was in line with the estimates.

The FFO was important, as it covers the company’s dividend. Apple Hospitality pays out the dividend monthly, a schedule that is less common than quarterly payments but can align better with people’s usual schedule of bills and expenses. The 8-cent monthly payment annualizes to 96 cents per common share, and gives a forward yield of 8%.

Barclays analyst Hightower paints an upbeat picture of APLE shares, noting the overall quality of the company and its prospects for continued gains.

“Despite recent operational headwinds and share price underperformance versus peers, we believe APLE to be a high-quality company that has produced solid long-term total returns for shareholders with far lower risk than several peers. We appreciate that APLE has a clear, definable strategy of owning a diversified portfolio of select-service hotels, which enjoy a simple business model and high absolute operating margins. Although we acknowledge that select-service-oriented chain scales have underperformed other hotel categories over the past couple of years, we believe revenue and expense trends are generally moving in a better direction. Additionally, we believe that investors benefit from APLE’s low-leverage balance sheet, high capex efficiency, and general skill in capital allocation,” Hightower noted.

These comments back up the analyst’s Overweight (i.e., Buy) rating on the stock, and his $14 price target implies that the shares will gain 12% over the next 12 months. Add in the 8% dividend yield, and the total one-year return here may reach 20%. (To watch Hightower’s track record, click here)

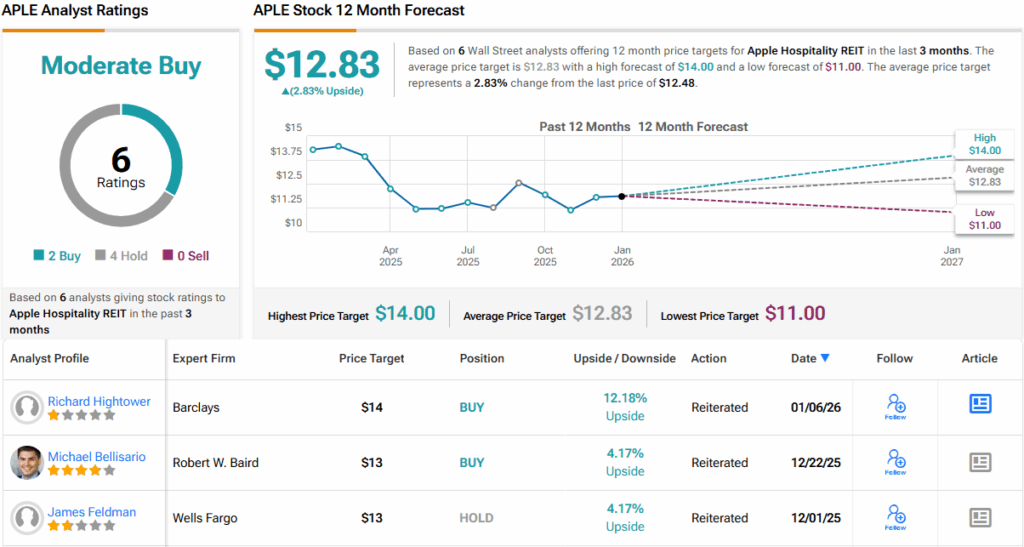

Overall, with 6 analyst reviews on file for this stock, including 4 to Buy and 2 to Hold, Wall Street’s analysts give APLE a Moderate Buy consensus rating. (See APLE stock forecast)

Park Hotels & Resorts (PK)

The second stock we’ll look at is Park Hotels & Resorts, a $2.3 billion Virginia-based lodging REIT that was formed in 2017 through a corporate spin-off from Hilton Worldwide. The transaction separated Hilton’s real estate holdings into a standalone company, allowing each business to focus on its core strengths – Park on owning and operating hotel properties, and Hilton on brand management and franchising.

Park’s portfolio today consists of 35 hotels and resorts encompassing roughly 23,000 rooms. The properties are concentrated in high-barrier U.S. markets, with approximately 90% of the portfolio in the luxury or upscale segments and about 80% located in central business districts or major resort and conference destinations. Similar to Apple’s approach of focusing on premium positioning, Park’s hotels are affiliated with leading brands, including Hilton, Marriott, and Hyatt.

The company has also been active in refining its portfolio. Park regularly divests non-core assets to maintain its upscale focus, and in December announced the sale of five such properties. Those transactions, expected to close early this year, are projected to generate $198 million in gross proceeds.

On the income front, Park declared a quarterly dividend of $0.25 per share on October 23, payable January 15. At an annualized rate of $1 per share, the payout translates into a forward dividend yield of 9.3%.

Financially, revenue in 3Q25 declined 6% year over year to $610 million, though the figure modestly exceeded consensus expectations by roughly $296,000. Funds from operations came in at $0.35 per share, missing estimates by $0.03. Still, FFO for the quarter comfortably covered the declared dividend, supporting the sustainability of the payout despite near-term earnings pressure.

The Barclays view here, expressed by analyst Hightower, explains why this stock looks good for investors: “Although PK’s stock has provided a relatively poor return-versus-risk proposition for investors historically, we believe the company has outlined a credible path to significant (and underappreciated) portfolio improvement and commensurate de-leveraging. From nearly every angle — whether as a multiple of cash flow, in comparison replacement cost, or as compared to our internal estimate of NAV — we believe PK’s shares are attractively valued at current levels.”

Quantifying this stance, the analyst gives the stock an Overweight (i.e., Buy) rating, with a $13 price target that suggests a one-year upside potential of 13%. With the forward dividend yield added in, investors may be looking at a one-year return of 22%.

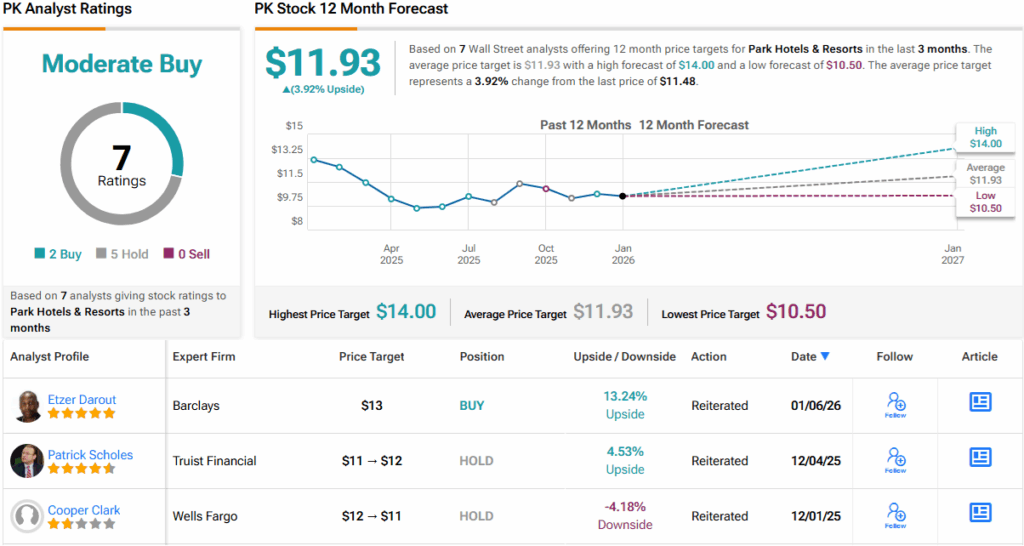

More broadly, PK earns a Moderate Buy consensus on Wall Street, with 2 Buys outweighing a larger camp of 5 Holds. (See PK stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.