Dick’s Sporting Goods (DKS) has closed its $2.4 billion acquisition of Foot Locker (FL), marking a big step in expanding its global retail reach. The move cements Dick’s as a giant with more than 3,200 stores worldwide, but Wall Street’s reaction shows investors are split.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Dick’s Expands Retail Footprint with Merger

The deal brings Foot Locker and its brands, including Kids Foot Locker, Champs Sports, WSS, and atmos, under the Dick’s umbrella. Management expects the merger to deliver $100–$125 million in cost synergies and to boost earnings per share by Fiscal 2026. For investors, this means the payoff may take time.

In the short term, Dick’s will need to juggle integration costs, leadership changes at Foot Locker, and the challenge of uniting two very different retail formats. While the scale of the combined business is undeniable, execution risks remain front and center.

Analysts Debate Upside versus Risk

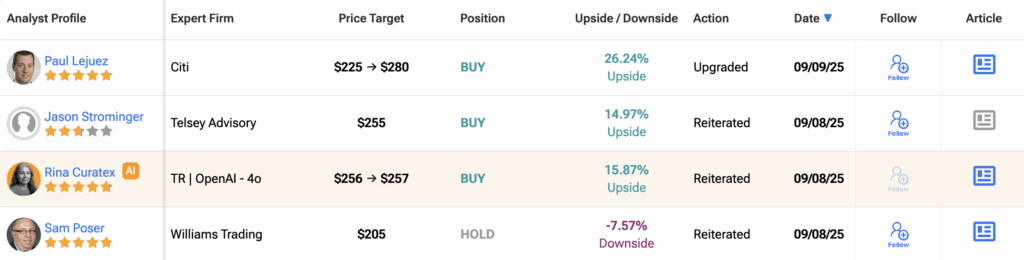

Not all analysts are looking at the deal the same way. Michael Baker at DA Davidson reiterated his Buy rating with a $230 target, arguing that Foot Locker shareholders will gain more value by converting their shares to Dick’s stock than by taking the cash offer. Telsey Advisory Group’s Jason Strominger also boosted his price target to $255 while keeping an Outperform rating, pointing to healthy consumer demand.

On the other hand, some analysts are urging caution. Sam Poser of Williams Trading kept a Hold rating with a $205 target, saying that synergy benefits are real but will not show up until at least Fiscal 2026. He also highlighted the risk of managing different customer bases and retail formats under one roof. TD Cowen’s John Kernan echoed this sentiment earlier this month, reaffirming a Hold rating with a $233 target.

Insider Selling Clouds Sentiment

Adding to the mixed picture, insider activity has tilted negative. Data shows that over the past quarter, more insiders have been selling shares of Dick’s than earlier this year. While not unusual after a big transaction, it has added to the cautious tone among some investors.

Is Dick’s Sporting Goods a Good Buy?

Based on 18 analyst ratings in the past three months, Dick’s Sporting Goods currently carries a “Moderate Buy” consensus. Out of the 18 analysts, 10 issued Buy ratings, eight suggested Hold, and none recommended Sell.

The average 12-month DKS price target sits at $242.50, representing a potential upside of about 9.33% from the latest price.