Coca-Cola (KO) and Disney (DIS) aren’t just celebrating 70 years of partnership, they’re reigniting two of the most recognizable brands on Earth at a time when both could use a bit of magic in their stock stories. The launch of Coca-Cola’s new Star Wars-themed campaign, “Refresh Your Galaxy,” isn’t just a fizzy nostalgia play. It’s a calculated brand offensive with shareholder implications.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Brand Equity Goes Galactic

At first glance, it’s collectible cans and hologram gimmicks. But zoom out. You’ve got 30 limited-edition Coke designs hitting shelves in global markets from Asia to the Americas. It’s not just about fans collecting, it’s about reigniting emotional loyalty with one of the most commercially powerful fanbases in history.

For Coca-Cola, this kind of cross-generational marketing doesn’t just spike short-term sales. It builds long-term equity. We’re talking retail uplift, social media engagement, and maybe most importantly: pricing power. Limited edition packaging gives Coke a reason to flex its premium branding muscle in an increasingly competitive beverage landscape.

And yes, collectors will buy more than one.

Disney’s Content Flywheel Gets New Fuel

On the other side of the can: Disney (DIS). The House of Mouse is juicing the Star Wars IP across platforms. From cinema ads to in-park exclusives, this campaign is a masterclass in ecosystem monetization.

Theme park traffic? Boosted. Coke’s exclusive designs are only available at Disney parks in Florida and California. That’s incremental spend on-site, plus food, merch, and everything else that comes with a theme park visit.

Disney also wins from eyeballs. The ad spot, a crowd of cosplayers using Coke bottles as lightsabers in a theater screening A New Hope, is engineered to go viral. Viral means reach, and reach means more subscriptions, more merch, more ticket sales.

The Impact on Disney and Coca-Cola Stock

For Coca-Cola, this isn’t just brand theater. It’s a margin story. Limited editions help drive volume, but more importantly, they support pricing in an inflation-heavy environment where differentiation matters. If the campaign drives even a modest increase in global sales velocity, it could meaningfully impact earnings, particularly in emerging markets where brand-led growth is key.

For Disney, the campaign is a reminder that Star Wars remains a crown jewel, and a lever that can pull revenue across theme parks, streaming, merchandise, and more. In a year when Disney’s streaming margins are under scrutiny and parks face post-COVID normalization, multi-channel campaigns like this offer synergistic upside.

Is Coca-Cola a Good Stock to Buy?

According to 16 Wall Street analysts, Coca-Cola is firmly in “Strong Buy” territory. The consensus includes 15 Buy ratings and one Hold, with zero Sell recommendations in sight. The average 12-month KO price target is $79.53, a healthy 14.2% upside from its current level of $69.64.

Why it matters? A global campaign tied to Star Wars nostalgia and AR-driven social engagement doesn’t just move hearts, it moves units. If this cross-promotional campaign lands well (and early signs suggest it will), it could drive volume, especially in international markets where brand saturation still has room to grow.

Is Disney a Good Stock to Buy?

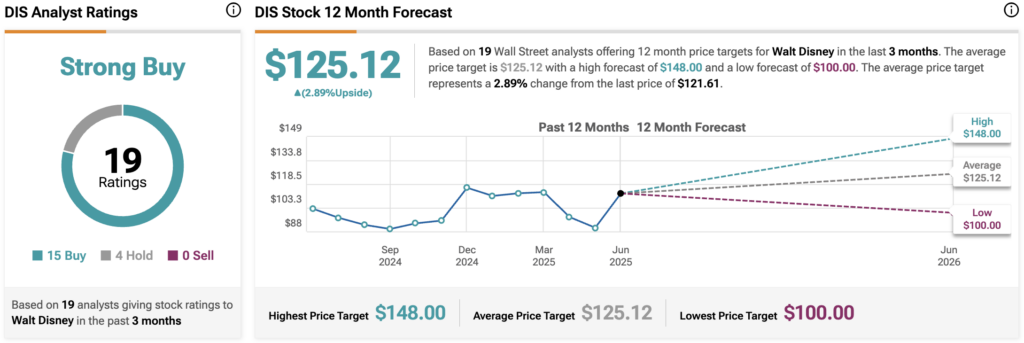

Meanwhile, Disney isn’t far behind in analyst confidence. Out of 19 ratings, 15 are Buys, four are Holds, and, again, zero Sells. The average 12-month DIS price target of $125.12 suggests 3% upside from the current price of $121.61.

Star Wars continues to be one of Disney’s most monetizable IPs, from box office and streaming to parks and now partnerships. The AR campaign with Coca-Cola amplifies that flywheel, driving engagement in a way that touches nearly every corner of Disney’s ecosystem, from Disney+ subscribers to theme park foot traffic.