While it would be easy to think that economic uncertainty powered by multiple trade wars and a Presidential administration that is only about six months old could mean dark clouds for restaurants and eating out, that does not seem to be the case for chain group Yum Brands (YUM). In fact, JPMorgan analysts are calling it out as a potential substantial growth vector for investors. That was all investors needed to hear, as they sent shares up over 2.5% in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The word from JPMorgan analyst John Ivankoe—who has a five-star rating on TipRanks—saw Yum Brands get bolstered from a Neutral rating to Overweight, but saw the price target take a bit of a cut, paring back from $170 per share to $162. That still represents a premium of around 14% against Tuesday’s close.

Ivankoe noted that Yum Brands could be in line for substantial growth, noting that the company has excellent free cash flow, unit growth of 4% or better, and, just to top it off, a current valuation below where it likely should be. That led Ivankoe to note that the stock is currently selling for what it was around late 2021, and that means it “…deserves a revisit in our opinion.” Throw in a newly-minted CEO who is likely to keep up a tech focus in order to push shareholder returns and the end result should be a positive one for investors.

And Speaking of Technology

Ivankoe’s projections of a more tech-focused Yum Brands is not out of line, as new reports suggest it will be in line to add Venmo (PYPL) to its lineup of ways to pay. While Yum Brands already accepted Venmo at KFC, it will now open the floor up to Venmo payments at Taco Bell locations as well. And PayPal, Venmo’s parent company, is even sweetening the pot with a little extra deal.

Reports note that those who check out with PayPal in the Taco Bell app will get 20% cash back on any purchase over $5. But before you get the idea to go out and fill your freezer with bean burritos on the cheap, there is a $10 maximum amount of cash back, so this really only works on orders under $50. The offer stands until July 31, 2025, and can be redeemed weekly, reports note.

Is Yum a Good Stock to Buy?

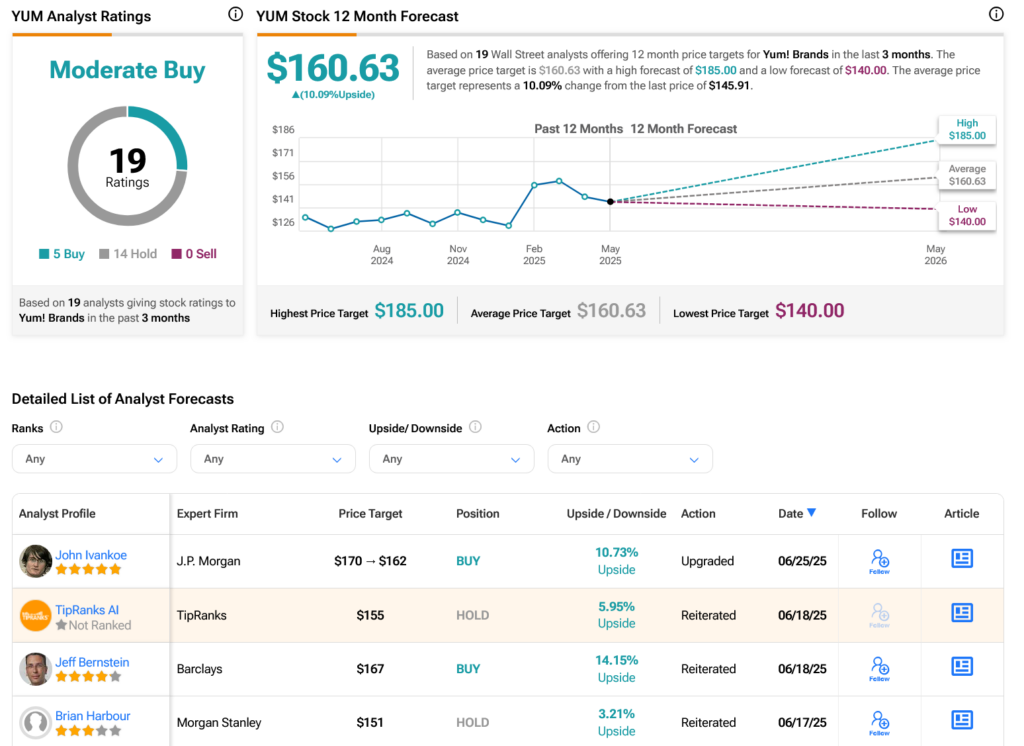

Turning to Wall Street, analysts have a Moderate Buy consensus rating on YUM stock based on five Buys and 14 Holds assigned in the past three months, as indicated by the graphic below. After a 8.14% rally in its share price over the past year, the average YUM price target of $160.63 per share implies 10.09% upside potential.