Dell Technologies (DELL), commonly known as Dell, might not be your go-to artificial intelligence (AI) hardware play. Yet, I encourage you not to overlook Dell even if you’re concerned about AI stocks’ overblown valuation. I am bullish on DELL stock because the company produced excellent quarterly results and is probably on the cusp of divesting on a losing investment. Dell Technologies was known for years for manufacturing and selling old-fashioned desktop and laptop computers. Don’t assume that the company is a dinosaur in 2024, though.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nowadays, Dell sells plenty of AI-enabled servers and generates a lot of revenue, and there’s data to prove this.

I understand if you’re not in the mood to buy an AI stock now. The king of AI hardware companies, NVIDIA (NVDA), recently posted an EPS beat, but the stock fell anyway. Dell isn’t the same as NVIDIA, so let’s catch up on the latest news about Dell, as it’s definitely an AI-tech firm to watch.

Dell Would Likely Benefit from Possible Asset Sale

Before discussing Dell’s latest quarterly financial figures, there’s a major development that cannot be ignored and supports the bullish argument for DELL stock. Specifically, Reuters reported that Dell is exploring the sale of its cybersecurity subsidiary, SecureWorks (SCWX). If fulfilled, this action would truly benefit Dell.

Granted, it’s not the first time Dell has explored selling SecureWorks, and there’s no guarantee that a sale will happen in the near future. Currently, Dell owns 79.2% of SecureWorks through share ownership. Back in 2019, Dell considered selling SecureWorks to reduce its debt.

How would Dell benefit from a sale of SecureWorks? First, Dell bought SecureWorks for $612 million in 2011, and now it has a market value of roughly $800 million. Therefore, Dell stands to make a profit and get a capital infusion from a potential sale of SecureWorks.

Furthermore, Dell would probably be better off without SecureWorks. Dell should be laser-focused on producing and selling AI servers in 2024 and 2025. As we’ll discuss in a moment, the data shows Dell is progressing excellently in this field.

SecureWorks Valuation Struggles

SecureWorks seems like a great weight over Dell’s shoulders. The stock has lost over two-thirds of its value since topped out in September, as it “has struggled to compete and differentiate its offerings against larger cybersecurity providers.” Analysts collectively rate SecureWorks stock as a Moderate Sell and expect it to lose value over the next 12 months.

SecureWorks is expected to release its second-quarter Fiscal Year 2025 financial results on September 5. The company is only expected to have earned a penny per share. So, to be completely honest, Dell would be wise to get rid of SecureWorks.

Dell Knocks It out of the Park with AI Server Shipments

In order to fully present the bullish sentiment over Dell, one must be convinced of the firm’s evolution from an old-fashioned personal computer (PC) seller to an AI-enabled server provider. Its impressive second-quarter results support the contention that DELL stock has room to run over the long term.

Here’s the need-to-know info about Dell’s performance in the second quarter of Fiscal Year 2025. First and foremost, Dell Technologies Vice Chairman and Chief Operating Officer (COO) Jeff Clarke announced that the company’s AI-optimized server demand increased by 23% to $3.2 billion, reaching $5.8 billion year-to-date.

Not only that, but Clarke revealed that Dell’s AI-server order backlog was $3.8 billion, and the company’s “pipeline has grown to several multiples of our backlog.” Hence, it appears that Dell Technologies has outgrown its dinosaur reputation once and for all.

With the help of robust AI-server demand, Dell exceeded Wall Street’s top-line and bottom-line forecasts in Q2 of FY2025. The company generated revenue of $25 billion, up 9% year-over-year and ahead of the analysts’ consensus estimate of $24.1 billion. Dell’s quarterly adjusted earnings grew 9% year-over-year to $1.89 per share, whereas analysts only called for $1.70 per share earnings.

Dell’s Valuation

The final reason for my bullish sentiment lies within the company’s reasonable valuation. Dell Technologies surpassed Wall Street’s sales and profit forecasts based on strong demand for the company’s AI-optimized servers. Yet, DELL stock is still reasonably valued, with a GAAP-measured trailing 12-month price-to-earnings (P/E) ratio of 21.25x, while the sector median P/E ratio is around 30x.

Is DELL Stock a Buy, According to Analysts?

On TipRanks, DELL is a Strong Buy based on 13 Buys and two Hold ratings assigned by analysts in the past three months. The average Dell Technologies stock price target is $147.54, implying a 27.70% upside potential.

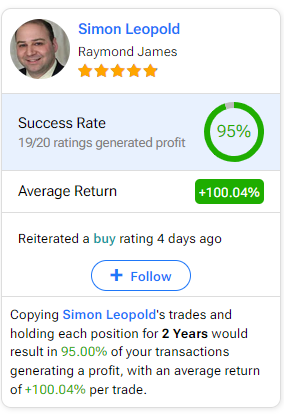

If you’re wondering which analyst you should follow if you want to buy and sell DELL stock, the most profitable analyst covering the stock (on a one-year timeframe) is Simon Leopold of Raymond James, with an average return of 100.04% per rating and a 95% success rate. Click on the image below to learn more.

Conclusion: Should You Consider DELL Stock?

There are a few factors for a bullish position regarding DELL stock. First, as some might suggest, it’s not a dinosaur in the tech realm. Second, the company isn’t richly valued like NVIDIA, and some other AI technology businesses might be. Third, there’s the possibility of its SecureWorks being sold, which hinders the company’s margins. If the divestment is achieved, the company will gain a substantial capital infusion to its cash flow.

Overall, Dell is positioned to surprise and impress investors who haven’t considered the company lately. So, I would certainly consider owning DELL stock as a confident buy-and-hold asset in the AI hardware space.