The Walt Disney Company (DIS) reports Fiscal fourth-quarter results on Nov. 13, and investors are preparing for what could be a telling update on the entertainment giant’s transformation.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Wall Street expects modest top-line growth but muted profits, as Disney’s streaming momentum runs up against theme park softness and integration costs. The consensus estimate calls for revenue of $22.88 billion, up just 1.3% year over year, and earnings per share of $1.05, down nearly 10%.

Disney stock has fallen slightly this year, trailing the broader market and its streaming competitors. Yet optimism remains for the company’s longer-term turnaround, with management guiding to fiscal 2025 adjusted EPS of $5.85, an 18% increase from last year.

Streaming Expansion Drives Optimism

Disney’s Direct-to-Consumer segment continues to be the company’s growth engine. Management projected more than 10 million new subscriptions across Disney+ and Hulu in the quarter, helped by the new Charter Communications (CHTR) distribution deal and the August launch of ESPN’s $29.99 monthly streaming service.

The company expects $1.3 billion in operating income from entertainment streaming this Fiscal year. While Hulu’s full integration into Disney+ by 2026 remains on track, the effort will come with one-time costs that could weigh on near-term profits.

Content engagement also helped retention. Marvel’s Fantastic Four: First Steps posted Disney’s best 2025 opening weekend, while new streaming releases like Eyes of Wakanda and Only Murders in the Building season five sustained demand on Disney+. Analysts say a rebound in streaming profitability could offset slower growth in other areas, at least temporarily.

Disney’s Experiences Segment Faces Headwinds

Disney’s Experiences division, which includes theme parks, resorts, and cruise lines, has shown signs of fatigue. Attendance at Walt Disney World reportedly slowed through August and September, prompting discounts such as free dining packages and multi-park ticket offers.

Those promotions, along with $50 million in pre-opening expenses for Disney Cruise Line’s new ship, likely pressured per-capita spending and margins. While management still expects full-year Experiences operating income growth of 8%, the short-term softness underscores ongoing consumer spending concerns.

Disney Trades at a Discount Despite Streaming Progress

At roughly 16.8 times forward earnings, Disney trades below the industry average of 19.1, even after hitting profitability in streaming. DIS stock has slipped about 0.5% year-to-date, while the consumer discretionary sector is up 1.8%. Competitors like Netflix (NFLX) and Amazon (AMZN) are outperforming, with gains of 23.8% and 11.4%, respectively.

This discounted valuation could appeal to long-term investors, but near-term clarity remains key. The company also continues to absorb the financial impact of its India joint venture and recent Hulu acquisition, which together are expected to result in about $200 million in equity losses this quarter.

Investors Stay Cautious as Parks Slow and Margins Tighten

Disney’s upcoming earnings report will test whether management’s turnaround plan is gaining real traction. Investors are watching for signs that streaming profits can offset weakness in the Experiences segment, where lower park attendance and heavy cruise line costs weighed on margins last quarter.

The company’s $5.85 adjusted EPS guidance for Fiscal 2025 remains the key benchmark. Analysts say hitting that target will depend on sustained Disney+ subscriber growth, ESPN’s new streaming uptake, and cost controls across parks and media operations.

Until those results show measurable improvement, most analysts recommend holding positions rather than adding exposure. If streaming momentum holds and margins stabilize, Disney could finally turn its multiyear restructuring into tangible shareholder gains, but the next few quarters will need to prove it.

Is Disney Stock a Buy, Hold, or Sell?

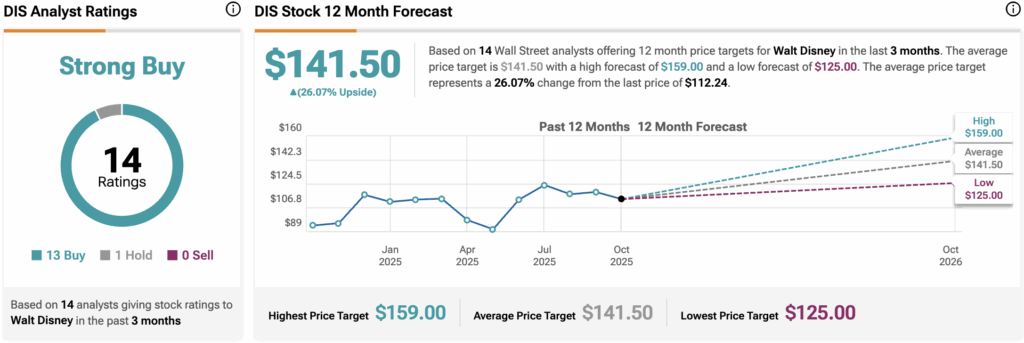

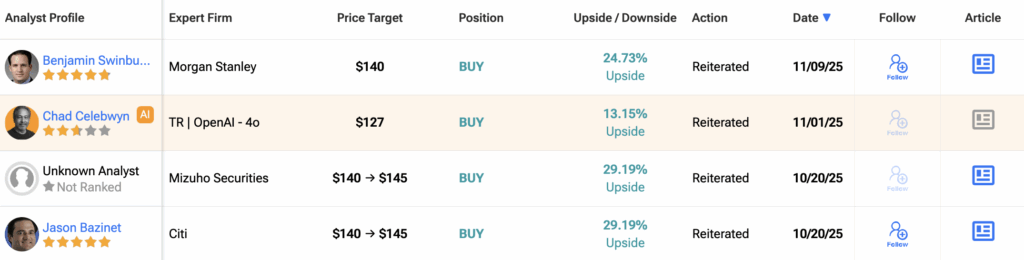

Wall Street remains optimistic about Disney’s outlook heading into earnings. Based on 14 analyst ratings over the past three months, the stock carries a “Strong Buy” consensus, with 13 Buy and one Hold recommendation.

The average 12-month DIS price target sits at $141.50, implying a 26% potential upside from the recent close.