For anyone wondering which companies the new Department of Government Efficiency (DOGE) will target, a new report advises the agency to zero in on TransDigm Group (TDG). The Bear Cave, a newsletter that focuses on the short selling market, recently published a detailed analysis of Transdigm, making the case for why the aerospace manufacturing company should be targeted by the agency tasked with eliminating government waste, alleging that it has engaged in price gouging toward government agencies.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

According to author Edwin Dorsey, Transdigm’s business model is “enabled by burdensome regulation and bureaucratic negligence” and will be severely impacted when Donald Trump assumes the presidency.

What’s Happening with Transdigm Stock?

While TransDigm stock is falling today, it hasn’t declined by much. As of this writing, TDG is only down 1% for the day and its current trajectory suggests that it could rebound. The past quarter has been volatile, but through unfavorable market conditions, TransDigm has mostly performed well and is still in the green for the past three months, despite multiple declines.

It’s important to note that while The Bear Cave certainly makes a strong case against TDG, it is not revealing a short position in the company, as Dorsey has stated that he does not bet against the companies he covers. However, if his findings are correct, they may compel actual short sellers to take a position. The report alleges that TransDigm is guilty of price gouging tactics against both public and private sector clients, including the United States Department of Defense.

The company would likely stand to lose any defense contracts if the DOGE found it guilty of what Dorsey alleges. That could highly compromise share prices, especially if it involves a lengthy investigation into the company’s history of providing technology to government agencies. Even if no illegal activity is found, TransDigm will likely lose its share of the booming defense tech market as the U.S. government turns to its competitors.

Wall Street Is Bullish on TransDigm Stock

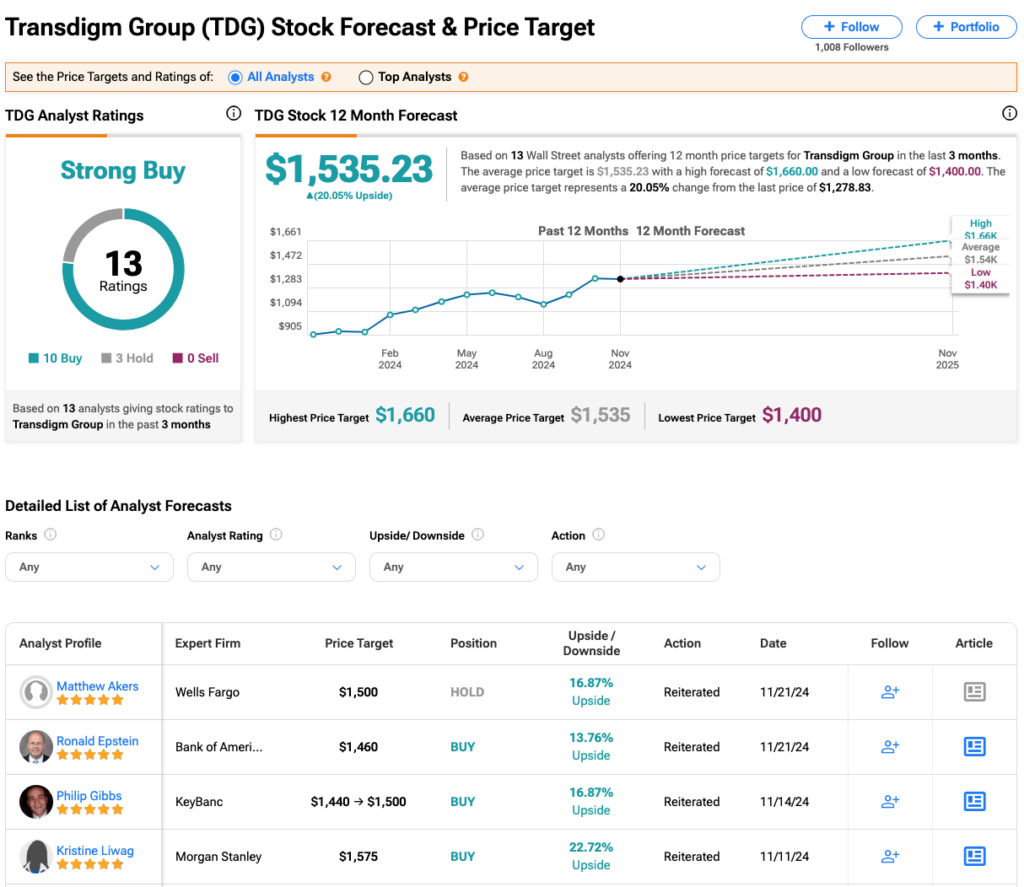

Turning to Wall Street, analysts have a Strong Buy consensus rating on TDG stock based on 10 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 37% rally in its share price over the past year, the average TDG price target of $1,535 per share implies 20% upside potential.