Shares in digital infrastructure investment firm DigitalBridge Group (DBRG) jumped 9.73% on Monday afternoon as analysts deemed the rumored $16-per-share acquisition offer by Japanese conglomerate SoftBank (SFTBY) as logical and feasible.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to Bloomberg, SoftBank is looking to take over the firm, even as CEO Masayoshi Son continues his campaign to strengthen his company’s exposure to the boom in AI infrastructure demand. While no deal has been finalized and specific details remain unavailable, Wall Street has started to assess the deal.

DigitalBridge invests in infrastructure such as data centers, cell towers, fiber networks, and facilities for edge computing, a type of computing in which computing power is brought closer to where data is created for faster processing.

What Are Analysts Saying about the Deal?

Raymond James analyst Ric Prentiss believes that there is a “strong logic” in SoftBank’s takeover bid as DigitalBridge holds strategic value for the conglomerate. Prentiss also believes that both firms have like-minded chief executives. Nonetheless, he sees the $16-per-share valuation as underwhelming.

On his part, B. Riley analyst Matthew Howlett believes that the deal is feasible and aligns with SoftBank’s investment in AI. Howlett also pointed to DigitalBridge’s portfolio, including the 20 gigawatts of data center capacity already under the alternative asset manager’s control.

The analyst reaffirmed his $20 price target on DBRG, indicating about 44% upside from the stock’s closing price of $13.92 on Friday.

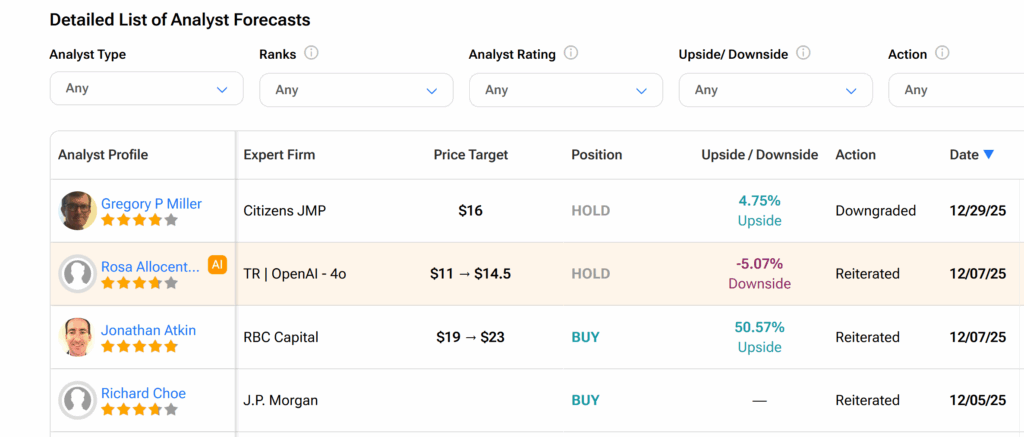

However, not all analysts are upbeat about the deal. For instance, Citizens JMP analyst Gregory P. Miller downgraded his DBRG rating from Outperform (Buy) to Market Perform (Hold). Miller stuck to his price target of $16, implying less than 5% upside.

Is DBRG a Good Stock to Buy?

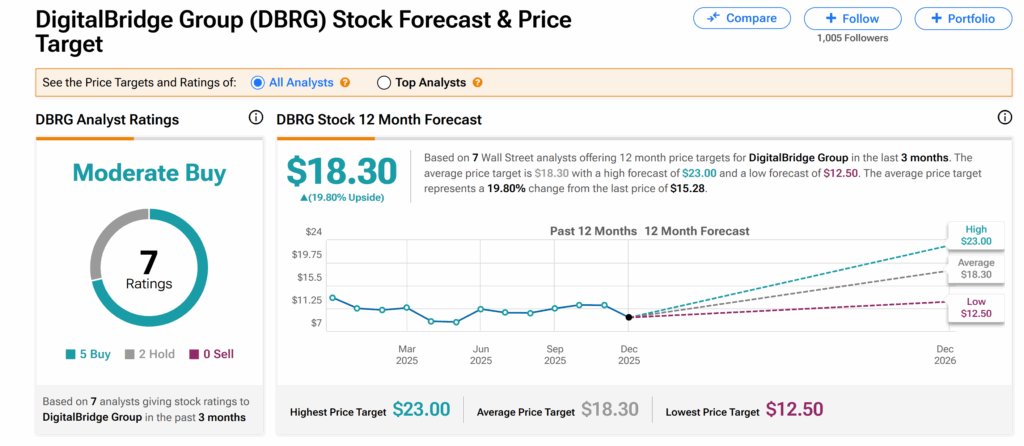

Across Wall Street, DigitalBridge’s shares have a Moderate Buy consensus rating based on five Buys and two Holds issued by seven analysts over the past three months.

In addition, the average DBRG price target of $18.30 represents approximately 20% upside from current trading levels.