Shares of Dell Technologies (DELL) are down in today’s trading after some pessimistic comments from Morgan Stanley ahead of its fiscal fourth-quarter results on February 25. Indeed, analyst Erik Woodring described the tech company’s current setup as “tricky” and took on a more cautious view of the stock by lowering his price target from $154 to $128 per share.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Woodring’s concerns include the potential for a downward revision of the company’s guidance for Fiscal Year 2026, which has happened in four of the past six years. He also expects to see pressure on margins in the Infrastructure Solution Group segment and limited upside from AI estimates in the near term.

Interestingly, though, Woodring maintained his Overweight rating on the stock despite these concerns. In addition, he pointed to some positive developments, such as strong demand for AI servers and a rise in enterprise hardware spending. Furthermore, Woodring believes that a conservative outlook for Fiscal Year 2026 has already been priced in due to the stock’s weak year-to-date performance.

Is DELL Stock a Good Buy Now?

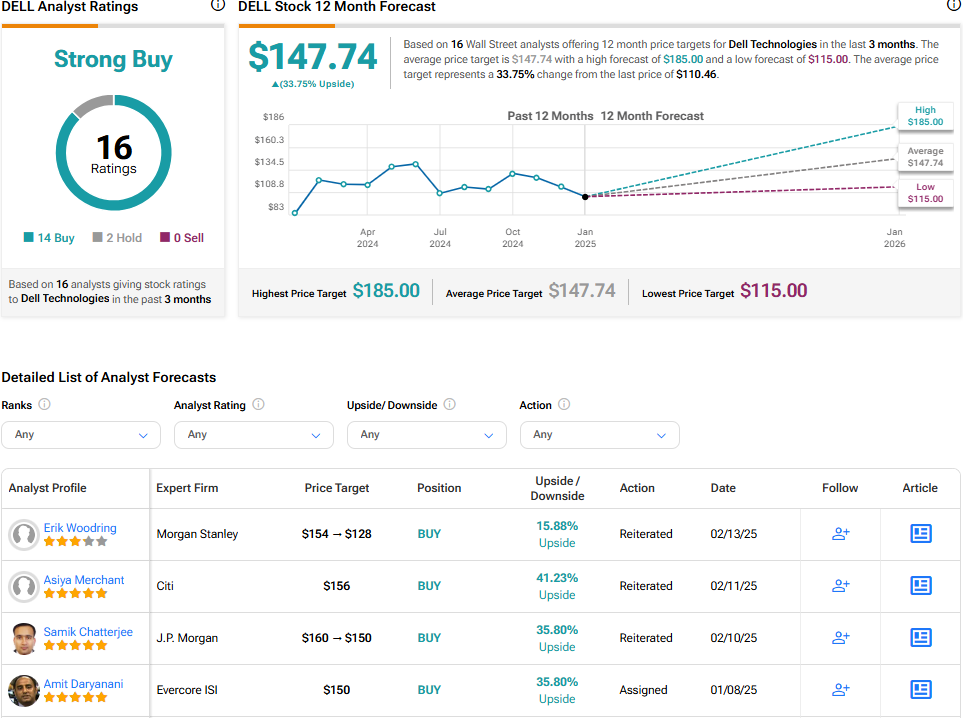

Overall, analysts have a Strong Buy consensus rating on DELL stock based on 14 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 30% rally in its share price over the past year, the average DELL price target of $147.74 per share implies 33.8% upside potential.