Digital Turbine (APPS) shares fell on Friday after Bank of America Securities (BofA) downgraded the media and mobile communications stock from Neutral to Underperform and cut the price target from $3.50 to $1 per share. This was due to unclear turnaround timelines and weak growth prospects. The firm, led by five-star analyst Omar Dessouky, pointed to rising competition in performance advertising and slower-than-expected progress in growth initiatives as reasons for its cautious outlook.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

BofA highlighted that the revised FY25 growth forecast of a 12% decline in revenue year-over-year compared to prior expectations of 1% growth marks the third consecutive year of revenue drops. In addition, its legacy business is facing challenges, especially in gaming performance ads. At the same time, a gradual financial recovery is expected in its On-Device Solutions (ODS) segment due to a reduced supply base after nearly two years of weak device volumes.

Additionally, BofA cut its FY26 revenue and EBITDA estimates for Digital Turbine to $502M and $83M, respectively, down from previous estimates of $596M and $111M. It’s worth noting that, so far, Dessouky has enjoyed a 61% success rate on his stock ratings, with an average return of 28.4% per rating.

What Is the Price Target for Apps?

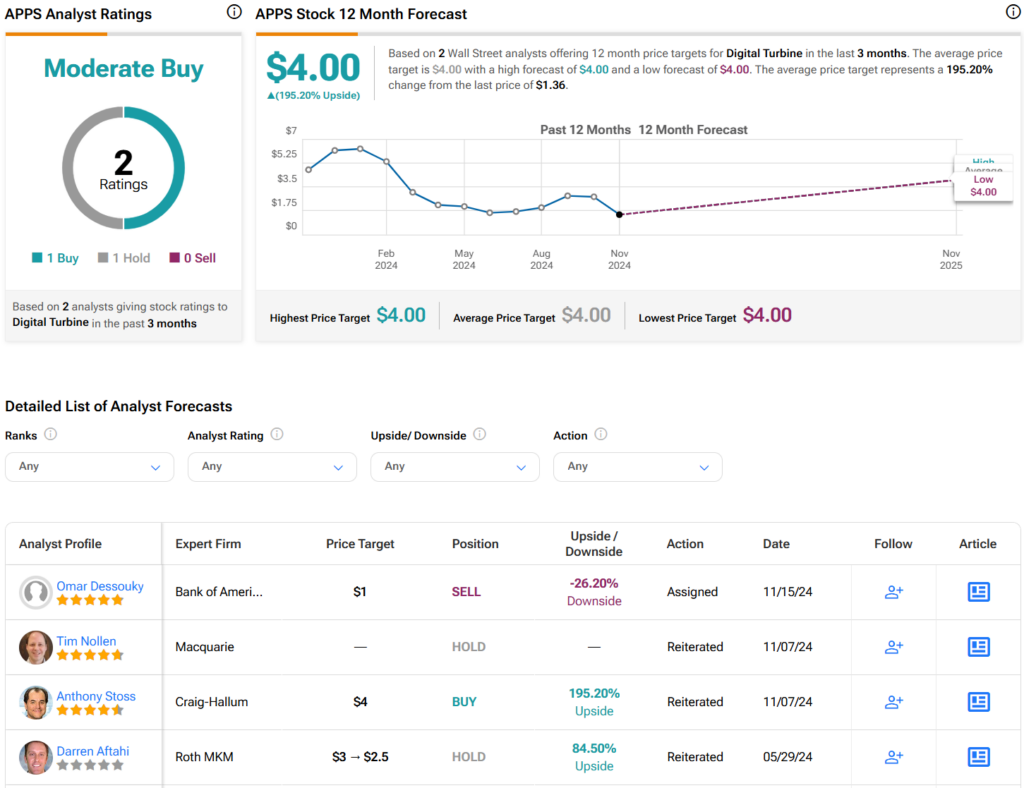

Turning to Wall Street, analysts have a Moderate Buy consensus rating on APPS stock based on one Buy and one Hold assigned in the past three months, as indicated by the graphic below. After a 74% decline in its share price over the past year, the average APPS price target of $4 per share implies 195.2% upside potential.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue