In investing, I would argue that valuation is a very important consideration. That’s because buying the same stock at two different valuations could have immensely different outcomes. A higher valuation means that the starting yield for a dividend stock is lower, and future capital appreciation can be capped by such a valuation. A great example of the importance of valuation is Wells Fargo (WFC), with its shares soaring 50% year-to-date.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following my review of Wells Fargo’s third-quarter operating results, I am initiating coverage with a Hold rating. This is because shares look fully priced here despite a decent growth outlook, a well-covered dividend, and a healthy balance sheet.

Wells Fargo Delivered Results in Q3

On October 11th, Wells Fargo reported third-quarter results that I thought supported my Hold rating. The company’s total revenue decreased by 2.4% year-over-year to $20.4 billion during the quarter, which aligned with the analysts’ consensus. The company’s adjusted EPS increased by 2.7% over the year-ago period to $1.52, well above the analysts’ consensus of $1.28.

Respectable Growth Lies Ahead for Wells Fargo

Wells Fargo also has the potential to generate decent future growth, which is another reason for my Hold rating. For one, the Federal Reserve has cut the U.S. federal funds rate by 75 basis points from its recent peak of between 525 and 550 basis points to the current rate of between 450 and 475 basis points. Another 25 basis point cut at the December meeting later this month is being priced in by the market as there is an 89% probability of such a cut being announced, with just an 11% chance of rates being held steady.

It will take some time before these rate cuts affect the economy and company results. However, these rate cuts are important because lower interest rates incentivize consumers and businesses to borrow. That acts as a catalyst for banks like Wells Fargo.

Another tailwind for Wells Fargo is the potential lifting of the $1.95 trillion asset cap imposed by the Federal Reserve. This cap was a punishment for the bank’s millions of fraudulent account openings in the past. If lifted in the first half of 2025, it could be a boon for growth, allowing the company to be active in mergers and acquisitions again. Additionally, the incoming Trump administration could lower the threshold for antitrust scrutiny, making it easier for M&A to occur. This could further enhance Wells Fargo’s growth prospects.

As a result, the analyst consensus is that adjusted EPS will rise by 6.1% in 2025 to $5.60. Wells Fargo’s adjusted EPS is expected to jump another 16% to $6.50 in 2026. These growth rates come from an anticipated 9.3% increase in adjusted EPS to $5.28 in 2024.

WFC Pays a Sustainable Dividend and Boasts a Solid Balance Sheet

Wells Fargo’s 1.95% dividend yield is above the financial sector average of 1.3%, another factor behind my Hold rating. This higher starting income also looks to be viable for the future. That’s because Wells Fargo’s dividend payout ratio for 2024 is expected to be in the high 20% range. This provides a sizable buffer for the company to keep paying its dividend. That’s also why I believe double-digit annual dividend growth will likely continue for the foreseeable future.

Wells Fargo’s financial health is yet another positive. The company’s CET1 ratio improved by 30 basis points year-over-year to 11.3% in the third quarter. For perspective, this is about 150 basis points above its new CET1 regulatory minimum plus buffers of 9.8% as of the fourth quarter per CFO Mike Santomassimo’s opening remarks during the Q3 2024 earnings call. That is why Wells Fargo possesses a BBB+ credit rating from S&P Global (SPGI) on a stable outlook.

Shares of Wells Fargo Look Overvalued

As I hinted from the outset, Wells Fargo’s valuation is the only element that prevents me from a Buy rating. At the start of the year, the stock was trading at a forward P/E ratio of approximately 10 based on a 2024 EPS consensus of around $5 at the time. That compared very favorably to the 10-year normal P/E ratio of 12.7, which explains why Wells Fargo stock has rallied so sharply so far this year. The present forward P/E ratio of approximately 13.2 stands just above the 10-year P/E ratio. This comes despite a growth profile that’s fairly similar to past years. That’s why I believe an attractive entry point for Wells Fargo stock is somewhere in the mid to high $60 range.

What Does Wall Street Think?

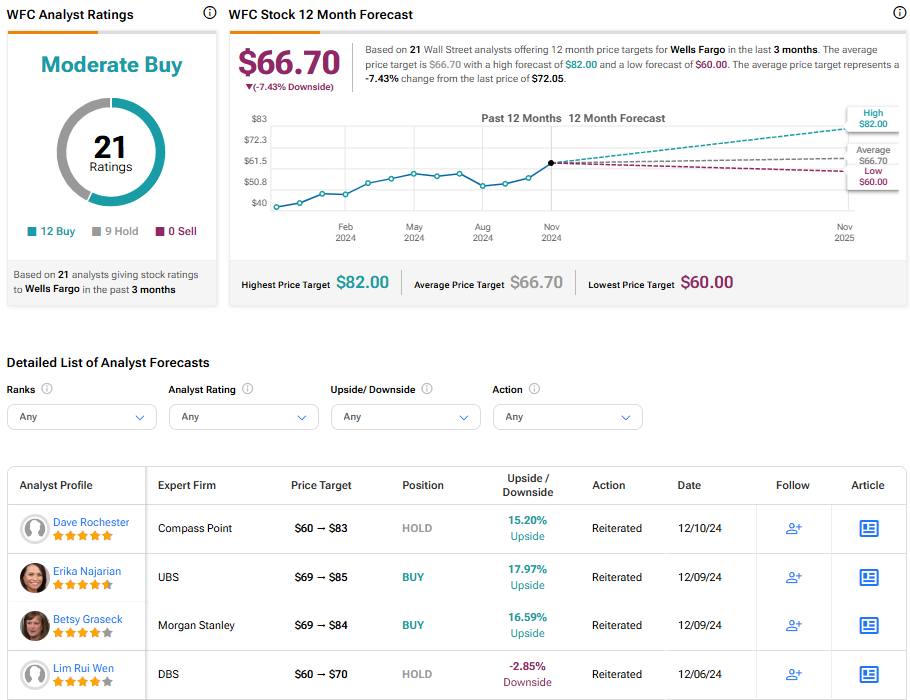

Turning to Wall Street, analysts have a Moderate Buy rating consensus on Wells Fargo. Out of 20 analysts, 11 have issued Buy ratings, and nine have assigned Hold ratings in the last three months. The average 12-month price target of $66.70 would represent a 7.43% downside from the current share price.

Investment Summary

Wells Fargo stock has been a big winner this year. Operationally, the company should continue to do well via its growth catalysts and sound balance sheet. However, the valuation will probably have to catch up a bit. That’s why I’m starting coverage with a Hold rating.