DeFi Technologies (CBOE:DEFI)(OTC:DEFTF), a Canadian company, is set to make a significant impact on the digital asset investing scene in 2025. With favorable government policies in both Canada and the United States, the company is in a prime position to lead the global decentralized finance (DeFi) sector.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Bridging Traditional Finance and Blockchain

Founded in 2020, DeFi Technologies aims to connect traditional finance with the rapidly growing world of decentralized finance. They offer investors a way to tap into digital assets like Bitcoin, Ethereum, and Solana through familiar investment channels. This means you don’t have to navigate the complexities of owning cryptocurrencies directly.

Their main tool for this is Exchange Traded Products (ETPs), provided through their subsidiary, Valour Inc. These ETPs are available on major European stock exchanges, such as the Frankfurt Stock Exchange and the Spotlight Stock Market. This setup allows investors to gain exposure to leading cryptocurrencies and unique assets, like the Uniswap (UNI) ETP—the first of its kind globally. In essence, DeFi Technologies makes it easier for traditional investors to access the digital asset market without diving into the deep end of crypto ownership.

Beyond ETPs, DeFi Technologies is actively involved in decentralized blockchain networks. They participate in activities that support network security, governance, and transaction validation. This hands-on approach not only strengthens their operations but also places them at the forefront of blockchain innovation.

DEFI Is on a Strong Financial Trajectory

Financially, the company is on a strong upward trajectory. As of January 31, 2025, Valour reported C$1.4 billion (US$1.009 billion) in Assets Under Management (AUM), reflecting a 23% increase from the previous month. This growth was driven by rising digital asset prices and continued net inflows of C$48 million (US$33.5 million) in January, fueled by strong demand for ETPs such as XRP (XRP-USD), SUI (SUI-USD), and DOGE (DOGE-USD).

Additionally, Valour ended January with a cash and USDT balance of approximately C$27.2 million (US$18.9 million), reflecting a 24.9% increase from the prior month.

This financial success is mirrored in their stock performance. Trading under the ticker “DEFI” on the CBOE Canada, the stock hit an all-time high of C$5.24 on December 6, 2024, a significant jump from its 52-week low of C$0.37. This surge reflects the growing prominence of the cryptocurrency sector and investor confidence in the company’s direction.

Leading the charge is CEO Olivier Roussy Newton, who is dedicated to expanding investor access to decentralized technologies. The company’s mission is to identify innovative opportunities within the DeFi space and invest in technologies that offer diversified exposure to the decentralized ecosystem. This forward-thinking approach ensures that DeFi Technologies remains a key player in merging traditional financial markets with decentralized platforms.

Government Initiatives Fuel Blockchain Adoption

Canada has been proactive in embracing blockchain technology. The Canadian Securities Administrators (CSA) have developed a regulatory framework that integrates digital assets into the financial system. This has led to the approval of crypto-based exchange-traded funds (ETFs), positioning Canada as a leader in blockchain innovation.

Additionally, Canada’s 2025 National Cyber Security Strategy highlights the importance of securing digital infrastructures, including blockchain technologies. This strategy demonstrates the government’s commitment to fostering innovation while ensuring the security of digital assets.

In the United States, President Donald Trump’s administration has also shown support for digital assets and blockchain technology. In January 2025, President Trump signed Executive Order 14178, titled “Strengthening American Leadership in Digital Financial Technology.” This order emphasizes the administration’s commitment to supporting the growth of digital assets across the economy. It revokes previous directives that hindered blockchain innovation and prohibits the establishment of a central bank digital currency, signaling a clear endorsement of decentralized financial systems.

Global Trends Propel DeFi Growth

In Asia, Hong Kong has made strides by potentially accepting cryptocurrencies as proof of wealth for immigration purposes, according to Reuters. This reflects a broader acceptance of digital assets in financial and governmental sectors.

Furthermore, DeFi Technologies is expanding into key markets such as Asia, the Middle East and Africa by recently signing a Memorandum of Understanding (MOU) with AsiaNext, a leading Singapore-based securities exchange and an MOU with the Nairobi Stock Exchange.

DeFi Technologies Rides the Crypto ETP Trend

In 2024, the crypto world saw a massive surge in Exchange-Traded Products (ETPs), and DeFi Technologies was right there, riding the trend. When the U.S. greenlit spot Bitcoin ETPs in January 2024, it was like opening the floodgates—investors poured in, eager to get a piece of the action. BlackRock’s iShares Bitcoin Trust ETF (IBIT), for instance, pulled in a whopping $50 billion in assets that year. This set a new record, according to iShares.

Europe wasn’t left behind. Deutsche Börse reported that their ETF and ETP assets hit an all-time high of €1.83 trillion in 2024, with trading volumes up by 28%, reaching €230.8 billion.

DeFi Technologies, through its subsidiary Valour Inc., jumped on this trend by rolling out a variety of crypto ETPs. In fact, Valour plans to have a total of 100 ETPs by the end of 2025.

Is DeFi Technologies a Buy?

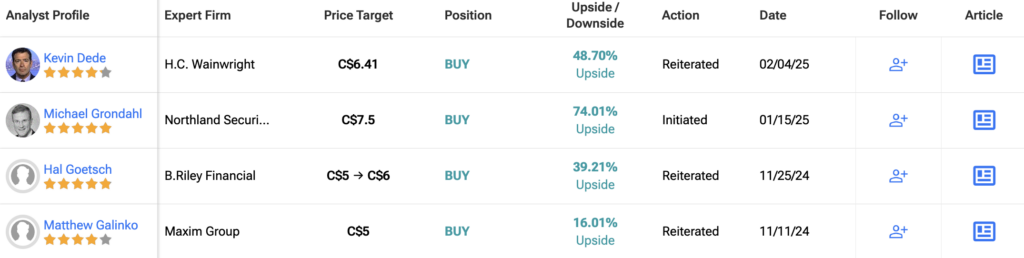

Analysts remain bullish about DeFi Technologies stock, with a Strong Buy consensus rating based on 3 Buys. Over the past year, DEFI has increased by more than 410% and the average DEFI price target of C$6.64 implies an upside potential of 54.06% from current levels.