Trump’s sweeping tariffs have tanked Bitcoin mining profits, shocked investors, and reignited the argument that Bitcoin could outlast the U.S. dollar.

Trump Tariffs Fuel Bitcoin Versus Dollar Fight

Trump’s global tariff storm, launched via executive order on April 2, has done more than just jolt trade partners—it’s rattled belief in the U.S. dollar itself. After tariffs hit full throttle on April 9, Bitwise’s Jeff Parks posted on X, “Higher chance Bitcoin survives over the dollar in our lifetime after today.” He added that for the first time, this felt like a real possibility, not a hypothetical.

Bitwise CEO Hunter Horsley chimed in too, saying the dollar no longer inspires confidence and that “you wind up buying Bitcoin” when all the other options—foreign currencies or even gold—start to feel like dead ends. Gold (CM:XAUUSD), he said, comes with headaches like storage and transport. Bitcoin doesn’t.

Bitcoin author Saifedean Ammous didn’t hold back either. In an April 8 post, he claimed the U.S. problem wasn’t a single country’s deficit, but “aggregate deficits worldwide” fueled by a “fiat money printer.” His blunt take? “Stop using America’s shitcoin.”

Tariffs Hit Mining Rig Prices and Shift Global Power

But the impact isn’t just philosophical—it’s tangible. The tariffs are also clobbering the crypto mining world, especially in the U.S.

According to Hashlabs Mining, CEO Jaran Mellerud says demand for rigs in the U.S. is set to “plummet, likely nearing zero,” because tariffs are pushing machine costs up by 24%—turning a $1,000 rig into a $1,240 investment. Meanwhile, in places like Finland, the same rig still costs $1,000.

Mellerud said non-U.S. miners could now snag cheap surplus inventory as manufacturers look to offload rigs originally built for the U.S. market. That could shift a big chunk of Bitcoin’s hashrate outside the U.S.

Confidence in U.S. Crypto Mining Cracks

Even if the tariffs get reversed, Mellerud warned the “damage is done.” U.S. miners were counting on Trump’s return for regulatory stability—but instead got slapped with overnight cost hikes. “Few will feel comfortable making major investments when critical variables can change overnight,” he said.

The U.S. still contributes nearly 40% of Bitcoin’s hashrate. But as Mellerud put it, expansion now looks “steep and uncertain.”

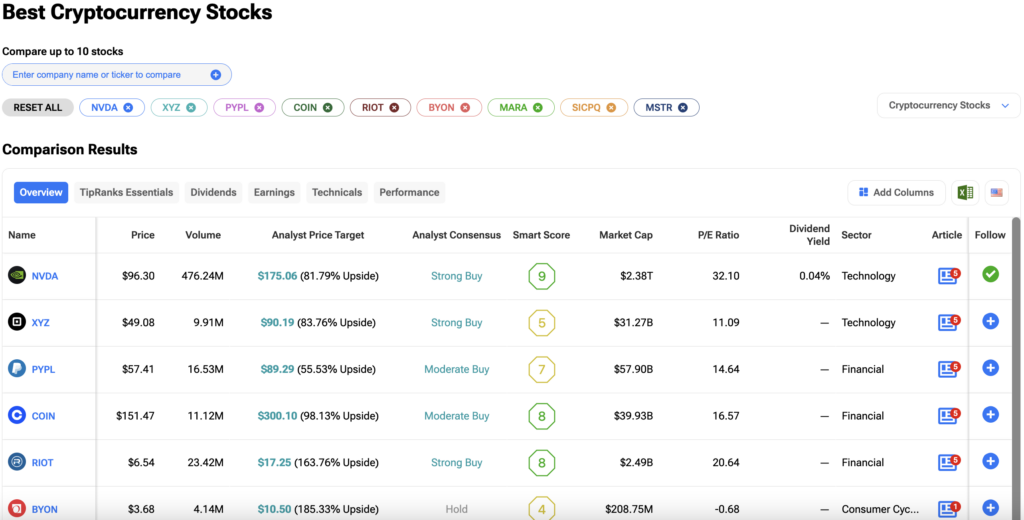

Which Are the Best Crypto Stocks to Buy?

For investors looking to find crypto stocks that best suit their needs, conducting thorough research is crucial. A helpful resource for this is TipRanks’ Compare Crypto Stocks tool. This tool allows investors to compare various crypto stocks side-by-side, examining key metrics such as performance history, valuation ratios, and analyst price targets.