Blockbuster hit Moana 2 helped drive The Walt Disney Company (DIS) to beat quarterly profit expectations amid a resurgence in studio successes, even as the company started to lose Disney+ streaming customers.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

DIS posted Fiscal first quarter earnings on Wednesday that topped Wall Street forecasts, with adjusted earnings per share (EPS) rising 44% to $1.76 versus the $1.46 expected. Revenues rose 5% to hit $24.69 billion vs. $24.62 billion expected. Shares rose about 1% in pre-market trading.

However, the company saw a 1% decline in subscribers to its flagship Disney+ streaming platform. Total paid Disney+ subscriptions fell to 124.6 million from 125.3 million over the quarter, though Hulu subscriptions rose 3% during the period to 53.6 million.

Disney also warned that it expects another “modest decline” in Disney+ subscribers during the second quarter. More positively, price hikes helped the average monthly revenue per paid subscriber increase 4% to $7.99.

DIS Earnings Driven by Films as Parks Take Weather Hit

Operating income at its Entertainment division rose $800 million to $1.7 billion, with a significant contribution from Moana 2 during the quarter as revenues rose 9% to $10.87 billion.

Moana 2 became Disney’s third 2024 release to exceed $1 billion at the box office, joining Inside Out 2 and Deadpool & Wolverine in the club and capping a record year for the studio as audiences at last returned to theaters in meaningful numbers.

However, domestic theme park operating income within the Experiences segment declined 5% as it took a $120 million hit from hurricanes Helene and Milton in Florida. International Parks and Experiences operating income increased 28% from a year ago.

Ahead of the Superbowl, sports is also delivering well, with domestic ESPN advertising revenue up 15% from Q1 Fiscal 2024.

DIS Fiscal 2025 Outlook Positive

For Fiscal 2025, DIS expects high single digit adjusted EPS growth, within which Entertainment is set to deliver “double-digit percentage segment operating income growth.” It anticipates operating income at its Direct-to-Consumer business, which includes the Disney+ platform, to be $875 million. Sports should grow about 13% and Experiences, which includes theme parks, is set to grow 6-8%.

Is DIS a Good Stock to Buy?

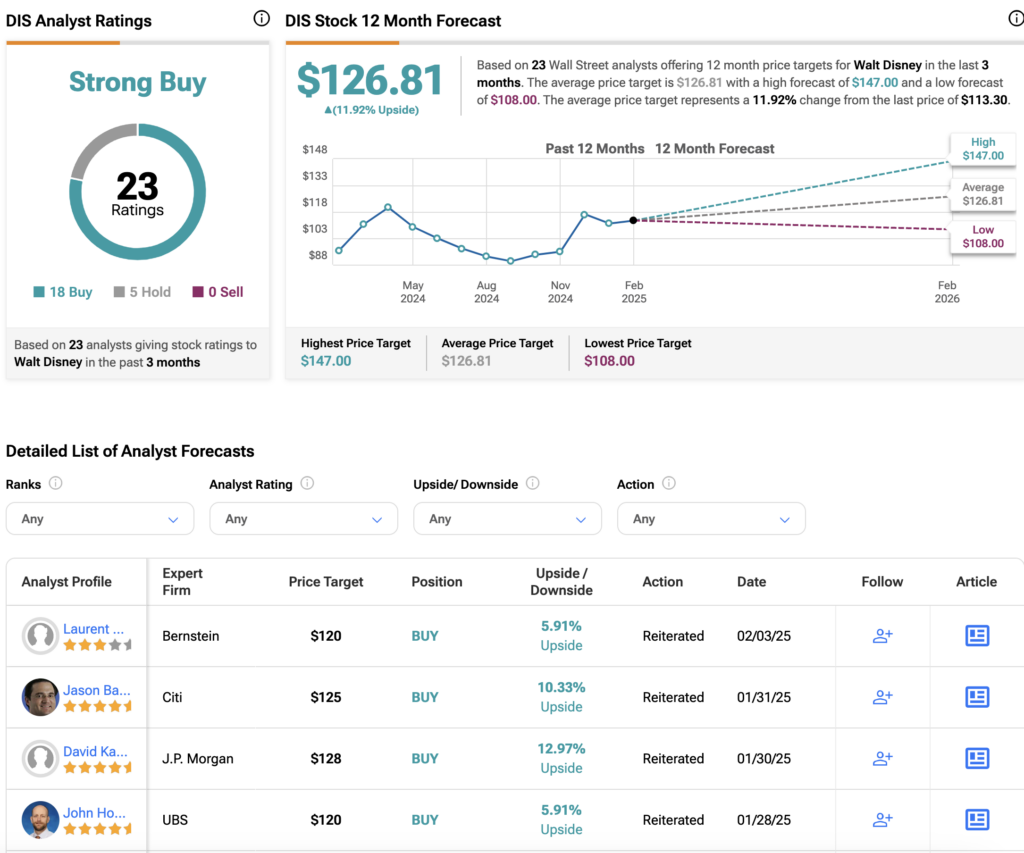

Overall, Wall Street has a Strong Buy consensus rating on DIS stock, based on 18 Buys and five Holds. The average DIS price target of $126.81 implies about 12% upside.