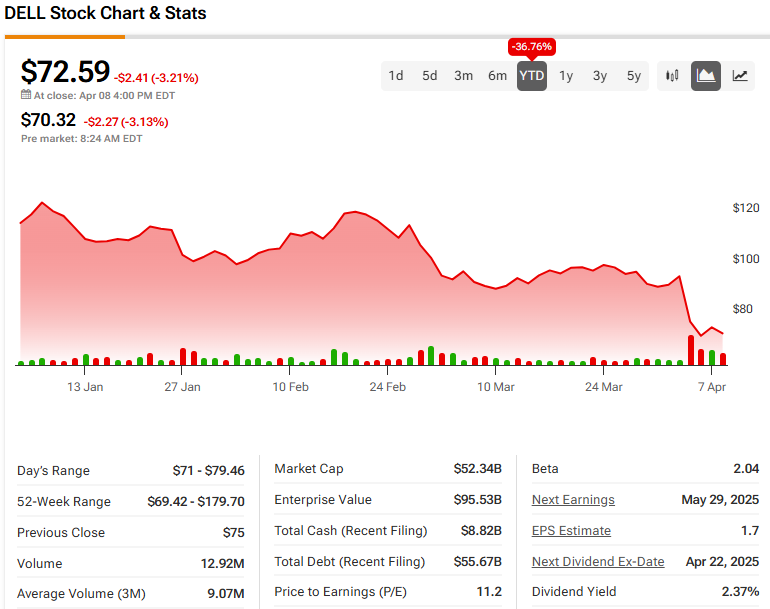

Dell Technologies (DELL) is facing some serious heat. The company’s stock has dropped over 24% since new tariffs were slapped on IT hardware entering the U.S. It’s now down 36% year-to-date. That’s a tough pill to swallow. These tariffs, ranging from 25% to 54%, are especially painful for Dell, which depends heavily on overseas manufacturing, particularly in China.

To make matters worse, China hit back last week with its own set of 34% tariffs on U.S. goods. While computer chips were spared, many other key parts that Dell needed were affected. As a result, Dell could cost an extra $500 per PC, which adds up fast. Analysts at Morgan Stanley (MS) warned that this could wipe out almost all of Dell’s profits for 2025. That’s alarming.

What’s Dell Going to Do? Not Sitting Still

Instead of backing down, Dell is leaning in hard. It’s moving forward with its ambitious push into artificial intelligence (AI). This means building powerful AI servers, which are expensive but key to future growth. Dell expects AI server revenue to jump from $9.8 billion to $15 billion by 2026. That is a pretty significant jump.

Of course, this push comes with short-term pain. Dell’s profit margins will take a hit of around 100 basis points because these AI systems cost a lot to produce. But Dell sees this as a wise trade-off. It’s also using AI inside the company to automate time-consuming tasks and cut down on costs.

Rough Patch in the Consumer Market

On the flip side, Dell’s consumer business isn’t doing great. Sales of personal-use laptops and desktops fell 17% to $7.5 billion in FY2025. But there’s good news: business sales helped balance the picture. Commercial PC sales rose 3% to $40.8 billion, and Dell’s Infrastructure Solutions Group – the part focused on servers and networking – jumped 29%.

Despite all the challenges, Dell’s total revenue reached $95.6 billion last year, up 8%. Net income was $4.6 billion. Cash from operations did fall sharply, mostly because of high investments in AI server inventory and weak performance on the consumer side of the business.

Nevertheless, Dell is confident about the future. It expects FY2026 revenue to hit between $101 billion and $105 billion. And it’s rewarding its shareholders with a record high dividend per share.

The Big Picture

Yes, Dell is facing big problems. Tariffs are squeezing profits, and competition in the PC space is fierce, with rivals like Lenovo (LNVGY) and HP (HPQ) gaining ground. Still, Dell isn’t standing silently; It’s making bold moves in AI, reshaping its business, and laying the foundation for future growth.

So, while things look rough now, Dell’s strategy could pay off in the long run, especially for investors willing to look past short-term pain.

Is DELL Stock a Good Buy Now?

Based on 14 analysts’ ratings, Dell is considered a Strong Buy. Its average price target is $134.39, signaling an 85.14% upside potential.