Shares of Dell (NYSE:DELL) tanked in after-hours trading after the tech company reported earnings for its first quarter of Fiscal Year 2025. Earnings per share came in at $1.27, which was in line with analysts’ consensus estimate. Interestingly, Dell had beaten estimates in each of the previous eight quarters.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Sales increased by 6.2% year-over-year, with revenue hitting $22.2 billion. This beat analysts’ expectations by $550 million. Revenue was primarily driven by a 22% increase in Infrastructure Solutions Group sales, with record servers and networking revenue of $5.5 billion, a 42% increase.

Investor Sentiment for DELL Stock Is Currently Negative

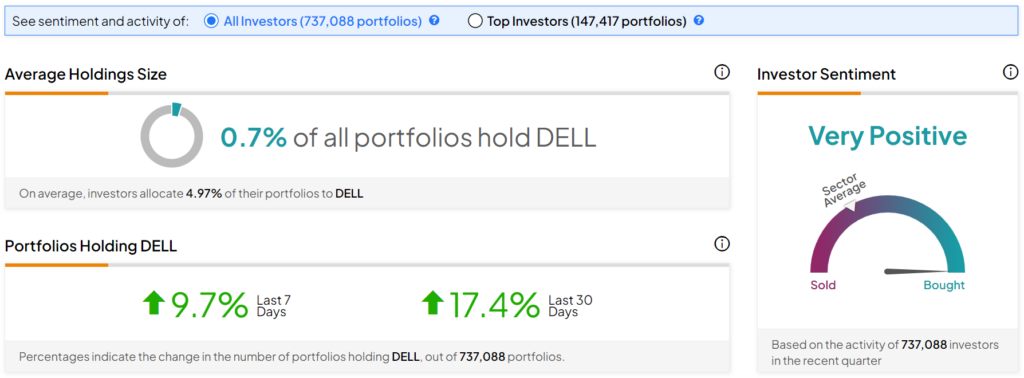

The sentiment among TipRanks investors is currently Very Positive. Out of the 737,088 portfolios tracked by TipRanks, 0.7% hold DELL stock. In addition, the average portfolio weighting allocated towards DELL among those who do have a position is 4.97%. This suggests that investors of the company are fairly confident about its future.

Furthermore, in the last 30 days, 17.4% of those holding the stock increased their positions. As a result, the stock’s sentiment is above the sector average, as demonstrated in the following image:

Is DELL a Good Stock to Buy Now?

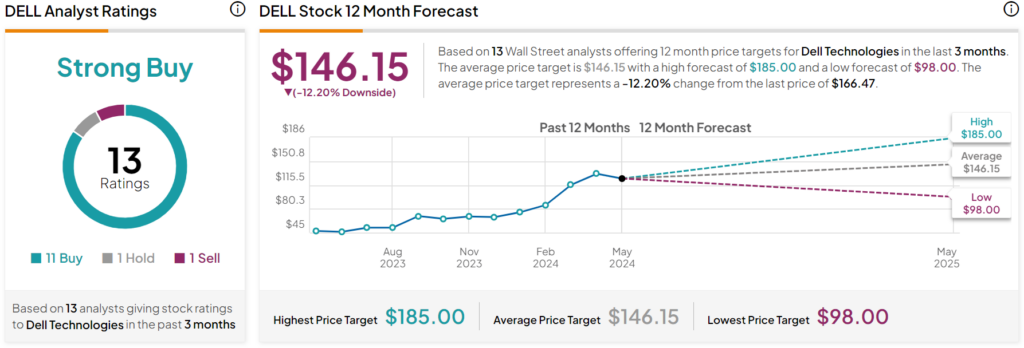

Turning to Wall Street, analysts have a Strong Buy consensus rating on DELL stock based on 11 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 279% rally in its share price over the past year, the average DELL price target of $146.15 per share implies 12.2% downside potential.