The stock of Dick’s Sporting Goods (DKS) is down 15% after the retailer announced that it is paying $2.40 billion to acquire rival Foot Locker (FL).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Dick’s, which is one of the biggest sporting goods retailers in the U.S., has offered $24 a share for Foot Locker, an 86% premium to the stock’s last closing price. Shares of Foot Locker are up more than 80% on news that the company is being acquired. However, DKS stock is falling as investors assess the deal.

Foot Locker has struggled since the Covid-19 pandemic shutdown its stores or forced them to operate at reduced capacity. Prior to news of the acquisition, FL stock had lost about 40% of its value this year and was down nearly 50% over the past five years.

Industry Consolidation

Dick’s Sporting Goods’ purchase of Foot Locker comes amid a wave of consolidation in the footwear sector. Private equity firm 3G recently announced a $9.42 billion buyout of sneaker maker Skechers (SKX). Analysts say companies are consolidating as businesses attempt to navigate the uncertainties caused by U.S. President Donald Trump’s trade policies.

Shoemakers are particularly vulnerable to President Trump’s import tariffs as most of their products are manufactured abroad in countries such as Vietnam and China. The acquisition of Foot Locker by Dick’s Sporting Goods is subject to regulatory approvals. DKS stock is now down 21% on the year.

Is DKS Stock a Buy?

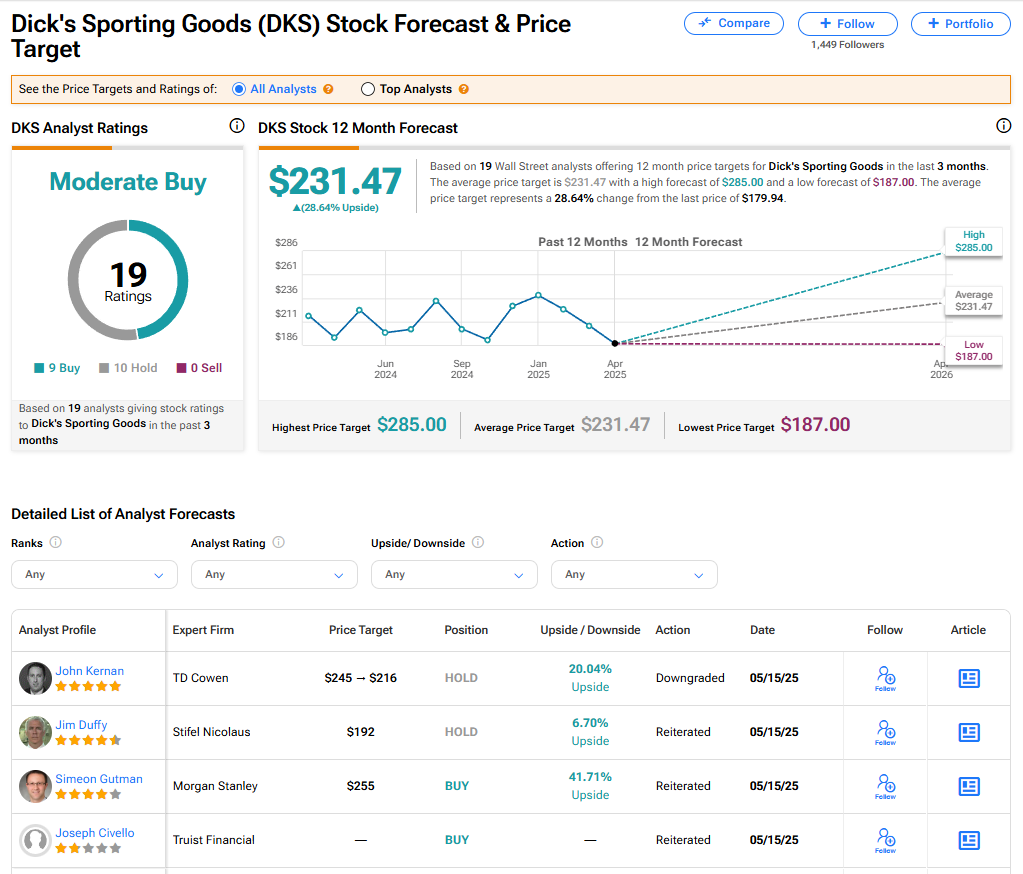

The stock of Dick’s Sporting Goods has a consensus Moderate Buy rating among 19 Wall Street analysts. That rating is based on nine Buy and 10 Hold recommendations issued in the last three months. The average DKS price target of $231.47 implies 28.64% upside from current levels.