While most of us likely think of online retail giant Amazon (AMZN) as a force in the market that has destroyed a lot of businesses, few of us consider the possibility that a startup might take it down. That is the latest proposition with Stord, a logistics firm that bought an entire UPS (UPS) subsidy and means to parlay it into a platform that can take down Amazon itself. Amazon shareholders, meanwhile, were not especially concerned, sending Amazon shares up fractionally in Monday afternoon’s trading.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Stord picked up Ware2Go, and though it kept quiet about many of the specifics of the deal, it hopes that the move will allow it to better compete with Amazon. That is a tall order given the nature and sheer access to resources that Amazon enjoys. But given that Ware2Go is a third-party delivery option that looks to speed up delivery and give merchants more options, it may have something there.

More specifically, it seems Stord will be targeting the small business vendor with its Ware2Go acquisition, a point that has been kind of a sticking point for Amazon for some time. Given how many small Amazon businesses are frustrated with Amazon’s multitude of seller policy changes, anything that represents a viable replacement option could be welcome to sellers, and a problem for Amazon.

Canceling the Successful Show

Then, in a move that left a lot of outside viewers baffled, Amazon took one of its popular series from Amazon Prime—The Bondsman—and shut it down. Not only was The Bondsman a former number one show from Amazon’s own top 10 lists, after a month and a half, it currently stands at the second most popular series on the site, second only to Reacher itself.

Amazon itself did not comment, at last report, but suggested causes of cancellation were episode cost and viewer commitment. While viewership numbers were suggested solid—it is the second most popular series on Amazon Prime, after all—there may be issues with viewers cutting out midway through. And of course, there is always the issue of cost. Since The Bondsman stars Kevin Bacon, that may have been too much of a bill for Amazon to foot.

Is Amazon a Good Long-Term Investment?

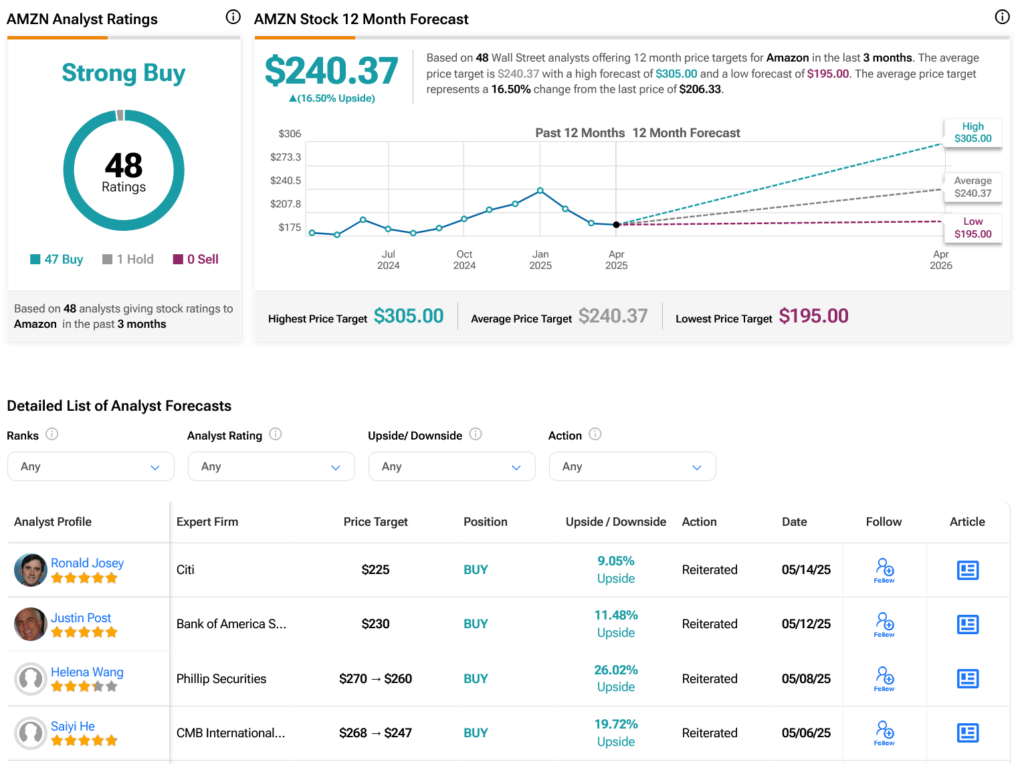

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 47 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 12.01% rally in its share price over the past year, the average AMZN price target of $240.37 per share implies 16.5% upside potential.