Cano Health (NYSE: CANO) reported stronger-than-expected Q1 results, topping both earnings and revenue estimates.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, despite the beat, shares of the leading value-based primary care provider and population health company dropped 8.9% on May 9 to close at $4.38.

Q1 Beat

The company reported breakeven earnings, which surpassed the street’s estimate of a loss of $0.04 per share.

Notably, revenues jumped 156% year-over-year to $704.3 million and exceeded consensus estimates of $666.03 million.

The increase in revenues reflects a surge in total membership, which increased 130% to 269,333 and included a 112% growth in Medicare capitated members to 160,306.

Outlook

Based on strong Q1 results, management reiterated financial guidance for FY2022.

The company continues to forecast revenues to be in the range of $2.8 billion to $2.9 billion. Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) are expected to be in the range of $230 million to $240 million.

CEO’s Comments

Cano Health CEO, Dr. Marlow Hernandez, commented, “To meet the growing demand for our services, we continue to add capacity in key markets and build scale and density. While rapidly expanding our business, our population health platform, combined with our differentiated growth strategy, is driving sustainable and profitable growth.”

Wall Street’s Take

Following Q1 results, Citigroup analyst Jason Cassorla decreased the price target on Cano Health to $8 (82.65% upside potential) from $10 and reiterated a Buy rating.

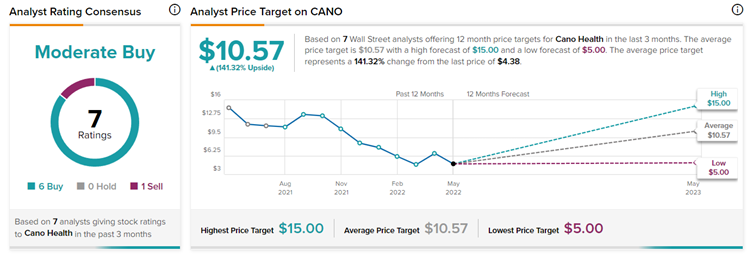

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on six Buys and one Sell. The average Cano Health price target of $10.57 implies 141.32% upside potential to current levels.

Conclusion

The company reported a Q1 beat along with an impressive gain in Medicare members that more than doubled year-over-year. Investors, perhaps, will keep a close watch on the shares and wait for better signs of profitability before getting more bullish about the stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Did Under Armour Shares Dip 23.9%?

Despite Q1 Beat & Raised Outlook, DraftKings Drops 8.9%

Beazley Reports Strong Q1 Results, Shares Up 5.58%