Shares in drinks giant Diageo (DEO) stumbled over 6% lower today on fears that a drop-off in demand could lead to it selling its iconic Guinness beer brand.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

American Tastes

The group, whose other tipples include Johnnie Walker whisky and Gordon’s gin, reported Q1 net sales of $4.9 billion between July and September. That’s down from $5 billion in the same period last year.

Sales in North America fell by 3.5% and sales in Asia Pacific dropped by 9.7% year on year, offsetting growth of about 5% in Europe.

In the US, where it generates the most sales, consumer spending was more cautious than it was expecting, leading to a tougher market for spirits.

It also noted more pressure from competitors, particularly affecting tequila – with sales dropping by “double digits”.

Diageo also flagged a sharp drop in both the volume and value of sales in China, with lower demand for white spirits including its national spirit baijiu. That’s important given its global revenues breakdown – see below:

However, it did record sales growth for Guinness and branded cocktails and ready-to-drink labels like Smirnoff Ice.

Diminished Appeal

Russ Mould, investment director at AJ Bell said that the fear for markets will be that Diageo’s performance reflects more than just the ups and downs associated with fluctuations in the economy and instead hints at shifting drinking habits and/or the diminished appeal of Diageo’s key brands.

“The weak Chinese business also suggests one of Diageo’s key levers of growth – selling more to an expanding middle class in emerging markets – has broken down,” he said. “Its travails may lead to pressure for more dramatic action to turn around the company’s fortunes, including a potential spin-off of Guinness to create a business with a distilled focus on spirits.”

Adding to investors’ headache was a warning that organic net sales are likely to be flat or slightly down over the full year compared with the previous year. It also flagged a cost savings target of $625 million over the next three years.

In addition, its guidance for the expected impact of tariffs into the US from UK and European imports remains unchanged at $200 million pre mitigation on an annualised basis.

Nik Jhangiani, Diageo’s interim chief executive, cautioned over “weakness in Chinese white spirits and a softer US consumer environment than planned for.” He said: “We are not satisfied with our current performance and are focused on what we can manage and control; acting with speed to drive efficiencies, prioritising investment and adapting more quickly to an evolving consumer environment.”

Is DEO a Good Stock to Buy Now?

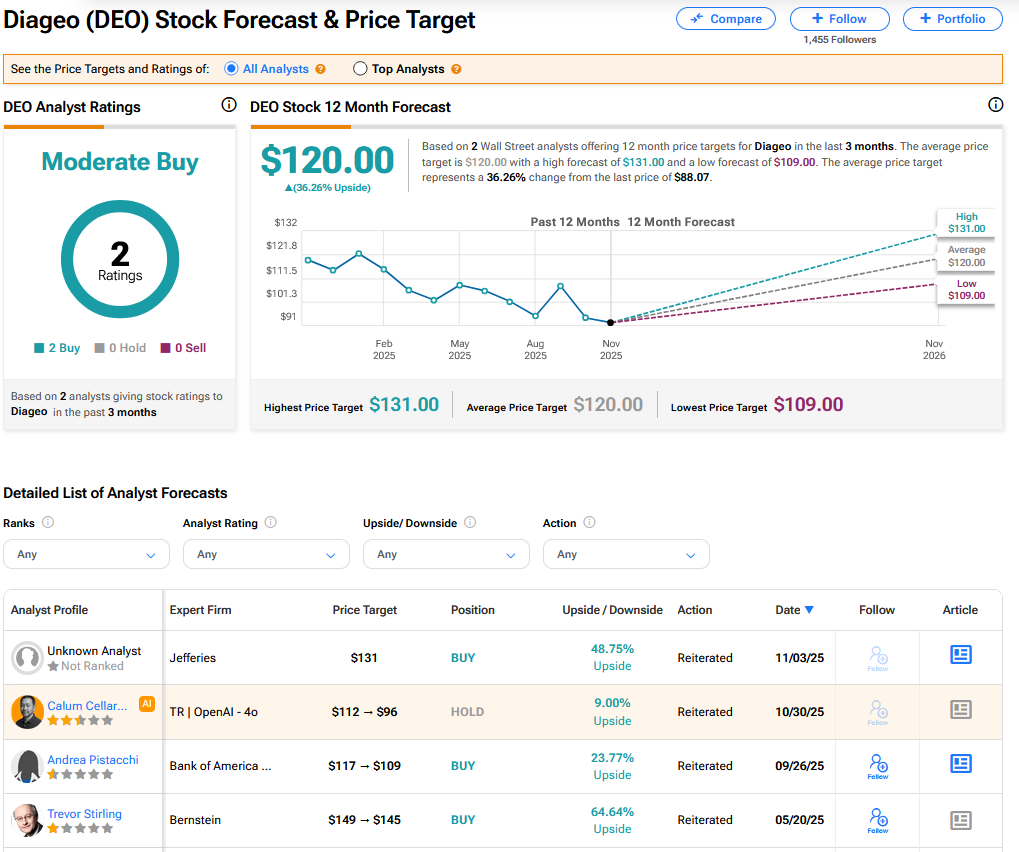

On TipRanks, DEO has a Moderate Buy consensus based on two buy ratings. Its highest price target is $131. DEO stock’s consensus price target is $120, implying a 36.26% upside.