The Walt Disney Company (NYSE:DIS), one of the largest entertainment companies in the world, is betting big on streaming with the decision to collaborate with Fox Corporation (NASDAQ:FOXA) (NASDAQ:FOX) and Warner Bros. Discovery, Inc. (NASDAQ:WBD) to create a sports streaming joint venture (JV). On the back of a 40% decline in the last three years, Disney stock looks attractive at a time when the company is going all-in on streaming. I am bullish on Disney stock, as I believe growth will accelerate in the future.

Cable TV Is Losing Its Saving Grace

Live sports, for almost a decade, have been the saving grace for the cable TV industry. When the cord-cutting movement intensified, sports fans were reluctant to ditch cable TV because of the unavailability of OTT (over-the-top) live sports streaming. Today, tables are turning with live sports streaming rights acquired by OTT platforms.

Many Wall Street analysts agree that the ongoing transformation of the media industry in favor of OTT sports streaming will put the final nail in the coffin for the cable TV industry. Last September, Wedbush Securities analyst Michael Pachter claimed that adding sports to streaming platforms would intensify the cord-cutting movement. Sharing a similar stance, Insider Intelligence analyst Ross Benes believes that cord-cutting is coming full circle with the addition of sports, dealing a fatal blow to the cable TV sector.

Not surprisingly, Pay TV subscribers have been declining steadily in the last decade. During the third quarter of 2023, the cable TV sector lost 1.1 million subscribers. According to Nielsen data, cable accounted for just 28.2% of total viewership time in the U.S. in December, down from about 31% in the corresponding month the previous year.

Zooming out, we find that cable TV accounted for the lion’s share of viewership a decade ago, which highlights the existential threat faced by cable TV today.

Implications of the Proposed JV on Disney’s Earnings

Amid the ongoing global transformation of the media sector, Disney is aggressively investing in its streaming platforms. The company has already succeeded in attracting millions of subscribers to its Disney+ platform and is now focused on digitalizing the sports streaming industry with the expected global launch of ESPN+ and the JV with Fox and Warner.

To understand the expected impact of this proposed JV on Disney’s long-term earnings, investors need to evaluate the outlook from a few aspects.

First, this venture will create a significant new revenue source for Disney. Live sports streaming will attract advertisers more than other content categories, which should allow Disney and its JV partners to earn revenue not only by selling subscriptions but also through advertising. In addition, this new platform will help Disney funnel sports fans into its other streaming subscriptions as well.

Second, this JV will enjoy significant competitive advantages, as the service will have streaming access to almost all major sporting events in the U.S., including the NFL, NBA, MLB, NASCAR, and even the FIFA World Cup.

Third-party sports streaming platforms such as fuboTV (NASDAQ:FUBO) will face an existential threat when this new platform goes live, as the JV can undercut third-party platforms by raising content licensing fees. For context, Disney, Fox, and Warner already have secured live TV rights for many of the sporting events highlighted above.

If this proposed JV gains traction in the market – which is likely to happen – Disney’s long-term competitive advantages will get a boost through the consolidation of the sports streaming sector.

Third, Disney will be able to mitigate the expected losses from a decline in cable TV viewership by converting cord-cutters into streaming subscribers. Regardless of whether Disney offers a streaming service or not, the cord-cutting movement will only accelerate in the future. By offering a robust streaming service, Disney can recoup some of the expected losses.

Finally, Disney may strategically bundle the new sports platform with existing streaming services such as Disney+, Hulu, and ESPN+ to enhance value for users, leading to higher retention of subscribers. A bundled platform should help the company’s average revenue per user in the streaming segment.

Overall, the new JV is likely to prove value accretive to Disney’s earnings in the long run, although this service will cannibalize revenue in the short term as users ditch higher-priced cable TV properties owned by Disney for this lower-priced OTT platform.

Is Disney Stock a Buy, According to Analysts?

With revenue growth decelerating throughout 2023, Disney stock had a disappointing outing while its tech peers enjoyed stellar returns. Wall Street analysts struck a bearish stance for Disney last year, but this trend is now reversing.

After digesting first-quarter earnings last week, Needham analyst Laura Martin upgraded Disney stock and assigned a price target of $120. This decision was influenced by several factors: anticipated strong EPS growth in the current fiscal year, the added value from increased dividends and share repurchases, projections for the direct-to-consumer segment to reach breakeven this year, and expectations of reduced subscriber churn over the long term.

Goldman Sachs (NYSE:GS) analyst Brett Feldman also has a $120 price target for Disney and believes the company is on track to reach annual cost savings of at least $5.5 billion, thanks to recently implemented strategic measures.

UBS (NYSE:UBS) analyst John Hodulik believes Disney’s earnings growth will accelerate this year, aided by the expected turnaround of the DTC (direct-to-consumer) segment. The analyst is projecting EPS to grow by 23% in Fiscal 2024.

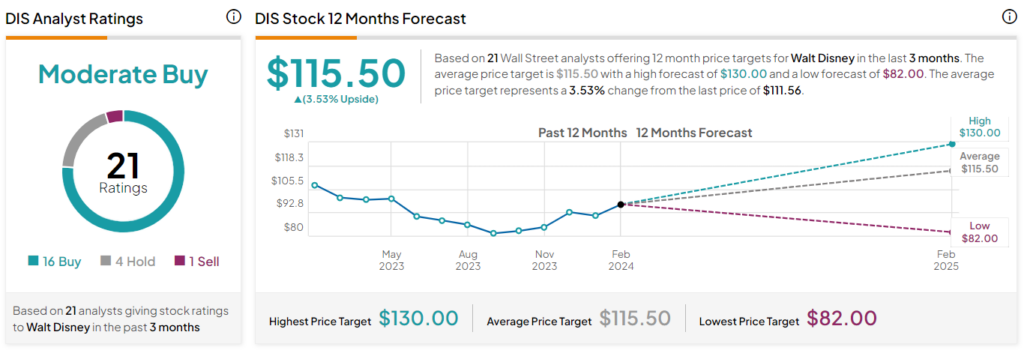

Based on the ratings of 21 Wall Street analysts, DIS stock comes in as a Moderate Buy. Additionally, the average Disney stock price target is $115.50, which implies upside of 5% from the current market price.

The Takeaway: Disney’s Prospects Are Changing for the Better

On the back of the expected launch of the new sports streaming JV and the notable profitability improvements in the DTC business, Disney is gearing up for a strong Fiscal 2024. Wall Street analysts are beginning to turn bullish on Disney, which may result in positive revisions to its average price target. Disney seems well-positioned to retain its competitive advantages as the media sector transforms into a fully digital landscape, which makes the company a bet on the future of media.