DGL Group (ASX:DGL) shares were up more than 10%, to around AU$1.65 in late afternoon trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The chemicals and logistics provider’s shares increased following the announcement that it completed the acquisition of Clarkson Freightliners.

The company is leveraging acquisitions as it pursues additional growth opportunities. DGL Group has completed more than a dozen acquisitions since July 2021.

Additionally, investors welcomed DGL Group’s announcement that CEO Simon Henry recently purchased a swag of extra shares in the company. On September 2, Henry purchased 318,000 additional shares in DGL Group in a transaction valued at more than $500,000. The latest purchase takes his total ownership up to more than 151 million shares.

DGL Group’s share price forecast

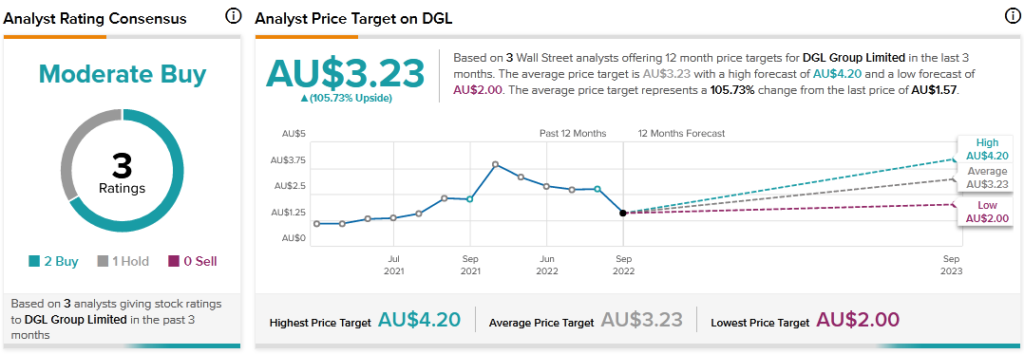

Although DGL Group shares have dropped about 50% year-to-date, analysts remain bullish on the stock. According to TipRanks’ analyst rating consensus, DGL stock is a Moderate Buy.

The average DGL Group price target of $3.23 implies over 106% upside potential.

Final thoughts

DGL Group stock has seen heavy selling since the company issued a tepid profit outlook for fiscal year 2023.

However, the management remains confident in the business, as demonstrated by the CEO’s move to buy the dip.