Entertainment giant Disney (DIS) is eyeing summer like children eyeing the arrival of the ice cream truck. This could be a very big deal for Disney, who badly needs some wins. And current projections say it may be able to get one with the upcoming release of Disney’s Thunderbolts*, which will be one of just two chances Marvel has to spark up interest in the Marvel Cinematic Universe ahead of Avengers: Doomsday. But investors are certainly upbeat, and Disney stock is up over 2% in Friday afternoon’s trading.

Things are starting off on track ahead of the film’s release. Critics are not especially enthusiastic about this, but no one seems to be knocking it very hard. In fact, Rotten Tomatoes currently has it at a Certified Fresh 88% with critics. Audiences are enjoying it even more, with early word coming in at a whopping 95%, which makes Snow White look like a poisoned apple by comparison.

Pre-release tracking, reports note, has Thunderbolts* coming in somewhere around $73 million and $75 million for opening weekend. That is certainly not Marvel’s new high-water mark, but it is well above the low, and at this point, that might be the best that Marvel—and by extension Disney—can ask for. Better news here is that Thunderbolts* will apparently be sufficiently self-contained to be worth watching by itself, instead of drawing in a lot of material from earlier films. There will be some of that, though, a good bonus for the long-term and attentive viewer.

The Villain, Misunderstood

And then Disney did something unexpected, something that has a lot of viewers raising questions. A new live show coming at the end of May to Disney’s Hollywood Studios titled Disney Villains: Unfairly Ever After will offer up some new backstory on those old classic villains that tries to paint them in a more “sympathetic” light, reports note. This is not the first time something like this has happened; remember both Disney’s own Cruella and recent blockbuster Wicked for trying to soften the villain.

This comes at an interesting time for Disney, as reports note that all of Disney’s in-house creative agencies—specifically The Hive and Yellow Shoes—will be unified together under Chief Brand Officer Asad Ayaz. The new unification seeks to “…dovetail brand and experience campaigns across Disney’s consumer touchpoints.” Some believe this will allow Disney to take full advantage of its range of intellectual property. Others believe it will hinder innovation, something that Disney built its Magic Kingdom on from the word go.

Is Disney Stock a Buy or Hold?

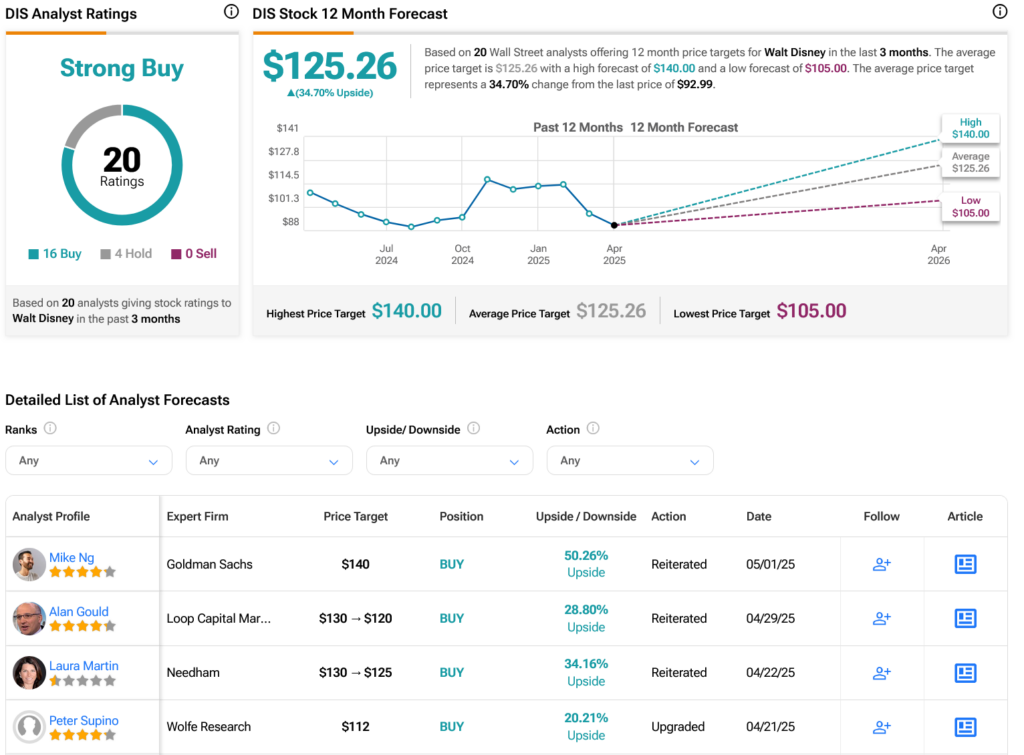

Turning to Wall Street, analysts have a Strong Buy consensus rating on DIS stock based on 16 Buys and four Holds assigned in the past three months, as indicated by the graphic below. After a 17.53% loss in its share price over the past year, the average DIS price target of $125.26 per share implies 34.7% upside potential.