Many stocks involved in artificial intelligence have attracted investors. AI is the latest craze. While the technology is solid, some corporations have outstretched valuations due to their involvement with the technology. Dell (NYSE:DELL) currently offers a better P/E ratio than most AI stocks. However, AI servers make up a small amount of revenue and are getting overhyped. Thus, I am bearish on Dell stock despite its low forward P/E ratio.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Artificial Intelligence Is the Main Catalyst

Dell didn’t report the most impressive financials in the fourth quarter of Fiscal 2024. Revenue dropped by 11% year-over-year in the quarter, while full-year revenue fell by 14% year-over-year. Net income was a brighter spot, as it increased by 91% in Q4 and grew by 32% during Fiscal 2024.

Dell has a low profit margin that eked above 5% in the fourth quarter. It’s not the first stock I would consider if I were looking at the financials without much context.

Despite those results, Dell stock has almost tripled over the past year, and artificial intelligence is the main reason why that happened. This quote from Jeff Clarke, vice chairman and COO of Dell Technologies, explains the stock’s demand.

“Our strong AI-optimized server momentum continues, with orders increasing nearly 40% sequentially and backlog nearly doubling, exiting our fiscal year at $2.9 billion.”

Bulls are salivating over the possibility of Dell gaining more market share in the AI server industry. The company has a $2.9 billion backlog for its AI-optimized servers. Dell delivered $800 million worth of AI servers in Q4 of Fiscal 2024.

AI-Optimized Servers Are a Small Percentage of Revenue

Corporations like Nvidia (NASDAQ:NVDA) and Super Micro Computer (NASDAQ:SMCI) make most of their revenue from artificial intelligence. Dell is also a beneficiary of AI tailwinds, but it is a relatively small part of Dell’s business. That’s important to keep in mind since AI-optimized server growth has an uphill battle before it generates a seismic shift in Dell’s revenue growth.

AI-optimized server revenue increased by 40% sequentially. It’s part of the company’s larger Infrastructure Solutions Group, which delivered $9.3 billion in Fiscal Q4-2024 revenue. This segment as a whole only grew by 10% sequentially. The unproductive segments of this group dragged down Dell’s 40% sequential growth in its AI servers.

That doesn’t even include the larger Client Solutions Group, which generated $11.7 billion in revenue. This segment’s revenue dropped by 5% sequentially and fell by 12% year-over-year.

Overall, Dell generated $800 million from its AI servers compared to $22.3 billion of total revenue in Q4. The big growth opportunity only made up 3.6% of Dell’s Q4 revenue. That’s not enough to get me excited about being a long-term investor.

The Dividend Hike Is Notable

Dell didn’t report the best financials over the past year, but the company did expand its profit margins. Leadership felt confident enough to hike the dividend by 20%. The quarterly dividend per share jumped from $0.37 to $0.445 per share. Dell raised its dividend by 12% in the previous year, so it can be an interesting candidate for dividend growth investors.

However, Dell isn’t a Buy just because it has good dividend growth. Investors are overestimating how much artificial intelligence will impact Dell’s revenue and earnings growth.

The stock shouldn’t have almost tripled over the past year when net income only increased by 32% in all of Fiscal 2024. Narrow profit margins offer limited net income upside unless the company returns to meaningful revenue growth.

The Valuation

Dell trades at a 26x P/E ratio and a 15.5x forward P/E ratio. The forward P/E ratio is a bit aggressive and assumes the company still reports impressive net income growth in Fiscal 2025.

SMCI trades at a much higher 79x P/E ratio and a 33x forward P/E ratio. Some investors may look at SMCI’s stretched valuation and assume that Dell is undervalued since it has a lower P/E ratio. However, that doesn’t make Dell a solid pick. The lower P/E ratio offers a better margin of safety, but it still isn’t a bargain.

Is DELL Stock a Buy, According to Analysts?

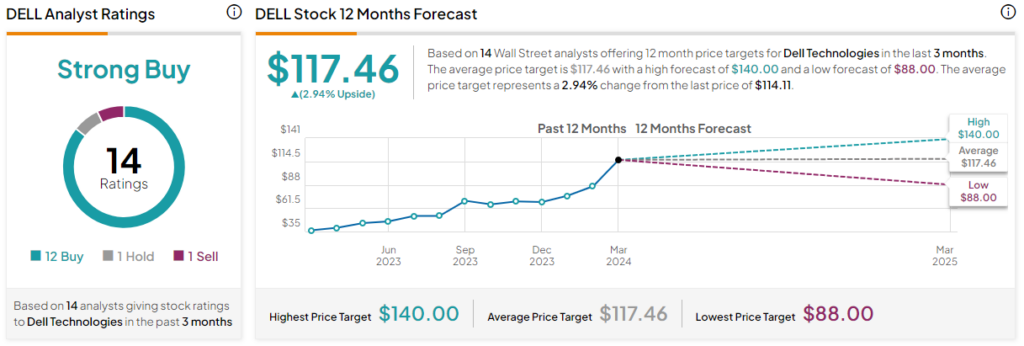

Dell is rated as a Strong Buy, according to analysts. The stock has 12 Buys, one Hold, and one Sell rating. The average DELL stock price target of $117.46, implying 2.9% upside potential. The highest price target is $140 while the lowest price target is $88.

The Bottom Line on DELL Stock

Dell is riding on the artificial intelligence hype, but the stock doesn’t look like it will live up to investors’ expectations. Dell only generated $800 million from its AI servers in Fiscal Q4 2024, which was 3.6% of the company’s total revenue.

Dell would have to maintain 40% sequential growth for all of Fiscal 2025 to earn $3.07 billion per quarter from its AI servers. Super Micro Computer already makes more revenue than that each quarter from its AI servers. A lower P/E ratio doesn’t make Dell the better pick, and I believe investors should consider other AI stocks instead.