Elon Musk pushes back hard against claims that Tesla’s (TSLA) board is actively seeking his replacement. In a sharp response on X, Musk slammed the Wall Street Journal report as a “deliberately false article,” accusing the outlet of breaching journalistic ethics. The fiery denial comes amid reports that Tesla’s board has initiated a search for a new CEO amid a declining share price and growing investor concerns.

Earlier today, Tesla Chair Robyn Denholm dismissed the media report as “absolutely false.” She also expressed strong support for Musk, stating the board has full confidence in his ability to carry out the company’s ambitious growth strategy.

Tesla Board Seeks New CEO to Succeed Musk

The WSJ report stated that the company’s board has begun seriously exploring the search for Musk’s successor. According to people familiar with the matter, board members contacted several executive search firms and zeroed in on one to assist with the CEO succession process. However, the current status of the search remains unclear.

The reports also stated that board members had urged Musk to commit more time to Tesla, and to make that commitment public. As a result, Musk announced that he would significantly reduce his involvement with the Department of Government Efficiency (DOGE) and focus more on Tesla following its disappointing Q1 earnings. While TSLA stock did experience a slight rebound, the situation remains under scrutiny.

In a recent cabinet meeting, Musk announced plans to dedicate only a day or two per week to DOGE and focus more on Tesla.

What this Means for Tesla’s Investors

Tesla’s investors have grown increasingly impatient with Musk’s focus on the White House. The news of a new CEO search has significant implications for the company’s investors. With Musk potentially stepping down, investors may face uncertainty regarding Tesla’s future direction. A leadership change could impact Tesla’s innovation pace, strategic decisions, and stock performance.

While some investors may view the search as an opportunity for fresh leadership, others may be concerned about the transition’s impact on Tesla’s brand identity and growth trajectory. As the search unfolds, investor sentiment will likely hinge on the board’s ability to identify a leader capable of sustaining Tesla’s market position.

Is Tesla Stock a Buy Now?

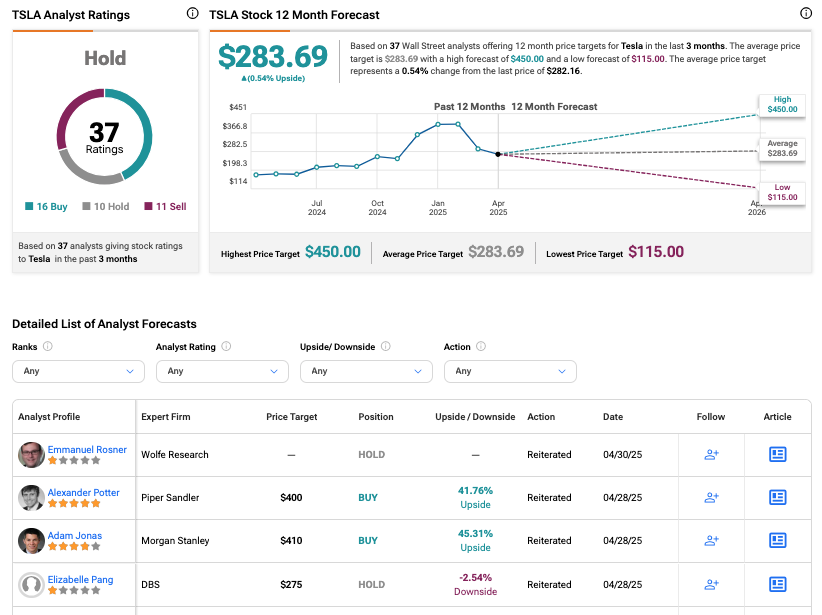

On Wall Street, analysts have maintained a neutral stance on Tesla stock. According to TipRanks, TSLA stock has received a Hold consensus rating, with 16 Buys, 10 Holds, and 11 Sells assigned in the last three months. The average price target for Tesla shares is $283.69, almost similar to the current levels.